Attractive Retail/Leisure Investment with Significant Development Potential

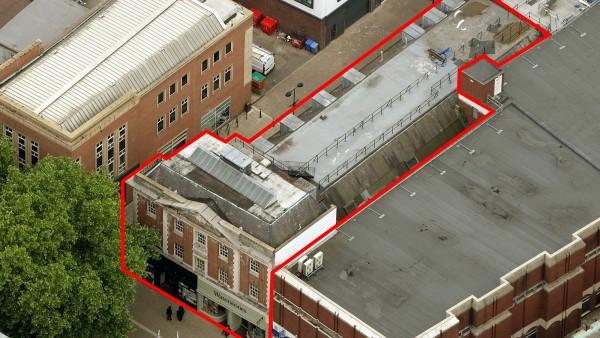

40-42 Bridge Street and 1 Wentworth Street | Peterborough | PE1 1DT

£1,065,000

subject to contract

GALLERY

Blockchain

Track all marketing and execution activity for this property in the clicktopurchase Blockchain – only available at the Singer Vielle Network.

Q: Why is this so important?

A: The ultimate in trust, accountability and transparency from the commencement of marketing to conclusion of a sale.

Summary

-

Located in a Cathedral City

-

Attractive building in the heart of the city centre

-

Rents have been rebased down to 57% of previous levels

-

Renewed lease to Waterstones Booksellers Ltd (Net Assets £63.4m)

-

New lease to Oodles - restaurant opened 5th August 2022

-

Potential to convert and extend the second and third floors to residential, subject to planning

-

Freehold

-

£1,065,000, subject to contract

-

Net Yield 8.00% based upon 9.36% for the commercial income, and only £155,000 for the vacant upper parts.

Location

Peterborough is an historic Cathedral city in the county of Cambridgeshire situated 82 miles (132 km) north of London, 35 miles (56 km) north-west of Cambridge and 41 miles (66 km) east of Leicester. Peterborough benefits from first class road communications being accessible via Junction 17 of the A1(M) which connects the city to London and the north and the A47 which connects the city to Leicester and the west.

Peterborough Railway Station is a major interchange on the East Coast Main Line providing direct daily services to London Kings Cross (51 minutes), Cambridge (50 minutes), Stevenage (49 minutes), Leicester (54 minutes), Birmingham (1 hour, 45 minutes) and Leeds (1 hour, 27 minutes).

London Luton Airport is approximately 60 miles (96 km) to the south and London Stansted Airport 65 miles (104 km) to the south east.

Peterborough benefits from a diverse economy and has become an important regional centre for business, education, health, industry, leisure and shopping. Between 2010-2020 Peterborough experienced 50% business growth, compared to averages of 27% in the East, and 32% across Great Britain. The city has a population of over 200,000 and has seen the fastest population growth rate of any UK city at 1.6% per annum over the last 10 years. It is predicted to grow to 225,000 by 2040.

The city centre is a vital hub for a catchment population of over 1 million nearby residents and over £1/2 billion is going towards regenerating the city centre. Queensgate Shopping Centre alone is undergoing a new £60 million extension including a new multiplex cinema.

(Source: www.investinpeterborough.co.uk)

Situation

The property is situated on the corner of the pedestrianised Bridge Street and Wentworth Street, directly opposite the Town Hall and within the heart of Peterborough’s Historic Centre.

Bridge Street is designated as a Heritage Attraction location on the Peterborough City Council city centre map.

The property is next door to WH Smith, Post Office and Mountain Warehouse with other businesses nearby including Greggs, B&M, TK Maxx, Specsavers and Millets.

Church Street is just 50 metres to the north of the property and comprises part of the main retail offering in the city. Well-known shops and eateries include Nando’s, Wildwood, Pizza Express, Bill’s, Five Guys, Starbucks and Boots.

Peterborough Cathedral and the Grade I listed St John the Baptist Church is just 50 metres from the property. Peterborough Cathedral is one of the finest Norman cathedrals in England dating back to 654 AD and the burial place of two queens. This is a major tourist attraction, drawing many visitors to the immediate vicinity.

The property is 150 metres from Cathedral Square and the iconic Guildhall with the surrounding area used for various events including Farmers Markets every second and fourth Thursday of the month.

