High Yielding and Active Management Retail Investment Opportunity

Units 1-5 New Inn Centre | Taff Street | Pontypridd | CF37 4UE

£1,175,000

subject to contract

GALLERY

Blockchain

Track all marketing and execution activity for this property in the clicktopurchase Blockchain – only available at the Singer Vielle Network.

Q: Why is this so important?

A: The ultimate in trust, accountability and transparency from the commencement of marketing to conclusion of a sale.

Summary

-

On behalf of Administrators, acting as agent without personal liability

-

Prominent retail investment

-

Secure covenants

-

High Yielding Opportunity

-

Opportunity to Active Manage and Improve the Income

-

Nominal rent on part of the property

-

Substantial site

-

£1,175,000, subject to contract

-

13% NIY

Location

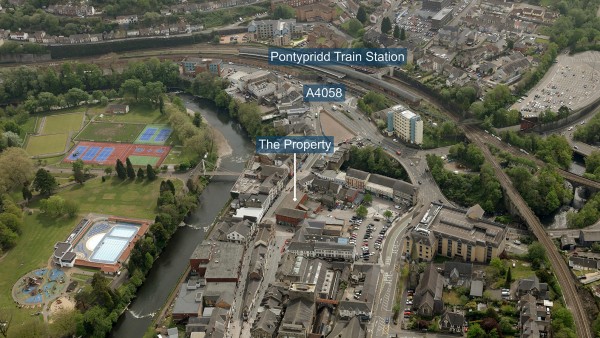

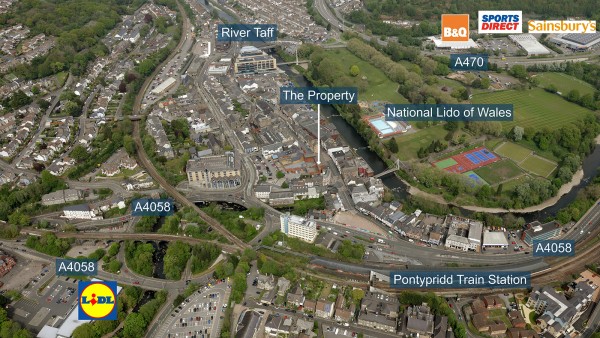

Pontypridd is located in Mid Glamorgan, South Wales, approximately 12 miles north west of Cardiff, 13 miles south of Merthyr Tydfil and 21 miles west of Newport.

The town benefits from being adjacent to the A470 dual carriageway, this route being the main access linking to the M4 Motorway at Junction 32 which is some 10 miles to the south. Furthermore, the A465 Heads of the Valleys dual carriageway is located 13 miles to the north of Merthyr Tydfil.

The town’s railway station provides a regular service to Cardiff with a journey time of approximately 30 minutes. Cardiff Airport is located some 18 miles south of the town.

Situation

The property is prominently located on a corner position at the southern end of Taff Street within the town’s main retailing area, close to the junction with Mill Street.

The property is directly opposite a retail unit occupied by B&M Bargains, with other retailers located nearby including Vodaphone, Superdrug, Barclays Bank and Three.

Description

The property comprises a terrace of three retail units. Predominantly the property is constructed over ground and two upper floors, although a large extension at the rear is only built at ground floor level.

Units 1 & 2 is occupied by WH Smith, the middle unit 3 is occupied by The Works, whilst units 4 and 5 are occupied by Poundland. The properties have been fitted-out by the tenants to their usual corporate styles. The units occupied by WH Smith and Poundland benefit from goods lifts.

The property includes a large surface car park and yard at the rear which is accessed from Mill Street.

Accommodation

The property has been measured by BKR Floor Plans and provides the following accommodation:

| Sq Ft | Sq m | |

|---|---|---|

| Units 1 & 2 – WH Smith | ||

| Gross Frontage | 40’1” | 12.22m |

| Net Frontage | 37’11” | 11.56m |

| Ground Floor – retail | 3,070 | 285.20 |

| ITZA | 1,441 | |

| First Floor – storage / offices | 1,422 | 132.10 |

| Second Floor – storage / offices | 1,133 | 105.26 |

| Total | 5,625 | 522.56 |

| Unit 3 – The Works | ||

| Gross Frontage | 19’9” | 6.02m |

| Net Frontage | 18’2” | 5.54m |

| Ground Floor - retail | 1,312 | 121.88 |

| ITZA | 678 | |

| First Floor – storage / offices | 613 | 56.95 |

| Second Floor – storage / offices | 537 | 49.89 |

| Total | 2,462 | 228.72 |

| Units 4 & 5 – Poundland | ||

| Gross Frontage | 43’11” | 13.39m |

| Net Frontage | 37’11” | 11.56m |

| Ground Floor - retail | 5,831 | 541.70 |

| ITZA | 1,867 | |

| First Floor – storage / offices | 2,050 | 190.45 |

| Second Floor – storage / offices | 2,266 | 210.51 |

| Total | 10,147 | 942.66 |

| Total Overall Area | 18,234 | 1693.94 |

A set of floor plans is available to download and the measured survey report will be re-addressed to a purchaser at a cost of £745 + VAT.

