Prime, Well Secured City Centre Retail Investment

102-106 High Street | Perth | PH1 1TH

£975,000

subject to contract

GALLERY

Summary

-

City centre retail investment opportunity

-

Let to Fat Face – Net Assets £156 million

-

100% Prime Retailing Pitch

-

6.5 year unexpired lease term

-

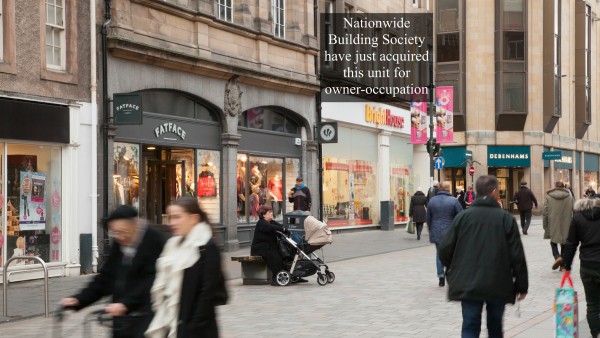

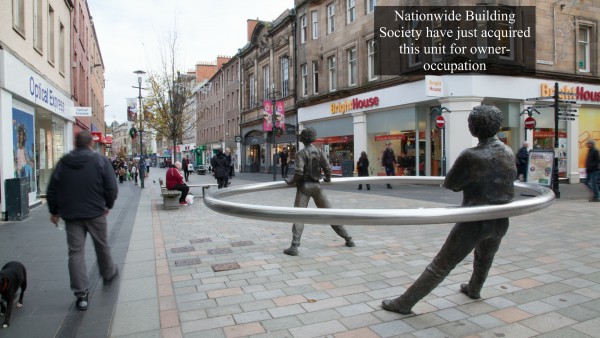

Nationwide Building Society have just acquired the adjoining unit for owner-occupation

-

£975,000, subject to contract

-

8.01% Net Initial Yield

Location

Perth sits within Central Scotland on the banks of the River Tay and is the administrative centre of Perth and Kinross. The city is approximately 69 km (43 miles) north of Edinburgh, 96 km (60 miles) north-east of Glasgow and 35 km (22 miles) south-west of Dundee.

Perth benefits from good road communications being easily accessible from the M90 and A90 trunk roads. In addition, the city is connected to the national railway network with a fastest journey time to Edinburgh and Glasgow of 1 hour 20 minutes and 1 hour respectively.

Perth is Scotland’s third fastest growing region and its economic activity rate outperforms the Scottish average. The current unemployment rate for Perth and Kinross is 2.4%, well below the Scottish average of 4.1% and its five-year business survival rate is higher than both the Scottish and UK averages. Perth’s workforce has the joint highest percentage of graduates of any Scottish city (61.5%) and seven of the UK’s top 50 universities, including three in the world’s top 200 list, are within a one hour drive from the city. (Source: Invest in Perth).

Situation

The subject property is situated in a highly prominent corner location at the junction of High Street and King Edward Street. The property occupies a 100% prime retailing pitch in the pedestrianised section of the High Street in the heart of the city centre. Surrounding occupiers include Marks & Spencer, Debenhams, Primark, Next, Superdrug, WH Smith, Boots and Santander.

The property benefits from being in very close proximity to St John’s Shopping Centre, the prime shopping destination in Perth city centre, anchored by Primark. Other retailers in the centre include River Island, H&M and JD Sports.

Description

The building lies on the site of the former Guild Hall dating back to 1722. The property was rebuilt in 1907 and then substantially redeveloped in the 1980’s behind the original B listed stone façade. The property is constructed around a steel frame structure with trussed pitched roof. There is a 2-storey extension to the rear.

Retail accommodation is provided on ground floor with ancillary accommodation at first floor. The remaining floors are separately owned and have residential and commercial use.

Internally the accommodation has been fitted out by the tenant to their usual corporate style.

The property was previously split into two individual units so is capable of sub-division in the future.

Planning

The property is situated within the Perth Central Conservation Area and forms a Category B listed building.

Accommodation

The property has been measured by Square Foot Media and provides the following Net Internal Areas;

| Zone A | 92.0 sq m | 990 sq ft |

| Zone B | 58.4 sq m | 628 sq ft |

| Zone C | 4.60 sq m | 50 sq ft |

| Total | 155.0 sq m | 1,668 sq ft |

| First Floor | 123.0 sq m | 1,324 sq ft |

| ITZA | 134.62 sq m | 1,449sq ft |

| Total | 278 sq m | 2,992 sq ft |

A set of floorplans are available to download and the measured survey report will be assigned to a purchaser at a cost of £350.00 + VAT.

