Highly Secure Retail Investment – 9.0%

49 Dudley Street | Wolverhampton | WV1 3ER

£790,000

subject to contract

GALLERY

Summary

-

Let to Vodafone

-

Highly secure income - Shareholders’ Funds £6,110 million

-

New letting in February 2019

-

Prime city centre retailing pitch

-

VAT-free investment

-

Freehold

-

£790,000, subject to contract

-

9.0% Net Initial Yield

Location

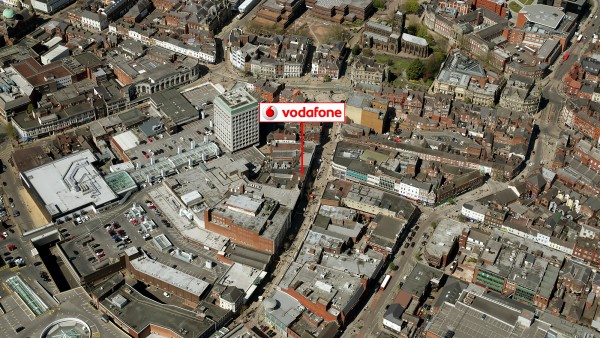

Wolverhampton is situated in the West Midlands and is approximately 24 km (15 miles) north west of Birmingham, 11 km (7 miles) west of Walsall and 29 km (18 miles) south east of Telford.

Wolverhampton benefits from good road communications being approximately 8 km (5 miles) west of Junction 10 of the M6 Motorway and 3.2 km (2 miles) south of Junction 2 of the M54 Motorway. The A41 Black Country Route provides direct access to the M5 at Junction 1 which links to Birmingham.

Wolverhampton is connected to the national railway network with a fastest journey time of 17 minutes to Birmingham New Street and 1 hour and 40 minutes to London Euston. HS2 will cut the journey time to London to 49 minutes. Birmingham International Airport is located approximately 44 km (27.5 miles) to the south east of Wolverhampton which provides domestic flights within the UK, and international flights to destinations in Europe, the Middle East, North America and the Caribbean.

The vibrant city of Wolverhampton has a population of approximately 260,000 and is one of the top ten growing economies in the UK. Located at the heart of Britain, the city is an ideal centralised location for businesses with 14 million people within 100 mins drive, 1.73 million with 30 mins and 3 million within 20 miles. Wolverhampton is one of only 13 cities nationwide where all four Mobile Network Operators have announced the rollout of 5G. It is ranked the top UK city for remote working according to the Remote Working Index.

Wolverhampton is home to sector leading firms including Jaguar Land Rover, Marston’s, Mogg and Collins Aerospace. The i54 strategic employment site north of the city centre is the most successful enterprise zone in the country attracting high quality jobs to the area. Jaguar Land Rover’s £1bn investment in a new engine plant at the site is creating in excess of 1,400 jobs.

The University of Wolverhampton produces a pool of 50,000 graduates every year and is ranked in the UK top 5 for graduate employability with 96% of students going onto employment or further study.

(Source: www.investwolverhampton.com).

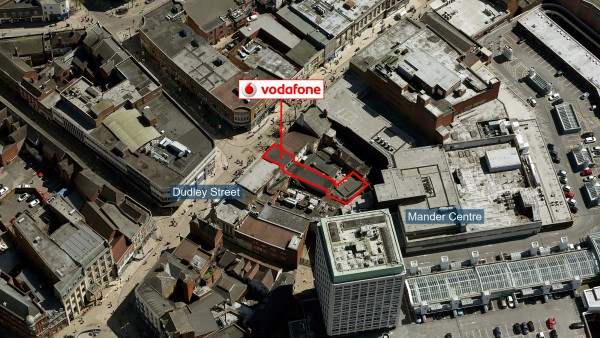

Situation

The property is located in the heart of the town centre, occupying a prime and prominent position on the pedestrianised Dudley Street, opposite its junction with Queen Street. Surrounding occupiers include The Body Shop (adjacent), McDonald’s, Holland & Barrett, Wilko, Nationwide, Carphone Warehouse and Boots.

The Mander Shopping Centre is immediately to the south. Comprising approximately 440,000 sq ft, occupiers include B&M, Greggs, JD Sports, Sports Direct, Ryman, Superdrug, Vision Express and Wilko. The UK’s first multi-million pound Frasers store opened in the centre on 12th April 2021. The 60,000 sq ft store, spanning three floors, is the first Frasers multi-brand store concept and houses the Frasers, Flannels and Sports Direct fascias.

The Wulfrun Shopping Centre is adjacent to the Mander Centre and is a single storey enclosed centre totalling approximately 200,000 sq ft with 570 car parking spaces. Anchored by Primark, other retailers include Iceland, Peacocks, Peacocks, Specsavers, Burger King and Virgin Media.

A vibrant indoor and outdoor market operates in the city centre four days a week, plus Craft and Farmers Markets enhance Dudley Street every first Friday of the month.

Description

The property comprises a ground floor retail unit with ancillary accommodation on first and second floors. Internally, the retail floor area has been fitted out by the tenant to their usual corporate style and is predominantly open plan with ancillary areas.

