High-Yielding Retail Opportunity – 13.7%

New Look | 3-9 Hope Street | Wrexham | LL11 1BG

£900,000

subject to contract

GALLERY

Summary

-

To be sold by clicktopurchase® online auction – 1st March, 11.00am

-

Freehold retail investment opportunity

-

Prime retailing pitch

-

Let to New Look Retailers Limited

-

Re-based rent - £3.78 per sq ft overall

-

Guide price £900,000, subject to contract

-

13.7% net initial yield

Location

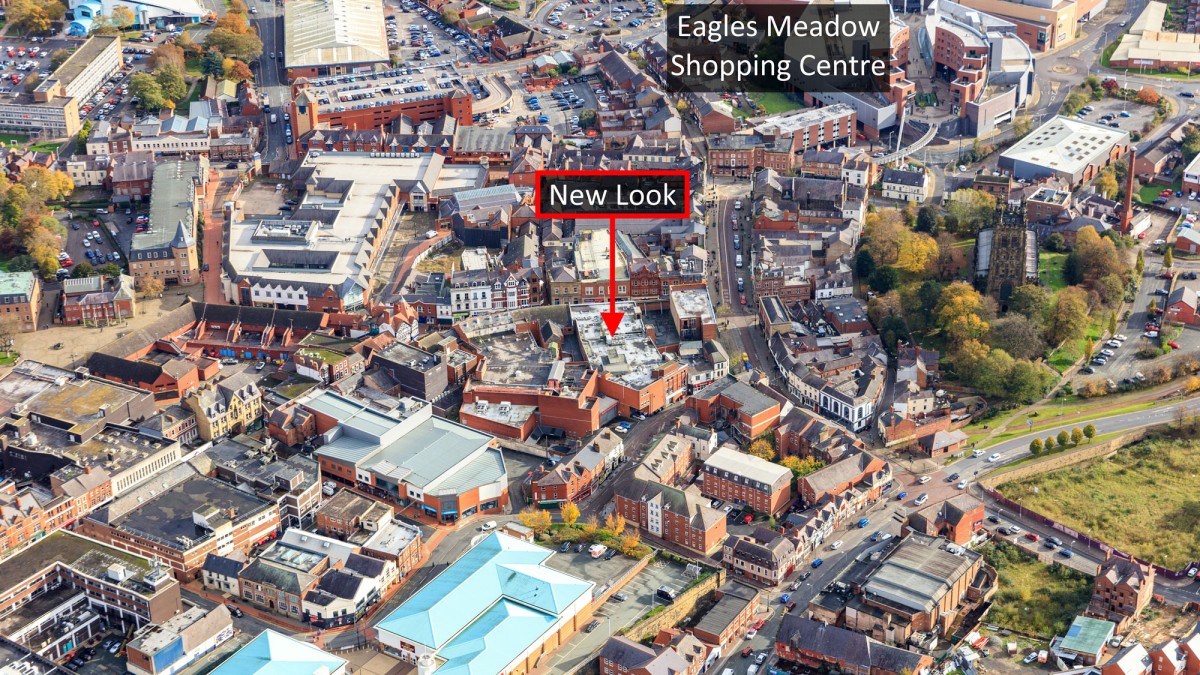

Wrexham is the largest town in North Wales, situated between the Welsh mountains and the lower Dee Valley alongside the border with England. It is the administrative, commercial and retail centre for the region. Wrexham is located approximately 86 km (53 miles) south-west of Manchester, 50 km (31 miles) north of Shrewsbury and 21 km (13 miles) south of Chester.

The town benefits from good road communications with the A55 being 14 km (9 miles) to the north, which in turn links with the M53 and M56 Motorways. The A483 also serves the town and provides access to Shrewsbury and the M54 Motorway to the south. The M6 Motorway is approximately 48 km (30 miles) to the east, accessed via the A534.

