Data Centre / NHS / Office Investment Opportunity

Kilby House | Liverpool Innovation Park | Liverpool | L7 9NJ

£8,000,000

subject to contract

GALLERY

Introduction

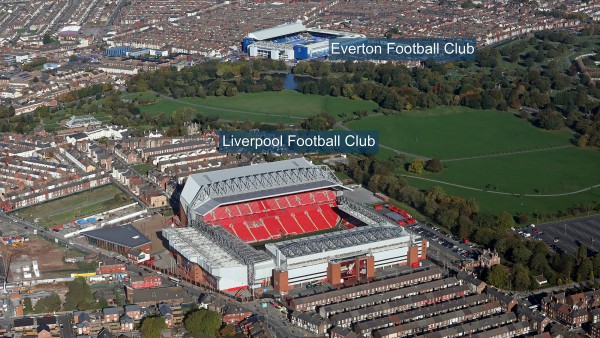

An opportunity to buy a piece of Liverpool! Famous as the birthplace of the Beatles, widely regarded as the most influential band in history; home of Liverpool Football Club at Anfield; venue for the famous Grand National steeplechase at Aintree; birthplace of numerous actors, comedians and sportspeople.

Summary

-

An opportunity to invest in Liverpool

-

Strategically located within the Liverpool Innovation Park

-

Attractive opportunity to invest in a Data Centre as well as National Health Service tenancies

-

Data Centre occupier specialising in services to the healthcare sector.

-

Offices occupied by National Health Service Trusts, in effect “AAA” government income, accounting for 60% of the rents

-

Rent increases linked to increases in the Retail Price Index

-

£8,000,000, subject to contract

-

7.8% Net Initial Yield

Location

The City of Liverpool is the commercial and administrative centre for the Merseyside region and is located approximately 341 km (212 miles) north-west of London, 159 km (99 miles) north-west of Birmingham and 56 km (35 miles) west of Manchester.

Liverpool benefits from excellent road links to the rest of the UK and is situated at the western end of the M62 Motorway which links with the M6 Motorway. The M56 & M53 Motorways give access from the South, while the M58 and M57 Motorways provide access to and from the Northern part of the city.

Liverpool John Lennon Airport handles over 5 million passengers a year with flights to over 70 destinations in the UK and across Europe and is a gateway for the City Region, the North West and North Wales. The airport plans to service more destinations including long haul, with passenger numbers forecast to grow to 7.8 million by 2030. Located on the Mersey Estuary, the City has historically acted as one of the UK’s most prominent ports and is home to a new major ferry terminal at Pier Head, accepting up to 40 cruise ships per year.

The Liverpool City region is in the north-west of England, which is the UK’s second largest regional economy; it is home to 267,000 business, and is worth £171 billion. The region hosts key facilities for participants in both the banking and wealth management sectors. Key occupiers include Santander, Barclaycard, Rathbones Investment Managament and Investec. Liverpool also houses global leaders in the manufacturing sector, with companies including Jaguar Land Rover, Unilever, Pilkington and Astra Zeneca, all of which have significant operations in the city.

Liverpool benefits from several universities including Liverpool John Moores University – one of the largest universities in the UK - as well as the University of Liverpool, which is a globally-ranked research institution; both of these play a significant role in the education and innovation-led initiatives around Liverpool.

The City has undergone a major resurgence since being awarded European Capital of Culture in 2008 and with a total of £4 billion of public and private investment, Liverpool’s visitor economy has doubled. (Source: www.investliverpool.com)

Liverpool is undergoing an £14bn regeneration programme, which is set to transform the city’s infrastructure and give rise to several initiatives including a 60 hectare, £5.5 billion redevelopment of Liverpool’s historic dockland, £2 billion of investment in Liverpool’s Knowledge Quarter, a £54m Television and Film Studio development, and £250m of road infrastructure enhancement. Furthermore, Liverpool will deliver 10,000 new homes, and 2 million sq ft of commercial office space within the next 5 years. (Source: www.regeneratingliverpool.com).