Accommodation

The property has been measured by BKR Floor Plans and provides the following Net Internal floor areas:

| Net Frontage | 6.99 m | 22’11” |

| Gross Frontage | 7.98 m | 26’2” |

| Zone A | 41.09 sq m | 442 sq ft |

| Zone B | 35.67 sq m | 384 sq ft |

| Zone C | 30.16 sq m | 325 sq ft |

| Remainder | 109.60 sq m | 1,180 sq ft |

| ITZA | 863 | |

| Total Ground Floor | 216.52 sq m | 2,331 sq ft |

| First Floor Ancillary | 120.05 sq m | 1,292 sq ft |

| Second Floor Ancillary | 37.96 sq m | 409 sq ft |

| Total | 374.53 sq m | 4,032 sq ft |

A set of floor plans is available to download and the measured survey report will be re-addressed to a purchaser at a cost of £375 + VAT.

Tenure

Freehold.

Tenancy

The entire property is let to Vodafone Limited on a full repairing and insuring lease for a term of 10 years from 22nd February 2019, expiring on 21st February 2029. There is a tenant’s break option on 22nd February 2024, subject to six months’ notice.

The current passing rent is £75,000 per annum which, based on our analysis, equates to a Zone A rate of £79.50 per sq ft. There is an upwards only rent review on 22nd February 2024.

It has been agreed that the rent will be paid monthly. The initial rent was £37,500 per annum, increasing to £75,000 per annum from 22nd August 2020.

The property is underlet to a franchisee, Akin Communications Limited, from 1st May 2019 to 19th February 2024 at the same passing rent. The underlease is outside 1954 Act Protection.

All rent is paid and up to date, with no arrears.

Covenant

Vodafone Limited (Co. No. 01471587), has reported the following figures;

| 31st March 2020 | 31st March 2019 | |

|---|---|---|

| Revenue | £5,657.6 million | £5,512.9 million |

| Pre-Tax Profits (Loss)* | (£375.0 million) | (£679.5 million) |

| Shareholders’ Funds | £6,110.3 million | £5,848.4 million |

*Includes reorganisation expenses as a result of restructuring under a three-year programme.

The company added 385,000 mobile contract customers in the year, supported by its new range of commercial plans including speed-tiered ‘Vodafone Limited’ mobile data propositions and the 5G launch in July. The company also added 475,000 prepaid customers and 176,000 broadband customers. Adjusted EBITDA increased by 15.7% and the adjusted EBITDA margin increased to 23.1%.

The ultimate parent company is Vodafone Group Plc. For the year ending 2020 the Group’s revenue grew by 3.0% to €45.0 billion and adjusted EBITDA grew by 2.6% to €14.9 billion.

Vodafone is a leader in technology communications through mobile, fixed, broadband and TV. Since making the first mobile call in the UK in January 1985, Vodafone has grown into an international business and one of the most valuable brands in the world. The Group has mobile operations in 22 countries, partners with mobile networks in 42 more, and provides fixed broadband in 17 markets. As of 30 June 2020, Vodafone Group had approximately 300+ million mobile customers, 27 million fixed broadband customers and 22 million TV customers, including all of the customers in Vodafone’s joint ventures and associates (www.vodafone.com).

VAT

The property has not been registered for VAT and therefore VAT is not applicable on the purchase price.

Proposal

We are instructed to seek a figure of £790,000 (Seven Hundred and Ninety Thousand Pounds), subject to contract, reflecting a net initial yield of 9.0%, assuming standard purchaser’s costs of 5.47%.

Please note that a purchaser will be re-charged the costs of the measured survey (£375 + VAT) and searches (£697.80) which are provided in the data room .

Please note that a purchaser will be charged a Transaction Fee of £5,000 plus VAT.

Investment Considerations

-

The property occupies a prime position in the city centre;

-

New 10 year lease from February 2019;

-

Securely let to Vodafone Ltd (Shareholders’ Funds £6,110 million);

-

VAT-free investment;

-

Freehold;

-

A purchase at the asking price reflects an attractive net initial yield;

-

Attractive lot size to an investor.

Data Room and clicktopurchase®

Access to the data room and for the ability to purchase online with speed and ease, please click the clicktopurchase® “C” icon or the clicktopurchase® side bar. Purchasers will be able to access the complete legal package, clear verification and submit legally-binding offers to acquire the property.

Purchasers benefit from the trust, security and transparency provided by the platform. All activities, including the online contract execution, will form part of the electronic audit trail which is anchored in the clicktopurchase® Blockchain.

clicktopurchase® provides the opportunity for any investor, whether located UK or abroad, to uniquely purchase online with ease and certainty. To learn more about clicktopurchase®, click here.

Finance

We have established relationships with a number of leading finance companies who are in a position to quote terms for suitable situations. To learn more, please visit our “Finance” section.

DOWNLOADS

BROCHURE

Contact Us

| Singer Vielle | +44 (0) 207 935 7200 | |

|---|---|---|

| Dale Henry | dale@singervielle.co.uk | +44 (0) 203 701 1356 |

| Daniel Elia | daniel@singervielle.co.uk | +44 (0) 203 701 1353 |

| Jon Skerry | jon@singervielle.co.uk | +44 (0) 203 995 6211 |

| Neil Singer | neil@singervielle.co.uk | +44 (0) 203 478 9120 |

Vendors Solicitor

| Freedman Hilmi | +44 (0) 207 871 8605 |

|---|---|

| Francis Katz | fk@freedmanhilmi.com |

| Nadeen Ahmed | nahmed@freedmanhilmi.com |