High Yielding, Add-Value City Centre Retail Investment

248 Commercial Road | Portsmouth | PO1 1EW

£400,000

subject to contract

GALLERY

Coronavirus Act 2020

The property is sold with the benefit of a rent guarantee from the vendor to ensure an investor has no issues receiving income in light of the Coronavirus Act 2020 Part 1 Section 82. This is no reflection upon the tenants’ ability to meet their rental obligations but an understandable protection for a purchaser. The guarantee is to end the earlier of the end of the rent moratorium, or a period of 6 months, whichever is the sooner.

Summary

-

City centre multi-let retail investment opportunity

-

Prominently located within the city’s prime retailing pitch

-

Freehold

-

Add-value opportunity

-

£400,000, subject to contract

-

15.12% Net Initial Yield

Location

Portsmouth is located on the south coast of the UK and is the second largest city Hampshire. It is a major commercial and retailing centre, one of the UK’s main commercial ports and is home to the Royal Navy. Portsmouth is a popular tourist destination with attractions such as Porstmouth Historic Dockyard, which houses HMS Victory and the Mary Rose, the Charles Dickens Birthplace Museum and Spinnaker Tower.

Portsmouth is located approximately 112 km (70 miles) south west of Central London, 29 km (18 miles) south east of Southampton, 72 km (45 miles) west of Brighton and 80 km (50 miles) south of Reading.

The city benefits from good road communications with convenient access provided into Portsmouth city centre via the M275, which in turn links the city to the M27 and A27 which form the main coastal route. The M27 provides access west towards Southampton and the A27 provides access east towards Chichester and Brighton and also to the A3(M) and A3, linking to the M25 and London.

Portsmouth is well connected to the national railway network with two train stations in the city centre; Portsmouth & Southsea Station and Portsmouth Harbour Station. The fastest journey time to London is approximately 1 hour 30 minutes. Portsmouth is also connected via the M27/M23 to two major airports; Southampton Airport, situated approximately 32 km (20 miles) to the north-west and London Gatwick, situated 90 km (56 miles) to the north-east.

Situation

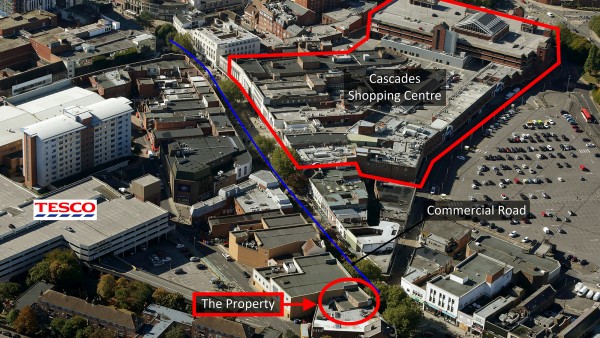

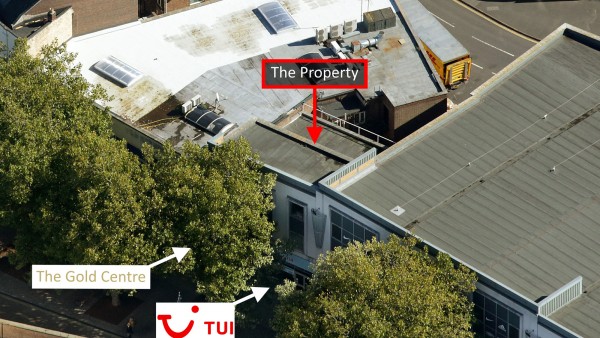

Commercial Road is Portsmouth’s principal retail thoroughfare. The subject property occupies a prominent retailing pitch on the northern end of the pedestrianised section of Commercial Road, opposite its junction with Charlotte Street. Nearby occupiers include KFC, Savers, Sports Direct, McDonald’s, Specsavers and Subway.

The property benefits from being in close proximity to the entrance to the Cascades Shopping Centre which provides 60 stores with a wide range of high street and independent boutique style shops. The scheme is anchored by Marks & Spencer, Primark and H&M with other retailers including Next, Lush, Starbucks, Thorntons and TK Maxx.

Description

248 Commercial Road comprises two separate self-contained retail units at ground floor, each with ancillary/storage space on first floor. Each unit has been fitted out by the tenant in their usual corporate style. Pedestrian access is provided at the front of each premises from Commercial Road and vehicular access from the rear via Commercial Place.

Accommodation

The property has been measured by BKR Floor Plans and provides the following net internal floor areas;

| TUI UK Retail Limited | ||

|---|---|---|

| Gross Frontage | 5.49 m | 18 feet |

| Net Frontage | 5.79 m | 19 feet |

| Sq M | Sq Ft | |

| Zone A | 33.72 | 363 |

| Zone B | 33.17 | 357 |

| Zone C | 17.56 | 189 |

| Ground Floor Total | 84.45 | 909 |

| ITZA | 589 | |

| First Floor | 53.51 | 576 |

| Second Floor | 17.84 | 192 |

| Sub-Total | 155.79 | 1,677 |

| Cleardale Limited (The Gold Centre) |

||

| Gross Frontage | 4.65 m | 15 ft 3” |

| Net Frontage | 4.32 m | 14 ft 2” |

| Sq M | Sq Ft | |

| Zone A | 27.96 | 301 |

| Zone B | 23.13 | 249 |

| Ground Floor Total | 51.10 | 550 |

| ITZA | 426 | |

| First Floor | 45.71 | 492 |

| Second Floor | 12.08 | 130 |

| Sub-Total | 108.88 | 1,172 |

| TOTAL | 264.67 | 2,849 |

Floor plans are available to download and the measured survey report will be assigned to a purchaser at a cost of £250.00 + VAT.

