Well Secured City Centre Retail Investment

127 Union Street | Aberdeen | AB11 6BH

£715,000

subject to contract

GALLERY

Summary

-

Prime City Centre Retail Investment

-

Highly Secure Income

-

Let to EE Limited – Pre-Tax Profits £416 million

-

New lease from December 2016

-

Re-based rent

-

Prominent retailing position

-

£715,000, subject to contract

-

8.0% net initial yield

Location

Aberdeen is located approximately 180 km (125 miles) north of Edinburgh and 210km (145 miles) north east of Glasgow. The city benefits from excellent road communications with the A90 and A96 offering direct links to Dundee and Inverness. In addition, the city is connected to the national rail network with direct services to London Kings Cross with a fastest journey time of 4 hours 20 minutes. Aberdeen International Airport is approximately 9.6 km (6 miles) north-west of the city centre and is used by around 3 million passengers a year for scheduled and charter holiday flights.

Aberdeen city & Shire is the third largest city region in Scotland and home to almost 0.5 million people of which 230,000 live in Aberdeen. Aberdeen is one of the world's top five energy cities and has been ranked as one of the UK's most competitive cities with innovative industries, excellent academic and research capabilities and a highly skilled workforce. Alongside continued investment in energy, life sciences, tourism and hospitability, food, drink and agriculture, digital and the creative sectors are industries on the rise (Source: Aberdeen City Council).

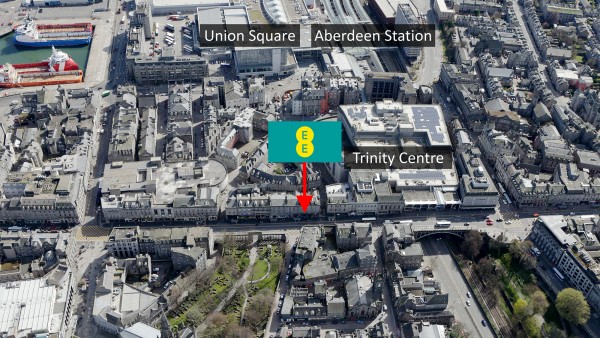

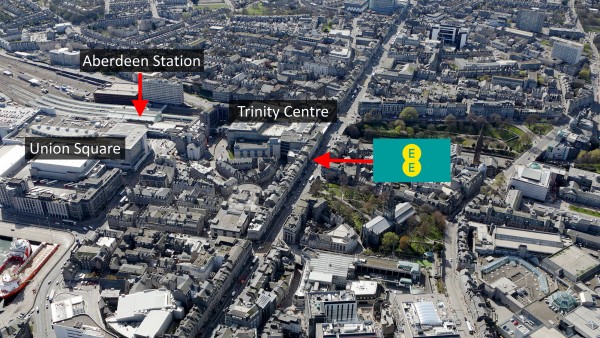

Situation

The subject property occupies a prominent position on Union Street. Also known as the ‘Granite Mile’, Union Street is the major shopping thoroughfare in Aberdeen and home to national retailers, designer outlets, boutiques and independent retailers.

National retailers surrounding the subject property include McDonalds, Primark, Molton Brown, Clarks, All Saints and Goldsmiths.

Union Street sits alongside a number of shopping centres:

Union Square Shopping Centre is immediately to the south of the subject property. A mixed-use retail-led scheme which opened in 2009, Union Square comprises 557,570 sq ft (51,800 sq m) with 79 tenants, 1,200 car parking spaces and a footfall of 15.3 million. The centre has a very wealthy and fashion conscious catchment with over 700,000 customers living within its principal catchment and includes a shopping park, 10 screen cinema as well as a 200 bed Jury’s hotel. Brands include Hugo Boss, Joules, The White Company, Apple, Superdry and House of Fraser (Source: Hammerson).

The Trinity Shopping Centre is approximately 250 feet from the subject property and comprises around 34 retail units anchored by Debenhams and Primark with other key retailers including Superdrug, Argos, Greggs, Schuh, HMV, Holland & Barrett and Waterstones.

Bon Accord & St Nicholas Shopping Centre is situated 0.32 km (0.2 miles) north of the subject property. With over 70 fashion, beauty and homeware stores as well as a food court, the centre totals 81,290 sq m (875,000 sq ft) with 6 flagship stores including a 9,290 sq m (100,000 sq ft) John Lewis and a 10,219 sq m (110,000 sq ft) Marks & Spencer. Other occupiers include Carphone Warehouse, Next, Boots, Disney Store, H&M and Jo Malone.