The town is connected to the national railway network with a fastest journey time to London Euston of 2 hours 24 minutes. There are also regular services to Chester with a 15 minute journey time. Liverpool John Lennon Airport is approximately 61 km (38 miles) to the north and Manchester International Airport is some 72 km (45 miles) to the north-east.

Situation

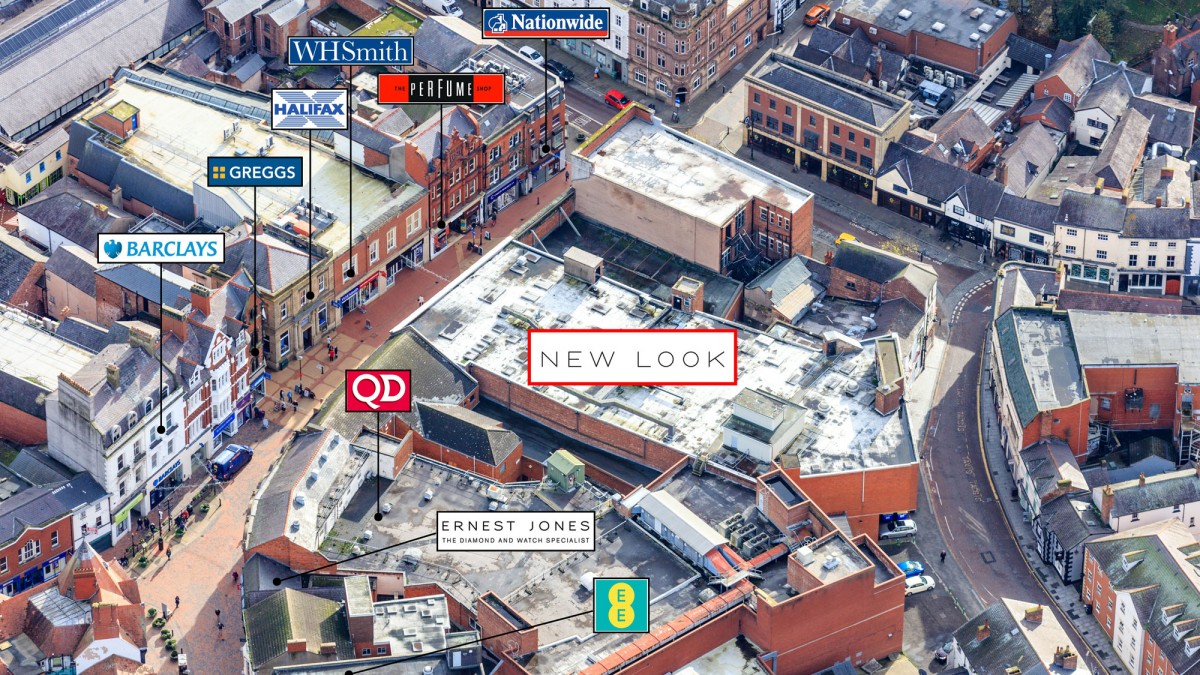

The property occupies a prime retailing position on the pedestrianised Hope Street, near its junction with High Street, within the very heart of Wrexham town centre. Pedestrian footfall in the vicinity of the property is high, being the principal retailing pitch. National high street retailers in close proximity to the property include WHSmith, Ernest Jones, Boots, Halifax, Greggs, O2, EE and Holland & Barrett.

The Eagles Meadow Shopping Centre is a short distance to the east. The centre benefits from occupiers including Debenhams, Marks & Spencer, Next, H&M and Topshop, plus an Odeon cinema and a 970 space car park.

Description

The property comprises a substantial building of traditional brick construction which provides a large open plan sales area on ground floor which has been fitted out to a high standard by the tenant to their usual corporate image. The property benefits from a service yard to the rear via Abbot Street.