Tenure

Heritable (Scottish equivalent of English freehold)

Tenancy

The ground and first floor are let to Fat Face on a Full Repairing and Insuring lease for a term from 4th September 2015 expiring on 3rd September 2025.

The current passing rent is £82,500 per annum, equating to £57 Zone A.

The initial lease included a tenant break option at 3rd September 2020. By way of a Minute of Agreement and Variation, the tenant’s break option has been removed in return for which the tenant has been granted a rent free period from 1st April 2019 for eight months. The vendor will “top-up” this rent free period so a purchaser does not suffer and income shortfall.

Covenant

Fat Face Limited (Co. No. 02954734) has reported the following figures:

| 2nd June 2018 | 3rd June 2017 | |

|---|---|---|

| Revenue | £235,295,000 | £224,137,000 |

| Pre-Tax Profits | £19,225,000 | £21,935,000 |

| Net Assets | £156,565,000 | £140,184,000 |

Established in 1988, FatFace is one of the UK’s most recognised multi-channel retail brands stocking a wide range of womenswear, menswear, childrenswear, footwear, and accessories, designed in-house at their headquarters in Havant, Hampshire.

There are currently over 230 FatFace stores in the UK, Ireland and the USA – located in market towns, holiday locations, high street shopping centres and high footfall travel hubs. For further information please visit www.fatface.com.

VAT

The property has been registered for VAT. It is anticipated that the sale will be treated as a Transfer of a Going Concern (TOGC).

Investment Evidence

We are aware of the following investment evidence on Perth High Street:

| Address | Tenant | UXLT | Price | NIY | Date Sold | Rent |

|---|---|---|---|---|---|---|

| 86-100 High Street | Superdrug | 6 yrs | £2,330,000 | 9.2% | April 2018 | £67 Zone A |

| 125-127 High Street | Mountain Warehouse | 3 yrs | £790,000 | 9.6% | April 2018 | £60 Zone A |

| 168-170 High Street | Oliver Bonas | 4.75 yrs | £450,000 | 7.5% | Feb 2018 | £39 Zone A |

| 111-119 High Street | Next & New Look | 7.5 yrs | £5,900,000 | 8.0% | Mar 2017 | £75 Zone A |

The adjoining property at 108-112 High Street & 2-6 King Edward Street, Perth, has just been acquired by Nationwide Building Society for owner-occupation.

Proposal

We are instructed to seek offers in the region of £975,000 (Nine Hundred and Sevenry Five Thousand Pounds), subject to contract, reflecting a net initial yield of 8.0%, assuming standard purchaser’s costs of 5.62%.

Please note that a purchaser will be re-charged the costs of the surveys and searches which are provided in the data room.

Please note a purchaser will be charged a Transaction Fee of £5,000 + VAT.

Investment Considerations

-

An opportunity to acquire a city centre retail investment;

-

The property occupies a 100% prime retailing pitch;

-

The property provides highly secure income, being let to Fat Face Limited (Net Assets of £156 million);

-

6.5 years unexpired lease term;

-

Nationwide Building Society have acquired the adjoining property for owner-occupation

-

A purchase at the asking price will provide an investor with an attractive net initial yield;

-

Attractive lot size to an investor.

DOWNLOADS

BROCHURE

Contact Us

| Singer Vielle | +44 (0) 207 935 7200 | |

|---|---|---|

| Dale Henry | dale@singervielle.co.uk | +44 (0) 203 701 1356 |

| Neil Singer | neil@singervielle.co.uk | +44 (0) 203 478 9120 |

| Daniel Elia | daniel@singervielle.co.uk | +44 (0) 203 701 1353 |

| Graham Waddell | graham@singervielle.co.uk | +44 (0) 141 221 4545 |

| Douglas Wilson | douglas@singervielle.co.uk | +44 (0) 141 370 0284 |

Vendors Solicitor

| Shepherd and Wedderburn LLP | +44 (0) 131 473 5217 | |

|---|---|---|

| David Mitchell | David.Mitchell@shepwedd.com | |

| Cameron Ramage | Cameron.ramage@shepwedd.com | |