High Yielding City Centre Investment Showing 15.0%

6A & 6B Bridlesmith Gate | Nottingham | NG1 2GS

£850,000

subject to contract

GALLERY

Coronavirus Act 2020

The property is sold with the benefit of a rent guarantee from the vendor to ensure an investor has no issues receiving income in light of the Coronavirus Act 2020 Part 1 Section 82. This is no reflection upon the tenants’ ability to meet their rental obligations but an understandable protection for a purchaser. The guarantee is to end the earlier of the end of the rent moratorium, or a period of 6 months, whichever is the sooner.

Summary

-

To be sold by clicktopurchase® Best Offers by 3.00pm 19th May 2021, unless sold prior

-

City centre investment opportunity

-

Located in the heart of Nottingham’s prime retailing centre

-

Established, long-term tenants – Kanoo Travel & Whittard

-

Re-based rents

-

£850,000, subject to contract

-

15.0% net initial yield

-

The property is sold with the benefit of a rent guarantee from the vendor to ensure an investor has no issues receiving income in light of the Coronavirus Act 2020 Part 1 Section 82

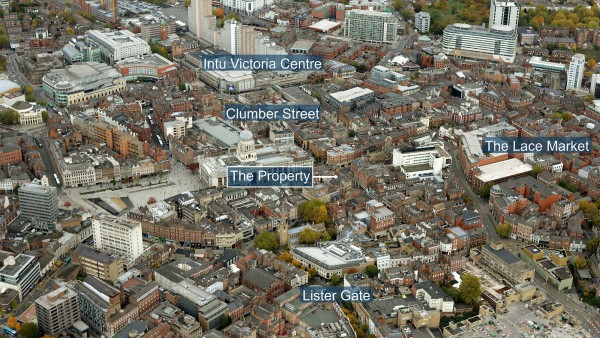

Location

Nottingham is located approximately 202 km (126 miles) north of Central London, 26 km (16 miles) north east of Derby, 48 km (30 miles) north of Leicester and 48 km (30 miles) south east of Sheffield.

The city benefits from good road communications with Junction 24 of the M1 Motorway approximately 17 km (9.5 miles) to the south west, Junction 25 approximately 12.4 km (7 miles) to the south west and Junction 26 approximately 8 km (4.5 miles) to the north west.

The city is connected to the national railway network with over 70 trains a day direct to London St Pancras with a fastest journey time of 1 hour 40 minutes. With Eurostar connections direct from St Pancras, Nottingham is connected into the heart of Europe. The city is also set to benefit as the HS2 network is constructed, with the East Midlands Hub base planned for Toton, on the outskirts of the city, further reducing journey times to London and bringing the rest of the country closer. Toton Innovation Campus will create around 10,000 new jobs and will sit alongside a new commercial and residential space as identified in the recently launched East Midlands HS2 Growth Strategy.

East Midlands Airport is approximately 22 km (14 miles) to the south west and Birmingham International Airport approximately 80 km (50 miles) to the north east. These two airports offer daily flights to European business hubs as well as connections to worldwide destinations.

Nottingham is home to two leading universities, The University of Nottingham and Nottingham Trent University. 18,000 jobs are supported in the UK annually by the University of Nottingham with a total economic impact of £677m generated by the university across Nottingham every year (Source: www.nottingham.ac.uk)

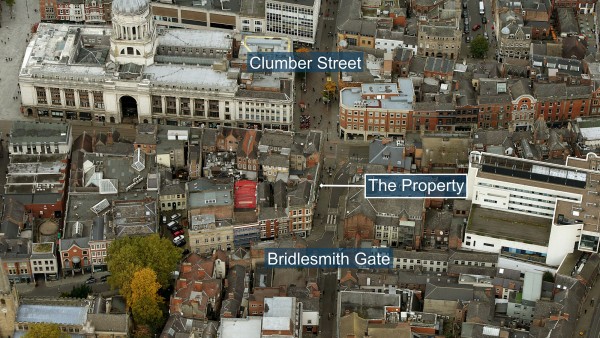

Situation

The subject property is situated within the heart of Nottingham City Centre, occupying a prominent position on Bridlesmith Gate. Surrounding occupiers include The Body Shop (adjacent), Waterstones, Kiehl’s, Molton Brown, Pret A Manger, Barclays, L’Occitane En Provence, Ted Baker and Jack Wills.