Site

The property provides a large site estimated at approximately 0.53 acres / 0.21 hectares.

We refer you to the Site Solutions Combined report by Argyll Environmental which is can be accessed in the data room. Note the report states “As the River Taff is located 50m east of the Site is modelled at a moderate risk of flooding (Flood Zone 2). But, as flood defences in the wider area offer a good standard of protection, the risk is low”. Furthermore, our client has had not flooding issues during the period of ownership, nor seen any evidence of flooding on the site. Our client has been involved since October 2021

Tenure

Freehold.

Tenancies

Units 1 & 2 was let to WH Smith Retail Holdings from 2 September 2016 until 1st September 2021 at a current rent of £60,000 per annum. The administrators have renewed the lease with the tenant on the following basis: rent at £12,000 per annum, 5 year term, service charge and rates payable by the tenant, landlord’s rolling break option on 3 months’ notice (excluding Christmas), tenant’s break option with effect from 31st March 2024.

Unit 3 is let to The Works Stores Limited from 11th October 2018 until 10th October 2028. The lease incorporates a tenant’s break clause on 11th October 2023. The current passing rent is £27,500 per annum.

Units 4 & 5 are let to Poundland Limited from 16th May 2016 until 15th May 2026 at a current rent of £122,500 per annum.

In summary, the current income is as follows:

• WH Smith Retail Holdings Limited £12,000

• The Works Stores Limited £27,500

• Poundland Limited £122,500

• Total £162,000

The recent lease renewal by the administrators in respect of units 1 & 2 provides a purchaser with time to seek a new tenant on a longer-term occupational basis, hence an ability to increase the total rental income.

Service Charge

There is no formal service charge at the property. Tenants are re-charged directly costs which are incurred in maintaining the property. The amount paid by the Works is limited to £2,000 per annum.

We are advised that the only costs incurred relate to the maintenance of the yard. The costs are recovered 24.26% as a direct charge from WH Smith, 11.50% as a fixed service charge quarterly from The Works and 64.24% as a direct charge from Poundland. There are no shortfalls. A copy of the May 2022 invoice is provided in the data room.

Rates

The rateable values and rates payable by the tenant for each unit is displayed in the table below.

| Property | Floor | Rateable Value | Multiplier | Rates Payable |

|---|---|---|---|---|

| WH Smith Units 1-2 | Ground, First & Second | £49,500 | 49.9 pence | £24,700.50 |

| The Works Unit 3 | Ground, First & Second | £23,250 | 49.9 pence | £11,601.75 |

| Poundland Units 4-5 | Ground & First | £64,500 | 51.2 pence | £33,024 |

| Poundland Unit 4 | Second | £670 | 51.2 pence | £343.04 |

| Poundland Unit 5 | Second | £2,100 | 51.2 pence | £1,075.20 |

| Total | £140,020 | £70,744.49 |

For further information on business rates please visit the Valuation Office Agency website via the following link - www.gov.uk/government/organisations/valuation-office-agency.

Covenants

WH Smith Retail Holdings Limited (Co. No 471941) has reported the following figures:

| Year Ending | 31 August 2021 | 31 August 2020 |

|---|---|---|

| Turnover | £160.225m | £181.561m |

| Pre-Tax Profit | -£12.511m | -£49.623m |

| Net Assets | £883.833m | £890.889m |

WHSmith is one of the longest standing chain stores in the world, being founded 230 years ago. The brand is now one of the leading retail groups and household names in the United Kingdom.

With over 540 high street stores in the United Kingdom including over 200 Post Offices within their shops, WH Smith employs around 11,000 staff. In addition to their high street stores the company is one of the world’s leading travel retailers operating in over 150 UK air units, over 130 UK hospital units and over 290 rail units.

WH Smith PLC is listed on the London Stock Exchange and is part of the FTSE mid 250 Index. For further information visit www.whsmith.co.uk.