The Queensgate Shopping Centre is immediately to the north-east, comprising 455,000 sq ft (42,270 sq m) of accommodation with 2,300 car parking spaces, key tenants include Primark, M&S, Joules and Hotel Chocolat.

Plans have been approved for a new market to trade five days a week on Bridge Street from June 2022. The new City Market will comprise of a new state of the art food hall with two butchers and a fishmonger, 2 permanent market stalls, housed in contemporary timber kiosks beneath the trees. Occupiers will include independent traders, fresh food businesses and non-food businesses. In addition, the market will have 12 pop up stalls for traders who wish to operate on a part time basis. This development is expected to draw an exceptional amount of footfall directly outside the property.

Description

The property comprises two retail properties arranged over ground, first, second and third floors, with a 71-foot (21.64m) return frontage onto Wentworth Street.

Part of the first and the entire second and third floors are vacant. These areas benefit from independent access from Wentworth Street.

40 - 42 Bridge Street, Ground and Part First Floors – Waterstones

The ground floor comprises large open plan sales accommodation with a dog leg shape to the rear. To the middle there is a large double ended staircase providing access to the first floor. To the rear there is ancillary accommodation, a goods lift, another staircase to the first floor and a fire exit leading onto Wentworth Street.

The first floor comprises sales accommodation, a staff area and WCs. The unit has a glazed frontage onto Bridge Street and a frontage onto Wentworth Street.

Unit 1, 40 – 42 Bridge Street, Ground Floor – Oodles

The property comprises several restaurant seating areas and an open plan kitchen. There are preparation areas, ancillary accommodation, and a fire exit to the rear.

The fit out of the new restaurant has recently been completed; the restaurant opened 5th August 2022.

Accommodation

The property has been measured by BKR Floor Plans and provides the following net internal floor areas.

| 40 - 42 Bridge Street, Ground and Part First Floors – Waterstones | ||

|---|---|---|

| Net Frontage | 7.34 m | 24’1” |

| Gross Frontage | 7.67m | 25’2” |

| Zone A | 44.78 sq m | 482 sq ft |

| Zone B | 44.78 sq m | 482 sq ft |

| Zone C | 43.01 sq m | 463 sq ft |

| Remainder | 157.65 sq m | 1,697 sq ft |

| Ground floor ITZA | 1,051 UNITS | |

| Ground Floor Total | 290.22 sq m | 3,124 sq ft |

| First Floor | 236.52 sq m | 2,546 sq ft |

| Total NIA | 526.74 sq m | 5,670 sq ft |

| Total GIA | 583.32 sq m | 6,279 sq ft |

| Unit 1, 40 – 42 Bridge Street, Ground Floor – Oodles | ||

| Net Frontage (Front) | 7.09 m | 23’3” |

| Gross Frontage (Front) | 7.47 m | 24’6” |

| Net Frontage (Side) | 19.41 m | 63’8” |

| Gross Frontage (Side) | 21.64 m | 71’ |

| Zone A | 42.36 sq m | 482 sq ft |

| Zone B | 41.99 sq m | 482 sq ft |

| Zone C | 38.46 sq m | 463 sq ft |

| Remainder | 5.11 sq m | 55 sq ft |

| Ground floor ITZA | 792 UNITS | |

| Total NIA | 127.92 sq m | 1,377 sq ft |

| Total GIA | 128.48 sq m | 1,383 sq ft |

| 40 - 42 Bridge Street, Part First, Second and Third – Vacant | ||

| Ground Floor | 10.50 sq m | 113 sq ft |

| First Floor | 44.50 sq m | 479 sq ft |

| Second Floor | 100.61 sq m | 1,083 sq ft |

| Third Floor | 64.19 sq m | 691 sq ft |

| Total NIA | 219.80 sq m | 2,366 sq ft |

| Total GIA | 310.38 sq m | 3,341 sq ft |

| Overall Total NIA | 874.46 sq m | 9,413 sq ft |

| Overall Total GIA | 9,413 sq ft | 11,003 sq ft |

A set of floor plans is available to download and the measured survey report will be re-addressed to a purchaser at a cost of £770 + VAT.

Tenure

Freehold.