Liverpool’s Knowledge Quarter is a 450-acre Mayoral Development Zone in heart of the City Centre. It is a hub for global research, and houses a cluster of bio-medical, research and science institutions as well as Liverpool University, Liverpool University Teaching Hospital and Liverpool John Moores University. In addition to the £600m invested since 2000, a further £2 billion of investment is being undertaken in the Knowledge Quarter over the coming years. This will see an expansion of the Royal Liverpool University Hospital through a £25 million Life Sciences Centre, and the £118 million Clatterbridge Cancer Treatment Centre, among many others. The Knowledge Quarter seeks to boost local employment, attract global talent, and encourage greater post-graduate retention from local Universities.

A 30-acre site at the eastern gateway of the Knowledge Quarter has been earmarked for a £1 billion expansion project, which will comprise 1.8m sq ft of life sciences, technology and education space; this is estimated to create more than 10,000 new jobs. Development is already underway, and notable buildings include the Spine building and the Rutherford Cancer Centre.

The 160,000 sq ft Spine building is the flagship development for Paddington Village and is the new HQ for the Royal College of Physicians, and is one of the first buildings in the UK to achieve the WELL certification standard of employee well-being.

The Rutherford Cancer Centre is a £20 million investment project in to cancer diagnostics. Rutherford Diagnostics aims to become a leader in prediction, detection and prevention of cancer, and seeks to reduce waiting times for diagnostic tests from weeks to days. (source: www.rutherforddiagnostics.co.uk).

The Littlewoods building sits adjacent to Kilby House, and is undergoing a £54 million regeneration project; this has received a £17 milion funding commitment from the Liverpool City Region Combined Authority’s Strategic Investment Fund. The Capital & Centric development has already been partially pre-let to anchor tenant Twickenham Studios, one of the UK’s oldest operating studios. John Moores University has also leased 75,000 sq ft of space. Liverpool is the most filmed British City outside of London, and with the regeneration underway, the Littlewoods development has coined the name “Hollywood of the North”.

Situation

Liverpool Innovation Park (LIP) is located in the heart of Liverpool’s thriving science and technology cluster. The park provides approximately 300,000 sq ft of office, research laboratory, retail and gym accommodation on a 22-acre site.

The Park is strategically positioned approximately 1.7 miles to the east of The Royal Liverpool University Hospital, and 2.2 miles to the west of Alder Hey Children’s Hospital, Liverpool Heart and Chest Hospital and Liverpool Broadgreen Hospital. It also sits approximately 0.5 miles to the west of Liverpool Shopping Park, which, once completed, will provide over 700,000 sq ft of retail space, with occupiers including B&Q, Boots, JD Sports, and M&S Foodhall.

LIP benefits from excellent connectivity; it is approximately 2 miles to the west of Junction 4 of the M62 motorway, which in turn provides access to the M60 orbital motorway network. The Park is situated approximately 2.5 miles to the west of Liverpool City Centre and 1 mile to the north-west of Wavertree Technology Park Railway Station, which provides regular services to Liverpool Lime Street and Manchester Piccadilly.

Access to the Park is through its main entrance on Innovation Boulevard, which sits on Edge Lane. The Property itself is accessed via Digital Way, a junction of Innovation Boulevard.

A video about Liverpool Innovation Park can be viewed here.

Description

Kilby House is a three storey building arranged over ground and two upper floors.

The building is of steel frame construction with reinforced concrete foundations. The elevations are predominantly formed of metal framed double glazed curtain walling with cavity brickwork construction at ground floor level together with powder coated metal framed double glazed casement windows.

Access into the building is via a communal entrance foyer serving the wider building estate. Internally, at ground floor level, the majority of the accommodation has been extensively fitted out to form a Class 3 data centre. Finishes include a mineral fibre suspended ceiling system, a combination of painted plastered walls to communal areas and pvc wall panelling to server areas along with vinyl floor finishes.

The first and second floor office areas have undergone refurbishment to CAT A finish including a suspended 600x600mm mineral fibre tile system, painted plastered walls with timber skirtings and a raised access floor complete with carpet floor coverings.

Internally, the offices have full height glazed partitioning, perimeter trunking and suspended ceiling incorporating recessed lighting and AC cassettes. The office occupiers have dedicated fibre connections to the data centre enabling them to access the secure Health and Social Care Network. The fit out works for the Alder Hey Childrens’ NHS Foundation Trust suite on the first floor were conducted in 2019.