Tenure

Freehold

Tenancies

Unit C is occupied by TUI UK Retail Limited (t/a TUI) by way of an expired lease which was on a Full Repairing and Insuring lease for a term of 5 years from 24th July 2015.The current passing rent under the expired lease is £37,500 per annum (£57.50 Zone A). The tenant is holding over. Rent is being paid monthly although without formal agreement of the landlord.

Unit D is let to Cleardale Limited (t/a The Gold Centre) on a Full Repairing and Insuring lease for a term from 26 November 2018 until 11th November 2029. There is a tenant only option to break on 11th November 2024 and an upwards only rent review on 12th November 2024. The previous rent paid for the unit was £35,000 per annum but the rent was re-based to £25,500 per annum (£52 Zone A) with effect from February 2020. Rent is being paid monthly although without formal agreement of the landlord.

The total income is, therefore, £63,000 per annum.

Payment History 2020

The position in respect of the rent payments by the tenants during 2020 is as follows:

Cleardale:

Quarterly rent payments have been due under the lease on 25th March 2020, 24th June 2020, 29th September 2020 and December 25th 2020. Quarterly rents are £6,375 + VAT (£7,650), plus Service charge of £535.63 + VAT (£642.7), hence £8,292.76. The tenant has been paying monthly during 2020. Current arrears are £9,485.14 (£7,904.28 plus VAT). These arrears are made up of a small residual rent amount for the September quarter, amounting to £192.38 along with December rent and service charge, which Cleardale have continued to pay monthly.

There is also an annual insurance charge, the current year premium is £194.51 plus VAT

TUI:

Information in relation to Tui's payment history is available on request.

Service Charge

The service charge budget for the period 25/12/2019 to 24/12/2020 is £8,250. The Service Charge Accounts and Service Charge Budgets are available to download.

Covenant

TUI UK Retail Limited (Co No. 1456086) has reported the following figures:

| 30 September 2019 | 30 September 2018 | |

|---|---|---|

| Revenue | £159,000,000 | £180,000,000 |

| Pre-Tax Profits (Loss) | £33,000,000 | £16,000,000 |

| Net Assets | £186,000,000 | £191,000,000 |

TUI UK Retail Limited is a wholly owned subsidiary of the larger TUI Group. As reported on their website, TUI Group is the world’s leading tourism provider. They employ approximately 67,000 employees worldwide, operate 1,600 travel agencies, 6 airlines (with over 150 aircraft), over 380 hotels and 16 cruise liners across the globe.

TUI Group has been built up of many of Europe’s leading tourism companies including Preussag AG, Hapag-Lloyd, Thomson Holidays, Nouvelle Frontieres and First Choice Holidays PLC.

TUI Group has reported the following figures:

| 30 September 2019 | 30 September 2018 | |

|---|---|---|

| Revenue | €18,928.0 million | €18,468.7 million |

| Net Profit | €531.9 million | €774.9 million |

As at 25th November 2020, Tui AG has a market capitalisation of €3.41bn.

Cleardale Limited (Co No. 03209955) is a private company based in Solihull. For the year ending 31 January 2020 they reported a Total Equity of £299,471.

VAT

The property has been registered for VAT. It is intended that the sale will be treated as a Transfer of a Going Concern (TOGC).

Proposal

We are instructed to seek offers in the region of £400,000, (Four Hundred Thousand Pounds), subject to contract, reflecting a net initial yield of 15.12%, assuming standard purchaser’s costs of 4.18%

Please note that a purchaser will be re-charged the costs of searches which are provided in the data room.

Please note that a purchaser will be charged a Transaction Fee of 1% of the Sale Price plus VAT.

Investment Considerations

-

An opportunity to acquire a freehold high yielding city centre multi-let retail investment;

-

Passing rents at a significant discount to the prime rents within Portsmouth;

-

The property occupies a prominent trading position on Portsmouth’s principal retailing thoroughfare;

-

A purchase at the asking price will provide an investor with an attractive net initial yield;

DOWNLOADS

BROCHURE

Contact Us

| Singer Vielle | +44 (0) 207 935 7200 | |

|---|---|---|

| Neil Singer | neil@singervielle.co.uk | +44 (0) 203 478 9120 |

| Dale Henry | dale@singervielle.co.uk | +44 (0) 203 701 1356 |

| Daniel Elia | daniel@singervielle.co.uk | +44 (0) 203 701 1353 |

| Jon Skerry | jon@singervielle.co.uk | +44 (0) 203 995 6211 |

Vendors Solicitor

| Stephenson Harwood LLP | +44 (0) 207 809 2147 |

|---|---|

| Stephen Laud | stephen.laud@shlegal.com |

| Edward Irving | edward.irving@shlegal.com |