Prime Restaurant / Retail Investment

1/3 Cheapside & 2/4 Silver Street | Leicester | LE1 5EB

£1,915,000

subject to contract

GALLERY

Summary

-

100% Prime Retail Investment

-

Prominently located within city centre retailing pitch

-

Primarily let to Five Guys (91% of the income) until December 2025

-

Five Guys is an internationally-recognised brand

-

Five Guys’s UK business is backed by Sir Charles Dunstone, one of the UK’s best-known entrepreneurs

-

Unused areas of the property providing potential to add-value

-

Freehold

-

£1,915,000, subject to contract

-

10.0% Net Initial Yield

-

£178 per sq ft / £1,919 per sq metre overall (gross internal)

-

Low apportioned value for the vacant upper floors

Location

The City of Leicester is located approximately 161 km (100 miles) to the north of London, 64 km (40 miles) to the north-east of Birmingham and 40 km (25 miles) to the south-east of Nottingham.

The city is served by excellent communications with Junction 21 of the M1Motorway, the intersection of the M1 and M69 Motorways, situated approximately 7 km (4 miles) south west of the city centre.

The city has good rail communications providing a frequent train service to London St Pancras with a journey time of approximately 70 minutes as well as frequent daily services to Birmingham, Nottingham and Sheffield. In addition, the city benefits from an extensive bus network and a park and ride service into the city centre.

East Midlands Airport is approximately 32 km (20 miles) to the north west of the City and provides daily flights to a number of domestic and international destinations.

Situation

The subject property is situated in a 100% prime position on the south side of the pedestrianised East Gates at the junction of Silver Street with Cheapside. This busy position benefits from significant footfall generated by the city’s core retail destinations.

Leicester’s retail provision is focussed on the pedestrianised thoroughfares of East Gates, Humberstone Gate, Silver Street, Cheapside and Gallowtree Gate.

Multiple operators in the immediate vicinity include Marks & Spencer, HSBC, Barclays, Savers, Virgin Money, McDonald’s, Greggs and Urban Outfitters.

The property is directly opposite the Highcross Shopping Centre, the former Shires Shopping Centre, which comprises 1.15m sq ft with over 100 shops anchored by John Lewis. Other tenants in the scheme include Apple, All Saints, Zara, H&M, JD Sports, Reiss and Hugo Boss. In addition, Highcross has a premium leisure provision with 35 cafes and restaurants, a 12 screen Cinema De Lux and Treetop Adventure Golf.

In addition, the Haymarket Centre situated along Humberstone Gate and Haymarket is anchored by Primark with other retailers including TK Maxx, B&M, Holland & Barrett, Tesco Express and Sky.

Another major city centre attraction is the historic Leicester Market which is situated on Market Place. Dating back 700 years the property has been redeveloped plan with the construction of a new Food Hall in 2014 which was awarded Britain’s Best Food Market 2015. In June 2017 a new chapter in the history of the market opened with the launch of the New Market Square – a new public piazza for events, activities and speciality markets. The square with contemporary street furniture and lighting spans from The Knight & Garter across the historic Corn Exchange and hosts a variety of regular markets and activities.

Description

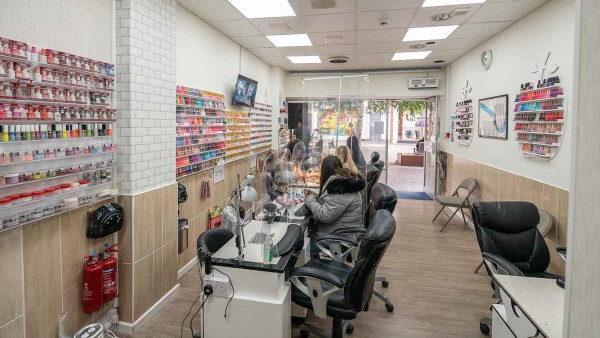

The property comprises a substantial corner property primarily occupied by Five Guys, along with a small section operating a nail bar. The property is arranged over basement, ground and three upper floors.

The restaurant area is arranged on the ground and part first floor, with the additional first floor being ancillary accommodation. The upper floors are generally capable of being self-contained, albeit leased to Five Guys. The basement is a former William Hill bookmakers which is currently not used.