Communal areas include male and female WC facilities on each floor.

The property benefits from 82 car parking spaces, of which 25 are adjacent to the building and 57 are located within the wider estate car park.

Lift Improvements:

During 2019, following recommendations by Knowsley Lift Services, improvements were undertaken to the lift services. Please refer to the report provided “Vertical Transportation Conditon Report” from Savills of March 2020. We have provided in the data room full details of the project.

Curtain Walling Works:

During 2020, works were undertaken by Delta Glazing, under the guidance of Tee Technical Building Forensics, to ensure the external façade was safe and water resistant. Please refer to the section within the data room. We provide the Health & Safety file along with the Specification and a Letter of Reliance issued by Tee Technical Building Forensics who advised on the works. We also provide further information regarding the specification from Delta Glazing, Promain, The Comprehensive Group.

Fire Risk Assessment:

A fire risk assessment undertaken in November 2020 by William Martin Compliance providing a risk rating of “Moderate”. An action plan was recommended and in the process of being implemented by the owner’s representatives.

The data centre section of the property provides a modern facility which provides high-speed connectivity to much of the Liverpool Innovation Park. Full details of the data centre specification can be found at the occupier’s website: www.aimes.uk/p-about-aimes. We draw your attention to the multiple Accreditations and impressive client list.

As an indication of the degree of infrastructure investment into the facility, Michael Walker, Project Director of AIMES, estimated that for AIMES to relocate to a different site, the capital investment required would be in the order of £5m. Mr Walker also confirmed that AIMES are shortly to embark on further significant capital expenditure to increase capacity in the Data Centre.

Mr Walker believes that the attractions for the Royal Liverpool and Broadgreen University Hospital Trust staff being located within the same building as the AIMES data centre include its location, facilities and digital connectivity, which enable the hospital’s IT staff to be productively located within Kilby House and, indeed, to have equipment hosted within the data centre.

In the case of Alder Hey Children’s Hospital, we are advised that the ability for front-line staff to be able to easily log-in to large, heavy images files for diagnostics, by being within the data centre below, assists the delivery of care on site and for the nearby hospital.

Accommodation

The property has been measured by BKR Floor Plans and provides the following Net Internal Areas:

| Offices / Data Centre | ||

|---|---|---|

| Ground Floor | 1213.00 sq m | 13,057 sq ft |

| First Floor (Aimes) | 695.73 sq m | 7,489 sq ft |

| First Floor (Alder Hey) | 349.40 sq m | 3,761 sq ft |

| Second Floor (Royal Liver) | 1099.66 sq m | 11,837 sq ft |

| Total | 3189.07 sq m | 34,328 sq ft |

| Shared Foyer | ||

|---|---|---|

| Ground Floor | 24.62 sq m | 265 sq ft |

| First Floor | 55.09 sq m | 593 sq ft |

| Second Floor | 39.67 sq m | 427 sq ft |

| Total | 119.38 sq m | 1,285 sq ft |

Floor plans are available to download and the measured survey report will be re-addressed to a purchaser at a cost of £845 + VAT.

Site

We estimate the site area to be approximately 0.49 acres (0.2 Hectares).

A Desktop Environmental Audit was undertaken by Paragon in July 2019 which concluded that “based on the continued commercial use of the site there is a low to medium risk with regard to environmental liability as the lease contains a ‘carve out’ whereby the client will have no liability under the lease to the landlord for any historical contamination” and “no further investigations are required in connection with the on-going use of the site”. (Please see clauses 3.12.5 and 3.12.16 of the Headlease)

The environmental report is available to download and will be assigned to a purchaser at a cost of £500 + VAT. We have provided the reliance letter in the data room.

Tenure

The property is held long leasehold from 19th June 2015 for a term of 250 years expiring on 18th June 2265 at a peppercorn rent (approximately 244.5 years unexpired).

Tenancies

The property is let in accordance with the attached tenancy schedule producing a current income of £675,720 per annum. As a result of a service charge shortfall in respect of the second floor letting, the net income is currently £667,969 per annum.

Lease are drawn upon internal repairing and insuring provisions with appropriate service charge contributions.

The ground floor data centre and part first floor is let to Aimes Management Services Limited at a combined rent of £270,890 per annum. The lease expires 16th September 2029.