Description

The interest for sale comprises the ground floor and basement levels of the building. The upper parts, which comprise a dental practice on first floor and residential on second & third floors, are in separate ownership. Internally, the property has been fitted out to a high standard in the tenant’s corporate image.

Accommodation

The property has been measured by Square Foot Media and provides the following Net Internal accommodation;

| Zone A | 44.20 sq m | 476 sq ft |

| Zone B | 39.54 sq m | 426 sq ft |

| Zone C | 11.11 sq m | 120 sq ft |

| ITZA | 718 | |

| Office/Store | 19.56 sq m | 212 sq ft |

| Total Ground Floor | 114.50 sq m | 1,232 sq ft |

| First Basement | Not measured | |

| Middle Basement | Not measured | |

| Bottom Basement | Not measured |

A set of floor plans is available to download and the measured survey report can be re-addressed to a purchaser.

Site

We understand the property is Category C listed and situated within a Conservation Area.

Tenure

Absolute (Scottish equivalent of English freehold).

Tenancy

The property is entirely let to EE Limited at a passing rent of £60,000 per annum (which we calculate equates to £82 Zone A).

The tenant has been in occupation since 2001 and such is their long term commitment to the property in December 2016 they signed a new full repairing and insuring lease for a term of 10 years from 16th December 2016, expiring on 15th December 2026. The lease benefits from an upwards only rent review on 16th December 2021.

There is a tenant’s break option on 16th December 2021, subject to 6 months’ prior written notice.

As part of the lease renewal the tenant was granted a 12 month rent free period expiring on 15th December 2017. In order that a purchaser does not suffer an income shortfall the vendor will top up the rent on completion by way of an adjustment to the purchase price.

The rent was re-based to its current level from £112,000 per annum.

Covenant

EE Limited (Co. No.02382161) has reported the following figures;

| 31st Dec 2015 | 31st Dec 2014 | |

|---|---|---|

| Revenue | £6,311 million | £6,327 million |

| Pre-Tax Profits (Loss) | £416 million | (£255 million) |

| Net Assets | £8,652 million | £2,987 million |

EE, which was acquired by BT Group Plc in January 2016, is the largest and most advanced digital communications company in Britain, delivering mobile and fixed communication services. EE has approximately 553 retail stores, and services more than 31 million connections across its mobile, fixed and wholesale networks. For further information, please visit ee.co.uk.

VAT

The property has been opted to tax. It is anticipated that the sale will be treated as a Transfer of a Going Concern (TOGC).

Proposal

We are instructed to seek offers in the region of £715,000 (Seven Hundred and Fifteen Thousand Pounds), subject to contract, reflecting a net initial yield of 8.0%, assuming purchaser’s costs of 4.94%.

Investment Considerations

-

An opportunity to acquire a retail investment in the heart of Aberdeen city centre;

-

The investment provides highly secure income being let to EE Limited – Pre-Tax Profits £416 million;

-

The tenant has recently demonstrated their commitment to this property by entering into a new lease;

-

Rent re-based in December 2016;

-

The property occupies a prominent retailing pitch on Union Street, the city’s main retailing thoroughfare;

-

The property is a listed building, hence there are no business rates payable;

-

Attractive lot size to an investor;

-

A purchase at the asking price reflects an attractive net initial yield.

DOWNLOADS

BROCHURE

Contact Us

| Singer Vielle | +44 (0) 207 935 7200 | |

|---|---|---|

| Neil Singer | neil@singervielle.co.uk | +44 (0) 203 478 9120 |

| Dale Henry | dale@singervielle.co.uk | +44 (0) 203 701 1356 |

| Richard Wolfryd | richard@singervielle.co.uk | +44 (0) 203 701 1353 |

| Graham Waddell | graham@johnstonwaddell.co.uk | +44 (0) 203 701 1388 |

| Faye Langoulant | faye@singervielle.co.uk | +44 (0) 203 478 9122 |

| Louanne Malan | louanne@singervielle.co.uk | +44 (0) 203 701 1386 |

Vendors Solicitor

| CMS Cameron McKenna | +44 (0)1224 267 160 |

|---|---|

| Derek Cameron | derek.cameron@cms-cmck.com |