The property is in close proximity to the prime retailing pitch of Clumber Street and the “intu Victoria Centre” to the north and Listergate to the south.

“intu Victoria” provides 91,140 sq m (981,000 sq ft) of retail, catering and leisure space across 127 units. The centre, which has undergone a £42 million refurbishment, is anchored by John Lewis and House of Fraser with other major retailers in the scheme including Next, Topshop, JD Sports, Swatch, Superdry, River Island and Lovisa.

The Lace Market and “Hockley Village” area of Nottingham is a short distance to the east. This is a vibrant, modern section of the city which has been described as “the Soho of Nottingham”. It is home to many design and fashion shops, restaurants, bars, cafes, galleries and the Lace Market Theatre.

Nottingham is embarking on an intense period of economic regeneration, with a £250m redevelopment of the ‘Southern Gateway’ into the city centre underway; encompassing a remodelled shopping complex and new ‘City Hub’ college campus.

Another key development in the city centre is Guildhall Place, a 2.4 acre mixed-use development site including a prestigious 100,000 sq ft office building, university academic facilities, student accommodation and a potential conference centre. Part of the development site includes the Grade II Listed Guildhall, with proposals to transform this historic building into a boutique hotel.

Description

6A Bridlesmith Gate comprises a retail unit on ground floor with ancillary accommodation on first and second floors.

6B Bridlesmith Gate comprises a retail unit on ground floor with ancillary accommodation on first floor.

The units have been fitted out by the tenants in their usual corporate style.

Planning

The property is Grade II Listed (hence no empty business rates) and is located within the Old Market Square conservation area.

Rateable Value

According to the Valuation Office website the rateable value for the property is as follows;

| Kanoo Travel | £106,000 |

| Whittards | £68,000 |

The business rate multiplier is 50.4 pence per pound.

As the property is Grade II listed there are no empty business rates payable.

Accommodation

The property has been measured by BKR Floor Plans and provides the following Net Internal floor areas:

| 6A Bridlesmith Gate (Kanoo Travel) | ||

|---|---|---|

| Net Frontage | 4.42 m | 14’6” |

| Gross Frontage | 7.92 m | 26’0” |

| Zone A | 40.97 sq m | 441 sq ft |

| Zone B | 26.76 sq m | 288 sq ft |

| Zone C | 3.25 sq m | 35 sq ft |

| ITZA | 594 | |

| Ground Floor Total | 70.98 sq m | 764 sq ft |

| First Floor | 62.52 sq m | 673 sq ft |

| Second Floor | 85.65 sq m | 922 sq ft |

| Sub-Total | 219.06 sq m | 2,358 sq ft |

| 6B Bridlesmith Gate (Whittard) | ||

| Net Frontage | 3.43 m | 11’3” |

| Gross Frontage | 6.48 m | 21’3” |

| Zone A | 35.95 sq m | 387 sq ft |

| Zone B | 12.54 sq m | 135 sq ft |

| ITZA | 455 | |

| Ground Floor Total | 48.49 sq m | 522 sq ft |

| First Floor | 44.68 sq m | 481 sq ft |

| Sub-Total | 93.27 sq m | 1,004 sq ft |

| TOTAL | 312.33 sq m | 3,362 sq ft |

The measured survey report is available to download and will be re-addressed to a purchaser at a cost of £490 + VAT.

Tenure

Freehold & Leasehold.

Most of the property (including the whole of Unit 2, occupied by Whittard Trading Limited) is comprised within one freehold title. The remainder of the property (including part of Unit 1, occupied by Kanoo Travel Limited) is held under the freehold title referred to above and two leasehold titles, pursuant to long leases expiring on 20th November 2147 and 23rd June 2981, respectively.

It should be noted that the long leasehold interests do not contain mortgagee protection provisions. The Tenant would, however, be able to apply for relief from forfeiture in the usual way.