The Works Stores Limited (Co. No 06557400) has reported the following figures:

| Year Ending | 2 May 2021 | 2 May 2020 |

|---|---|---|

| Turnover | £180.680m | £225.042m |

| Pre-Tax Profit | -£5.707m | -£0.672m |

| Net Assets | £5.733m | £4.992m |

The ultimate parent company is The Works.co.uk, listed on the London Stock Exchange.

Established in 1981, The Works is one of the UK’s leading multi-channel specialist retailers of value gifts, arts, crafts, toys, books and stationery. The company has over 500 stores throughout the UK & Ireland with over 3,600 employees. In 2021 it was voted 13th in the “Best Big Companies To Work For” Survey.

Their stores can be found on high streets, in retail parks, shopping centres and as concessions in various locations. The company also has a significant and growing online presence with its multi-channel offering, one of the first of its kind in the value retail sector, including a popular Click & Collect service, offering further convenience for customers.

For the year ending 1st May 2022 The Works.co.uk reported a strong trading performance, well ahead of pre-COVID levels. Total sales for the Period increased by 12.7% compared to FY20 (i.e. compared to two years ago). Two-year LFL sales increased by 10.4%, with positive growth continuing both online and in stores. The Group ended the Period in a strong financial position, with net cash of £16.3 million. For further information see www.theworks.co.uk.

Poundland Limited (Co. No 2495645) has reported the following figures:

| Year Ending | 27 September 2020 | 27 September 2019 |

|---|---|---|

| Turnover | £1,476m | £1,543m |

| Pre-Tax Profit | -£17.841m | £18.465m |

| Net Assets | £96.112m | £129.419m |

Established in 1990, Poundland offers thousands of quality products, from food and drink to homeware and garden supplies, to over seven million customers every week. For the Period ending September 2020 the company traded from 825 stores in the UK and Republic of Ireland.

The company is a subsidiary of Pepco Group, the fastest growing, multi-format, pan European discount variety retailer. Through its retail brands – PEPCO, Poundland and Dealz – the com Group trades from over 3,500 stores in 17 territories across Europe, serving 50 million shoppers each month. For further information see www.pepcogroup.eu.

VAT

The vendor has elected the property for VAT. It is anticipated that the sale will be treated as a Transfer of a Going Concern (TOGC).

Proposal

We are instructed to seek a figure of £1,175,000 (One Million, One Hundred and Seventy Five Thousand Pounds), subject to contract, reflecting a net initial yield of 13.0%, assuming purchaser’s costs of 5.91%.

Please note that a purchaser will be re-charged the costs of searches and measured survey which are provided in the data room.

Please note a purchaser will be charged a Transaction fee of 1% of the Purchase Price + VAT.

Investment Considerations

-

An opportunity to acquire a substantial retail block within Pontypridd’s town centre;

-

The property occupies a prominent and large site;

-

The property is currently let to well-known and secure covenants;

-

The investment is available at a high initial yield;

-

Active management is available to improve the income and increase the yield;

-

Attractive lot size.

Disclaimer

The affairs, business and property of the Company is being managed by the Joint Administrators Andrew Knowles and Steven Muncaster, who act as agents for the Company and without personal liability. Both are licensed by the Insolvency Practitioners Association and are bound by the Insolvency Code of Ethics.

Data Room and clicktopurchase®

Access to the data room and for the ability to purchase online with speed and ease, please click the clicktopurchase® “C” icon or the clicktopurchase® side bar. Purchasers will be able to access the complete legal package, clear verification and submit legally-binding offers to acquire the property.

Purchasers benefit from the trust, security and transparency provided by the platform. All activities, including the online contract execution, will form part of the electronic audit trail which is anchored in the clicktopurchase® Blockchain.

clicktopurchase® provides the opportunity for any investor, whether located UK or abroad, to uniquely purchase online with ease and certainty. To learn more about clicktopurchase®, click here.

DOWNLOADS

BROCHURE

Contact Us

| Singer Vielle | +44 (0) 207 935 7200 | |

|---|---|---|

| Dale Henry | dale@singervielle.co.uk | +44 (0) 203 701 1356 |

| Neil Singer | neil@singervielle.co.uk | +44 (0) 203 478 9120 |

| Daniel Elia | daniel@singervielle.co.uk | +44 (0) 20 3701 1353 |

Vendors Solicitor

| Field Fisher | +44 (0) 330 460 6942 |

|---|---|

| Tom Newborough | tom.newborough@fieldfisher.com |