Accommodation

The property has been measured by BKR Floor Plans and provides the following areas:

| Net Frontage | 32.97 metres | 108’2” |

| Gross Frontage | 33.55 metres | 110’1” |

| Sub-basement | 111.85 sq m | 1,204 sq ft |

| Basement | 385.72 sq m | 4,152 sq ft |

| Ground Floor | 1,491.60 sq m | 16,056 sq ft |

| First Floor | 1,207.42 sq m | 12,997 sq ft |

| Total Gross Internal Area | 3,196.60 sq m | 34,409 sq ft |

A set of floor plans is available to download and the measured survey report will be re-addressed to a purchaser at a cost of £795 + VAT.

Tenure

Freehold.

Tenancy

The property is entirely let to New Look Retailers Limited for a term expiring on 14th November 2023. The lease is subject to a Schedule of Condition. The current passing rent is £130,000 per annum (£40.67 per sq m / £3.78 per sq ft overall).

The existing lease of the property is for a term of 15 years from 15th September 2006, expiring on 14th September 2021. In accordance with a Deed of Variation dated 21st December 2018 and a Supplemental Lease dated 21st December 2018, the rent was re-based from £375,000 per annum (£117.31 per sq m / £10.90 per sq ft) and a supplemental lease granted to New Look Retailers Limited for a term of years from 15th September 2021, expiring on 14th November 2023.

Covenant

For the year ending 24th March 2018, New Look Retailers Limited (Co. No. 01618428) has reported the following figures:

| Revenue | £1,226,075,000 |

| Pre-Tax Profit (Loss) | (£257,010,000) |

| Net Assets | £177,604,000 |

Established in 1969, New Look is a leading fast fashion, multichannel retailer operating in the value-fashion segment of clothing and footwear market, predominantly in the UK, but also through franchise partners in countries spread across Europe, the Middle East and Asia. At the end of the financial year the company had 591 stores. For further information visit www.newlook.com.

On 21st March 2018 New Look announced the approval of a Company Voluntary Arrangement (CVA), which the company sees as a significant step towards delivery of their turnaround strategy, focused on returning the business to long-term profitability. In January 2019 the company agreed with key shareholders to reduce its debt by 80% with a £150m of capital raised by issuing new bonds which its executive chairman said “represents a critical step in our turnaround plans and lays the foundations to secure the future and long-term profitability of New Look by materially deleveraging our balance sheet and providing us with the financial flexibility to better attack our future”.

Note: The Supplemental Lease and deed of variation to the existing lease of the subject property are new contracts which the tenant entered into after the date of the CVA. Therefore, they replace the variations effected by the CVA and are not bound by its terms.

VAT

The property has been registered for VAT, however, it is envisaged the transaction will be treated as a Transfer of a Going Concern (TOGC).

Proposal

Guide price £900,000 (Nine Hundred Thousand Pounds), subject to contract, reflecting a net initial yield of 13.7%, after purchasers’ costs of 5.63%.

Please note that a purchaser will be re-charged the costs of the searches and surveys which are provided in the data room.

Please note a purchaser will be charged a transaction fee of £5,000 + VAT.

Investment Considerations

-

An opportunity to acquire a freehold retail investment;

-

The property occupies a prime retailing position in the heart of Wrexham town centre;

-

The rent has been significantly re-based from £375,000 per annum (£10.90psf) to £130,000 per annum (£3.78psf);

-

A purchase at the asking price will provide an investor with a highly attractive net initial yield;

-

Attractive lot size to an investor.

23.10.18

DOWNLOADS

BROCHURE

Contact Us

| Singer Vielle | +44 (0) 207 935 7200 | |

|---|---|---|

| Neil Singer | neil@singervielle.co.uk | +44 (0) 203 478 9120 |

| Dale Henry | dale@singervielle.co.uk | +44 (0) 203 701 1356 |

| Daniel Elia | daniel@singervielle.co.uk | +44 (0) 203 478 1353 |

| Ed Chamberlain | ed@singervielle.co.uk | +44 (0) 203 701 9121 |

Vendors Solicitor

| Boodle Hatfield LLP | +44 (0) 207 079 8125 |

|---|---|

| Katherine Worrall | kworrall@boodlehatfield.com |