Part of the first floor is let to Alder Hey Children’s NHS Foundation Trust at a current rent of £89,339 per annum. The lease expires 2nd April 2029, however the tenant has an option to renew for a further 5 years from 3 April 2029. At the time of letting, the rent reflected the landlord providing the accommodation fully fitted.

The second floor is let to Royal Liverpool and Broadgreen University Hospital Trust at a current rent of £305,000 per annum. The lease expires 16th June 2028 and incorporates a tenant’s break clause 16th June 2023. Should the tenant exercise the break, a break penalty is payable of £517,500. At the time of letting, the rent up to June 2023 reflected the landlord providing the accommodation fully fitted.

Please refer to the tenancy schedule in relation to the car parking allocation.

Rent reviews are based upon increases in the Retail Price Index, the exception being in respect of the letting on the second floor where the rent has a fixed review to £228,000 per annum on 17th June 2023 for the remainder of the term. Assuming an average Retail Price Index of, say 1% per annum, we suggest that the reversionary income will be £609,344 per annum by September 2024.

We have provided in the data room detailed payment histories for the tenants which shows an excellent payment record for all tenants.

Service Charge

The property is covered by two service charges, one relating to Kilby House and a second relating to the Liverpool Innovation Park.

The Liverpool Innovation Park Service Charge Budget for the year ending 30th September 2021 is £1,203,236 with an allocation to Kilby House of £78,687. Each tenant pays their due proportion of the Estate Service Charge. The total service charge budget for the period 29th September 2020 to 28th September 2021, is £121,747 (this figure includes the Park Service Charge of £78,687)

The service charge contribution by Aimes Management Services Limited in relation to Kilby House is fixed, increasing annually by reference to RPI with a 1% collar and a 4% cap. The current amount payable is £29,120 whereas the apportion due in relation to Kilby House is £22,674. The landlord is permitted to retain the surplus of £6,446.

The Royal Liverpool and Broadgreen University Hospital Trust is not required to pay the apportioned service charges for their accommodation. For the 2021 year this amounts to £15,365, hence this cost is met by the landlord.

The service charge budget for Kilby House for the year 2020 is due to be audited in the early months of 2021. We provide the service charge budgets for 2020 and 2021 which are available to download.

The cost of insuring Kilby House is not recoverable from Royal Liverpool and Broadgreen University Hospital Trust or Alder Hey Children’s NHS Foundation Trust. This cost currently amounts to £3,739 which is met by the landlord.

Covenants

“Aimes is an award winning cloud services provider” – www.aimes.uk. The company is a specialist in Healthcare digital services, providing “Health Cloud” services to the National Health Service and the wider healthcare sector.

Please see the following video regarding Aime’s activities: click here.

For the year ending 30th June 2020, Aimes Management Services Limited reported a balance sheet in excess of £2.55m.

Aimes supports over 100 clients including fifty major NHS and leading Academic institutions. Aime’s client list includes many National Health Service Trusts: click here.

Alder Hey Children’s NHS Foundation Trust cares for over 270,000 children, young people and their families and leads research into children’s medicines, infection, inflammation and oncology. They treat everything from common illnesses to highly complex and specialist conditions from their main hospital site in Liverpool and across community sites and clinics throughout the North West.

The Trust is:

• A Centre of Excellence for cancer, as well as spinal, heart and brain conditions

• A Department of Health Centre for Head and Face Surgery

• A Centre of Excellence for Muscular Dystrophy and the first UK Centre of Excellence for Childhood Lupus

• One of four national centres for childhood epilepsy surgery, a joint service with the Royal Manchester Children’s Hospital

• A designated Children’s Major Trauma Centre

• The Trust has Europe’s only intra-operative 3-T MRI scanner which is a pioneering technology for neurosurgery, reducing repeat operations in 90% of cases

The Trust employs a workforce of 3,750 staff who work across the community and hospital sites and as a teaching and training hospital the Trust provides education and training to around 540 medical and over 500 nursing and allied health professional students each year.

For the year ending 31st March 2020 the Trust reported an operating turnover of £291 million and a cash balance of £90.03 million.

For further information see www.alderhey.nhs.uk.

