Well Secured Retail Investment

161-163 High Street | Elgin | Scotland | IV30 1DW

£850,000

subject to contract

GALLERY

Summary

-

Prime retail location

-

Secure income - let to Poundland Limited (SF £93.866m)

-

In excess of 9 years unexpired on a recently extended lease

-

Asking Price £850,000, subject to contract

-

9.0% net initial yield

Location

Elgin, population 23,000 approximately, is a former cathedral city and Royal Burgh in Moray, situated on the south coast of the Moray Firth. It is the administrative and commercial centre for Moray, located approximately 105 km (65 miles) north-west of Aberdeen and 64 km (40 miles) north-east of Inverness. The town benefits from good road communications and is served by the A96. The town is also connected to the national railway network with services to Aberdeen, Inverness and Glasgow. Inverness Airport is approximately 48 km (30 miles) to the south-west.

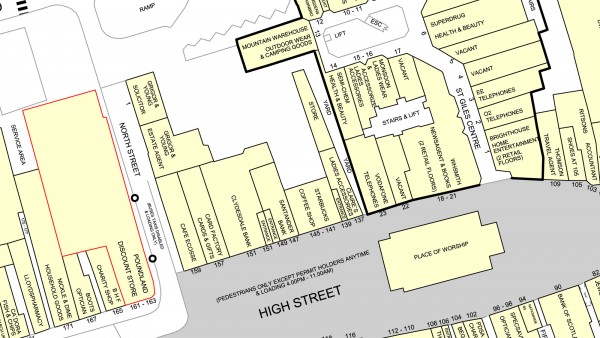

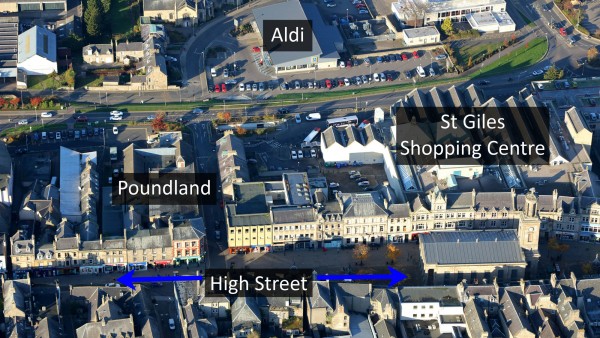

Situation

The subject property occupies a prominent corner trading position on the edge of the pedestrianised section of High Street, Elgin’s principal retail thoroughfare, at the junction with North Street. Surrounding occupiers include Clydesdale Bank, Holland & Barrett, Boots, H Samuel, Starbucks, Burton, Santander, Clarks and TK Maxx.

The property is prominently situated in close proximity to the entrance to the St Giles Shopping Centre which offers a wide range of established retailers and small specialist outlets all under one roof. Tenants include Superdrug, WH Smith, Mountain Warehouse, Argos, O2, Monsoon, Vodafone and Subway.

Description

The property is arranged over ground and two upper floors, plus an attic, to provide a retail unit on ground floor with ancillary accommodation at the rear of the ground floor and ancillary accommodation on first floor. The second floor and the attic have been sealed off and are therefore unused. Externally, the property provides extensive return frontage onto North Street with a goods entrance to the rear of the property which is accessed from Alexandra Road. Internally, the unit has been fitted out to the tenant’s usual corporate style.

There is a minor Schedule of Condition relating to the second floor and the attic. A copy is available to download from the legal package in the data room.

Accommodation

We have been advised that the property provides the following accommodation;

| Ground Floor | Sales | 1,075.83 sq m | 11,580 sq ft |

| Ground Floor | Ancillary | 94.76 sq m | 1,020 sq ft |

| First Floor | Ancillary | 583.90 sq m | 6,285 sq ft |

| Second Floor | Unused | Not measured | |

| Attic | Unused | Not measured | |

| Total | 1,754.49 sq m | 18,885 sq ft |

Tenure

Heritable (Scottish equivalent of English Freehold)

Tenancy

The property is entirely let to Poundland Limited on an effectively Full Repairing and Insuring lease for a term of 16 years from 29th September 2009, expiring on 15th November 2025. Therefore, the unexpired lease term is over 9 years.

The current passing rent is £80,000 per annum which equates to only £45.60 per sq m / £4.23 per sq ft on the usable floor area. The lease benefits from five yearly upwards only rent reviews. The next rent review is on 29th September 2020.

Covenant

Poundland Limited (Co. No. 02495645) has reported the following figures:

| 29th March 2015 | 29th March 2014 | |

|---|---|---|

| Turnover | £1,111,526,000 | £997,803,000 |

| Pre-Tax Profits | £ 45,922,000 | £ 41,017,000 |

| Shareholders’ Funds | £ 93,866,000 | £ 96,235,000 |

The principal activity of the company is that of a single price value retailer, with over 850 branches in the United Kingdom and 50 in Ireland. For further information visit www.poundland.co.uk.

It was reported in July 2016 that Poundland had recommended a £597 million takeover to its shareholders by the South African retail conglomerate, Steinhoff Europe AG, which also owns Harveys and Bensons for Beds in the United Kingdom. The deal is due to be completed during September 2016. Steinhoff International, the parent company, was listed on the Frankfurt Stock Exchange in December 2015 with a market capitalisation of 19 billion Euros.

Value Added Tax

The property has been elected for VAT. The sale will be treated as a Transfer of a Going Concern (TOGC).

Proposal

Our client is seeking offers of £850,000 (Eight Hundred and Fifty Thousand Pounds), subject to contract, reflecting a net initial yield of 9.0%.

Investment Considerations

-

An opportunity to acquire a prime retail investment within the heart of Elgin town centre;

-

In excess of 9 years unexpired on a recently extended lease;

-

The property occupies a prime trading position on the edge of the pedestrianized section of the town centre;

-

Substantial property extending to 1,754.49 sq m (18,885 sq ft) of usable accommodation;

-

The investment provides secure income, let to the strong covenant of Poundland Limited (Shareholders’ Funds £93,866,000);

-

Poundland is being acquired by Steinhoff Europe AG in an all cash transaction of nearly £600 million;

-

A purchase at the asking price reflects an attractive net initial yield of 9.0%;

-

The property provides an investor with an attractive lot size.

BROCHURES

DOWNLOADS

Contact Us

| Singer Vielle | +44 (0) 207 935 7200 | |

|---|---|---|

| Neil Singer | neil@singervielle.co.uk | +44 (0) 203 478 9120 |

| Dale Henry | dale@singervielle.co.uk | +44 (0) 203 701 1356 |

| Richard Wolfryd | richard@singervielle.co.uk | +44 (0) 203 701 1353 |

| Graham Waddell | graham@singervielle.co.uk | +44 (0) 141 221 4545 |

| Faye Langoulant | faye@singervielle.co.uk | +44 (0) 203 478 9122 |

| Louanne Malan | louanne@singervielle.co.uk | +44 (0) 203 701 1386 |

Vendor's Solicitor

| Shepherd & Wedderburn LLP | ||

|---|---|---|

| Vikki Henderson | vikki.henderson@shepwedd.co.uk | +44 (0)131 473 5260 |

| Michael Henderson | michael.henderson@shepwedd.co.uk | +44 (0)131 473 5189 |