Tenancies

6A Bridlesmith Gate

Let to Kanoo Travel Limited on a full repairing and insuring lease (subject to a Schedule of Condition for the 1st & 2nd floors – see data room) for a term of 10 years from 16th May 2018, expiring on 15th May 2028. There is a tenant’s break option on 16th May 2023, subject to 6 months’ prior written notice.

The current passing rent is £75,000 per annum which, based on our analysis, equates to £117 Zone A. The lease benefits from an upwards only rent review on 16th May 2023.

6B Bridlesmith Gate

Let to Whittard Trading Limited on a full repairing and insuring lease (subject to a Schedule of Condition for the 2nd floor – see data room) for a term of 10 years from 24th June 2014, expiring on 23rd June 2024. There is a tenant’s break option on 24th June 2022, subject to 6 months’ prior written notice and a three month rent penalty if exercised.

The current passing rent is £60,000 per annum which, based on our analysis, equates to £128 Zone A. The rent was re-based in June 2019 from a previous rent of £86,150 per annum.

Therefore, the total passing rent is £135,000 per annum.

In order to support both tenants during the pandemic the Landlord has agreed the following payment plan:

6A Bridlesmith Gate (Kanoo Travel):

-

Rent permitted to be paid monthly instead of quarterly.

-

Deferral of 50% of each of the Q3 2020 monthly payments (24th June, 24th July & 24th Aug).

-

Deferral of 25% of each of the Q4 2020 monthly payments (29th Sept, 29th Oct & 29th Nov).

-

Deferred rent to be repaid pro rata over the shorter of (i) a period of 24 months beginning on 1st Jan 2021) or (ii) the remaining lease term.

-

Deferral solely in respect of rent, not service charge payments.

The tenant is fully up to date with rent payments other than the deferred rent which, as of 22nd March 2021, totalled £15,468.74.

6B Bridlesmith Gate (Whittard):

In accordance with a side letter, the Landlord has agreed to the following concession:

-

Rent permitted to be paid monthly instead of quarterly.

-

Rent reduced to £40,000 excluding VAT (i.e. 66% of the passing rent) from 1st April 2021 to 31st December 2021.

-

In the event of another national lockdown by the Government, the rent to be reduced to 50% of the contractual level for any period of mandated store closure.

-

On completion of the side letter the tenant is to pay £40,000 plus VAT in full and final settlement of their arrears (in respect of the main rent) for the period 1st April 2020 – 31st March 2021.

In order that a purchaser does not suffer an income shortfall, the vendor will “top-up” the income until 31st December 2021 by an appropriate adjustment on the completion sum. Therefore, an investor will benefit from an income of £60,000 per annum.

Covenants

Kanoo Travel Limited (Co. No. 05776787) has reported the following figures:

| Year Ending | 31st December 2019 | 31st December 2018 |

|---|---|---|

| Revenue | £5,339,739 | £5,693,774 |

| Pre-Tax Profits (Loss) | (£421,011) | (£53,014) |

| Net Assets | £2,995,042 | £3,416,053 |

According to its website the family owned Kanoo Travel Group, an American Express franchise partner, is the largest travel company in the Middle East with a team of travel specialists in over 180 offices in the region and over 200 offices worldwide.

The Kanoo family's involvement in air travel goes back to 1937 when the company provided refuelling facilities in Bahrain for Imperial Airways seaplanes in route to India and Australia. In 1947 Kanoo Travel became the first IATA agency in the Gulf and has grown into the largest travel company in the Middle East.

April 2007 saw Kanoo Travel branch out into the UK travel industry, after acquiring American Express' A High Street leisure travel businesses. According to its latest published accounts Kanoo serves customers from 16 branches across the UK offering both travel and foreign exchange services at 7 of these locations with the remaining 9 operating as foreign exchange bureaux. For further information visit www.kanootravel.co.uk.