In October 2019, the Royal Liverpool and Broadgreen University Hospitals NHS Trust merged with Aintree University Hospital NHS Foundation Trust to create the Liverpool University Hospitals NHS Foundation Trust.

The merging of the two organisations was integral to regional NHS plans to deliver improved quality of care and to make changes in existing care models. The merger provides an opportunity to reconfigure services in a way that provides the best healthcare services to the city and improves the quality of care and health outcomes that patients experience.

The Trust runs Aintree University Hospital, Broadgreen Hospital, Liverpool University Dental Hospital and the Royal Liverpool University Hospital. It serves a core population of around 630,000 people across Merseyside as well as providing a range of highly specialist services to a catchment area of more than two million people in the North West region and beyond.

The Trust has an annual turnover of around £890m and a combined workforce of over 12,000 staff, making it one of the largest employers in the region. It also has a successful Volunteers scheme, with more than 900 volunteers providing support in a variety of roles.

For the year ending 31st March 2020, the Trust reported a Surplus of £283m.

Between 1st October 2019 and 31st March 2020:

• 191,434 emergency and urgent attendances

• 99,208 Type 1 Emergency Department attendances

• 36,150 admissions from Emergency Departments

• 47,258 inpatients and day cases

• 6,434 planned procedures

• 50,925 unplanned procedures

• 40,824 day case procedures

• 487,800 outpatient appointments

The Natonal Health Service (NHS) is overseen by The Department of Health and Social Care (DHSC), a department of Her Majesty’s Government. The department is led by the Secretary of State for Health and Social Care.

NHS Foundation Trusts are fully part of the NHS but are controlled and run locally, not nationally. NHS foundation trusts were created to devolve decision making from central government to local organisations and communities. They provide and develop healthcare according to core NHS principles - free care, based on need and not ability to pay.

A foundation trust has a Council of Governors and a Board of Directors and is regulated and monitored by both the Care Quality Commission and NHS Improvement. Although still part of the NHS, foundation trusts are not directed by the Government which means they have greater freedom to decide, with their governors and members, their own strategy and the way services are delivered. They also have greater financial independence and are able to retain their surpluses and invest in service improvements for patients and service users.

From a financing standpoint, following annual government spending revenues by HM Treasury, Parliament approves the UK Public Sector Budget. The DHSC enforces this budget, and distributes the funds to NHS England. In turn, NHS England apportions the funds to the various Clinical Commissioning Groups (CCGs), across the UK. Finally, the monies get distributed to the NHS Trusts. In this way, the income from the NHS tenants reflects the creditworthiness of the UK government.

HM Treasury -> DHSC -> NHS England -> CCGs -> NHS Trusts -> Owner of Kilby House

Hence, both these NHS Trust tenants provide in effect “AAA” Government income.

The 2019 NHS long-term plan was formed in the wake of the NHS’ 70th anniversary; it sets out initiatives designed to future-proof the NHS over the next decade.The plan seeks to enhance and promote care coordination, predictive prevention of diseases, and a differentiated support-offering within the NHS service model. A key component of this framework is the digitization of primary and outpatient data.The end goal is to digitally connect patients and healthcare professionals through digitization of appointments and prescriptions; the NHS aims to offer a ‘digital first’ option of care for most patients within the next 10 years. This will incorporate artificial intelligence (AI) decision-making systems and predictive techniques to help clinicians best support their patients. This will, in turn, promote rigorously enforced technology standards to ensure the security of NHS systems and data. (Source: NHS Long Term Plan)

Data Centre Market

According to Knight Frank’s Data Centre Market Report, Europe Q2 2020, COVID 19 has not dampened investor appetite towards data centres. In fact, a number of significant deals across Europe has made the period of M&A activity under COVID 19 one of the busiest periods in data centre history, with over $25 billion of total data centre investment expected to complete in 2020. In the UK, according to EG Radius Data Exchange figures, the number of data centre plans lodged since the Government enforced lockdown on 23rd March totals over 2.27m sq ft of space. This means that more data centre space was lodged in roughly three months than the whole of 2019, which saw over 2.05m sq ft of plans submitted (Source: Estates Gazette).