Accommodation

The property has been measured by Plowman Craven and provides the following net internal floor areas;

| Sq M | Sq Ft | |

|---|---|---|

| Ground Floor | ||

| Zone A | 127.3 | 1,370 |

| Zone B | 56.1 | 604 |

| Remainder | 18.5 | 199 |

| Total Ground Net Internal Area | 201.9 | 2,173 |

| ITZA | 156.9 | 1,689 |

| Basement Retail | 173.2 | 1,864 |

| Basement Storage | 18.9 | 203 |

| First Floor | 162.6 | 1,750 |

| Second Floor | 176.2 | 1,897 |

| Third | 68.0 | 732 |

| Total Net Internal Area | 800.8 | 8,619 |

| Overall | ||

| Basement | 220.1 | 2,369 |

| Ground | 231.3 | 2,290 |

| First | 256.3 | 2,759 |

| Second | 215.5 | 2,320 |

| Third | 74.9 | 806 |

| Total Gross Internal Area | 998.1 | 10,744 |

A copy of the floor areas and floor plans is available to download.

Tenure

Freehold.

Tenancy

The majority of the property is let to Five Guys JV Limited on effectively a full repairing and insuring lease from 1st January 2021 to 31st December 2025 at a current rent of £185,250 per annum. The tenant has a personal concession to pay rent monthly – please see data room.

The small ground floor unit is let to Lien Vu, trading as “Miss Nails”. Occupation is by way of a tenancy at will at a current rent of £18,200 per annum.

Hence, the total income is £203,450 per annum.

All rents are paid and up to date, with no arrears.

Asset Management

The upper floors and basement are currently not used. If one applies a sensible rate to the second floor of £5 per sq ft, the third floor of £2 per sq ft and the basement of £5 per sq ft, this would assess the rent for the restaurant at £164,000 per annum. Applying the asking yield to the premises of 10% would represent an apportioned value of £1,545,000, leaving £370,000 relating to remaining accommodation.

With the basement, second and third totally 4,696 sq ft net internal / 5,495 gross internal, this section of the property is in effect available at only £79 per sq ft net internal / £67 per sq ft gross internal. We suggest that this offers significant potential to enhance value by exploiting these areas for alternative uses, subject to planning.

Covenant

The latest accounts for Five Guys JV Limited, for the year ending 31st December 2019, reported a turnover of £173.227m, pre-tax profits of £696,000 and a balance sheet of -£34m (note the loans of £105m to Five Guys Europe Holdings Limited).

The latest accounts for Five Guys Europe Holdings Limited for the year ending 31st December 2019 reported a balance sheet of -£21m with loans of £181m from the parent, Five Guys European Holdings Limited. The accounts for the latter shows loans of £266m, primarily from Freston Ventures Investments LLP, the investment vehicle for Sir Charles Dunstone. https://frestonventures.com. It is reported that the UK business of Five Guys is a 50:50 joint venture between Sir Charles Dunstone and the US-based founder, the Murrell family.

Five Guys is an internationally-recognised restaurant group, operating in over 1,700 locations worldwide. www.fiveguys.com/fans/the-five-guys-story. It is reported that the UK business operates from 110 sites with plans to open it’s first drive-thru sites shortly.

VAT

The property has not been registered for VAT and, therefore, VAT is not applicable on the purchase price.

Proposal

We are seeking £1,915,000 (One Million, Nine Hundred and Fifteen Thousand Pounds) subject to contract, reflecting a net initial yield of 10.0%, assuming standard purchaser’s costs of 6.25%.

Please note that a purchaser will be re-charged the costs of the searches (£972.95 + VAT) which are provided in the data room.

Investment Considerations

-

An opportunity to acquire a prime restaurant investment;

-

The property is primarily let to an internationally-recognised brand with backing from one of the UK’s leading; entrepreneurs

-

Attractive initial yield;

-

Opportunities to enhance value;

-

A purchase at the asking price represents an attractive capital value.

Data Room and clicktopurchase®

Access to the data room and for the ability to purchase online with speed and ease, please click the clicktopurchase® “C” icon or the clicktopurchase® side bar. Purchasers will be able to access the complete legal package, clear verification and submit legally-binding offers to acquire the property.

Purchasers benefit from the trust, security and transparency provided by the platform. All activities, including the online contract execution, will form part of the electronic audit trail which is anchored in the clicktopurchase® Blockchain.

clicktopurchase® provides the opportunity for any investor, whether located UK or abroad, to uniquely purchase online with ease and certainty. To learn more about clicktopurchase®, click here.

DOWNLOADS

BROCHURE

Contact Us

| Singer Vielle | +44 (0) 207 935 7200 | |

|---|---|---|

| Neil Singer | neil@singervielle.co.uk | +44 (0) 203 478 9120 |

| Dale Henry | dale@singervielle.co.uk | +44 (0) 203 701 1356 |

Vendors Solicitor

| Addleshaw Goddard | +44 (0) 161 934 6241 |

|---|---|

| Ashley Raine | ashley.raine@addleshawgoddard.com |