Whittard Trading Limited (Co. No. 06753147) has reported the following figures:

| Year Ending | 29th December 2019 | 29th December 2018 |

|---|---|---|

| Revenue | £42,354,138 | £37,690,843 |

| Pre-Tax Profits | £878,079 | £316,760 |

| Total Assets | £11,938,608 | £10,624,176 |

Established in 1886 by Walter Whittard, the principal activity of the company is the selling of the highest quality teas, coffee and cocoas from around the world together with everything that enriches the experience of consuming them. Routes to market include owned and operated UK stores, a global ecommerce platform, international franchise stores, and worldwide wholesale. For further information see www.whittard.co.uk.

According to its latest published accounts the company continued to enjoy sustained double digit sales growth for the third consecutive year, driven by both like for like home market sales and international growth, particularly in Asia and Europe. As at the year-end the company had 50 trading stores and opened its first three franchised stores in Taiwan.

Sales growth momentum continued into Q1 2020 until the Government forced closures of the company’s stores on 21st March 2020 in response to the COVID-19 pandemic. The business reacted swiftly to the challenges that were faced, and the focus was to ensure that the brand was protected to ensure that the company could continue its growth trajectory as restrictions continued to ease. Customers migrated to ecommerce when physical stores were closed with growth of the ecommerce channel being more than 200% YoY which has helped offset some of the revenue losses due to the forced store closures. In addition to Government support schemes such as furlough and business rates relief the business has also secured an additional £1.5m of shareholder funding. The accounts state that the financial performance in 2019 has given the business a solid foundation to cope with the challenges COVID-19 has posed and that the outlook in the mid-term remains optimistic.

VAT

The property has been registered for VAT. It is anticipated that the sale will be treated as a Transfer of a Going Concern (TOGC).

Proposal

We are instructed to seek a figure of £850,000 (Eight Hundred and Fifty Thousand Pounds), subject to contract, reflecting a net initial yield of 15.0%, assuming purchaser’s costs of 5.56%.

Please note a purchaser will be re-charged the cost of the searches and measured survey which are provided in the data room.

Please note a purchaser will be charged a Transaction Fee of £10,000 + VAT.

Investment Considerations

-

An opportunity to acquire a freehold city centre investment;

-

The property occupies a prominent position in the heart of Nottingham City Centre;

-

Let to the established covenants of Kanoo Travel and Whittard who are long-term tenants;

-

Re-based rents;

-

Grade II listed property so no empty business rates payable;

-

A purchase at the asking price reflects a highly attractive net initial yield;

-

Attractive lot size for an investor.

-

The property is sold with the benefit of a rent guarantee from the vendor to ensure an investor has no issues receiving income in light of the Coronavirus Act 2020 Part 1 Section 82.

Data Room and clicktopurchase® "Best Offers" 3:00 pm May 19th 2021

Access to the data room and for the ability to purchase online with speed and ease, please click the clicktopurchase® icon or the clicktopurchase® side bar. Purchasers will be able to access the complete legal package, clear verification and submit legally-binding offers to acquire the property.

Purchasers benefit from the trust, security and transparency provided by the platform. All activities, including the online contract execution, will form part of the electronic audit trail which is anchored in the clicktopurchase® Blockchain.

clicktopurchase® provides the opportunity for any investor, whether located UK or abroad, to uniquely purchase online with ease and certainty. To learn more about clicktopurchase®, view clicktopurchase guides where ample videos and guides are available.

Note: offers submitted by clicktopurchase® are legal offers to treat. Should our client instruct us to accept the highest offer, an exchange of contracts will occur. In order to be able to submit an offer, you need to be provided with clearance to do so. Therefore, please note that interested parties should clear the verification process as soon as possible, regardless as to whether you choose to submit an offer. Please do not leave this to the last minute as this may prevent you from being able to submit your proposal.

DOWNLOADS

BROCHURE

Contact Us

| Singer Vielle | +44 (0) 207 935 7200 | |

|---|---|---|

| Dale Henry | dale@singervielle.co.uk | +44 (0) 203 701 1356 |

| Neil Singer | neil@singervielle.co.uk | +44 (0) 203 478 9120 |

Vendors Solicitor

| Eversheds Sutherland | +44 (0) 292 047 7932 |

|---|---|

| Adam Hooton | adamhooton@eversheds-sutherland.com |