Knight Frank’s report states that local and national lockdowns and the rapid increase in remote working have resulted in unprecedented upturn in demand for digital services. Video conferencing and remote access of work files and applications registered a particularly high increase in usage. In March, Microsoft recorded a 775% spike in demand for its Azure public cloud offering in Italy, as businesses turned to their IT to maintain a working structure.

Similarly, content streaming providers such as Netflix, Amazon Prime Video and YouTube have all been impacted by increased digitised leisure use and were forced to reduce picture quality in order to ration demands on bandwidth. In addition, gaming platform providers and on-demand cloud gaming apps such as Google Stadia and NVIDIA GeForce NOW entered the market to bolster their data centre capacity. The consumer shift toward online shopping also accelerated sharply. In the UK, online sales went from 19.9% of total retail spend to a high of 34.1% in May. As a result, many companies accelerated plans to develop a new data centre infrastructure.

It is forecast that the rise in digital services will continue after the COVID pandemic has passed and major firms are accelerating their growth plans. The report states that due to significant levels of additional demand, very few facilities across all European markets are holding surplus capacity. The report concludes that “data and connectivity has proven to be a huge asset. Digital resilience and agility will be a key area of businesses investment moving forward as ‘Just in Case’ strategies emerge…. digital transformation spending is still expected to rise by more than 10% in 2020. The demands on data centres therefore, will clearly continue to increase in support of this.”

In terms of the UK data centre market, according to Arizton Advisory & Intelligence, in 2019 and 2020 the UK market witnessed investments in over 30 data center projects and the market size is set to reach over $8.4 billion by 2025.

In its National Data Strategy, published in September 2020, the Government states that as our economy and public services become increasingly dependent on data, the security and resilience of the infrastructure on which data relies will also become more important.

The need to store and process data externally – for example, in data centres – will also become even more of a critical operating function. OECD figures show that the number of businesses in the UK purchasing cloud computing systems nearly doubled from 2014 to 2018. Therefore, data centres underpin an increasing amount of business and societal activity.

VAT

The property has been registered for VAT (Value Added Tax). It is intended that the sale will be treated as a Transfer of a Going Concern (TOGC).

Proposal

We are instructed to seek offers in the region of £8,000,000 (Eight Million Pounds), subject to contract, reflecting a net initial yield of 7.8%, assuming standard purchaser’s costs of 6.67%

Please note that a purchaser will be re-charged the costs of searches at £1,103.46 which are provided in the data room.

Please note that there are no Capital Allowances available for a purchase since they have been utilised by the vendor.

Investment Considerations

-

An opportunity to invest in Liverpool

-

Strategically located within the Liverpool Innovation Park

-

Opportunity to invest in a data centre with high speed connectivity

-

Data centre occupier is a specialist in providing services to the healthcare sector

-

Offices occupied by National Health Service Trusts, in effect “AAA” government income accounting for 60% of the rents

-

£8,000,000, subject to contract

-

7.8% Net Initial Yield

-

A rare opportunity for high net worth individuals and overseas investors to be able to invest in a data centre given the size of such investments can often command a large lot size.

Data Room

Access to the data room and for the ability to purchase online with speed and ease, please click the clicktopurchase® “C” icon or the clicktopurchase® side bar. Purchasers will be able to access the complete legal package, clear verification and submit legally-binding offers to acquire the property.

Purchasers benefit from the trust, security and transparency provided by the platform. All activities, including the online contract execution, will form part of the electronic audit trail which is anchored in the clicktopurchase® Blockchain.

clicktopurchase® provides the opportunity for any investor, whether located UK or abroad, to uniquely purchase online with ease and certainty. To learn more about clicktopurchase®, click here.

DOWNLOADS

BROCHURE

Contact Us

| Singer Vielle | +44 (0) 207 935 7200 | |

|---|---|---|

| Neil Singer | neil@singervielle.co.uk | +44 (0) 203 478 9120 |

| Dale Henry | dale@singervielle.co.uk | +44 (0) 203 701 1356 |

Vendors Solicitor

| Hamlins | +44 (0) 207 355 6000 | |

|---|---|---|

| Mark Hurst | mark.hurst@hamlins.com | +44 (0) 207 355 6024 |

| Angelique Umugwaneza | angelique.umugwaneza@hamlins.com | +44 (0) 207 355 6079 |