Tenancy

40-42 Bridge Street is let to Waterstones Booksellers Limited on a full repairing and insuring lease for a term of 5 years from 8th February 2022, expiring on 7th February 2027. Therefore, there are 4.5 years unexpired with no breaks. The passing rent is £50,000 per annum. The rent has been rebased downwards from £67,500 per annum.

Unit 1, 40-42 Bridge Street is let to Almunir Specialist Catering Limited (t/a Oodles) on a new full repairing and insuring lease for a term of 10 years from 10th February 2022, expiring on 9th February 2032. There is an upwards only rent review on 9th February 2027. The tenant has a break option at the end of the fifth year, subject to 6 months written notice. Therefore, there are 4.5 years until the break option and 9.5 years until the lease expiry. The passing rent is £40,000 per annum. The rent has been rebased downwards from when it was let to the previous tenant at £90,000 per annum.

The tenant had the benefit of a rent-free period until 10th August 2022, after which the tenant will be paying half rent until 10th August 2023.

The tenant has paid a rent deposit equivalent to 4 months’ rent totalling £13,333.33 + VAT.

The tenant has invested substantially into refurbishing and fitting out the premises (we understand the tenant’s investment has been in the order of £220,000). The landlord presentation and design pack are available to download.

The vendor will top-up the income by way of an adjustment to the completion sum, to account for the half rent period, in order that the purchaser does not suffer an income shortfall.

The total passing rent for the entire property is £90,000 per annum. This is 57% lower than the previous total rent at the property of £157,500.

Covenant

Waterstones Booksellers Ltd (co. no 00610095) has reported the following figures:

| 24th April 2021 | 25th April 2020 | |

|---|---|---|

| Revenue | £230,885,000 | £376,024,000 |

| Pre-Tax Profit | £4,172,000 | £21,048,000 |

| Net Assets | £63,382,000 | £60,501,000 |

Waterstones was founded in 1982 and operates from 280 bookshops and employ over 3,000 people.

An average sized Waterstones shop will sell a range of approximately 30,000 individual books, stationary, other related products and some stores have integrated cafes.

The company have kept up with e-commerce trends and operate their own online bookstore.

Almunir Specialist Catering Limited, trading as Oodles

Oodles is one of the UK’s leading fast-casual dining concepts serving authentic Indo Chinese food since 2010.

The company has since grown to over 21 restaurants and have ambitious plans for continued growth. The typical investment the company make into each restaurant is between £130,000 and £250,000.

The concept of Oodles is on trend with open plan kitchens and a customer led experience. Oodles provide freshly cooked food using the best ingredients in a relaxed casual dining setting. The recognisable restaurant fit outs are characterised by distinctive and modern features, some have described the fit outs as ‘Instagramable’.

The menu works in three easy steps. Pick a potion size, pick two starters, and pick two main dishes. This model is loved by customers, allows for quick execution and works seamlessly for in-dining, takeaway and delivery.

The tenant has lodged a rent deposit of £13,333.33 + VAT which will be passed on to the purchaser.

Development Potential

Part of the first floor and the entire second and third floors are vacant and benefit from independent access from Wentworth Street. This offers an opportunity to exploit these parts and extend at first and second floor levels in the near future, converting to residential use, subject to planning permission.

An indicative scheme has been drawn up by the vendor for 15 residential units as follows:

-

First Floor: 2 x 2-bedroom apartments plus 5 x 1-bedroom studios

-

Second Floor: 7 x 1-bedroom studios

-

Third Floor: 1 x 2-bedroom apartments

A set of the proposed floor plans is available to download.

Our research suggests that 1- and 2-bedroom flats above retail in this location are worth in the order of £110,000. Hence an exit value in the order of £1,650,000, thereby providing significant potential to enhance value.

Alternatively, these parts could be let to occupiers who operate under Class E use.

VAT

The property has been registered for VAT. It is anticipated that the sale of this property will be treated as a Transfer of a Going Concern (TOGC).

Proposal

We are instructed to seek a figure of £1,065,000 (One Million and Sixty Five Thousand Pounds), subject to contract, reflecting a net initial yield of 8.00% assuming standard purchaser’s costs of 5.81%. [The rental top-up will be dealt with by way of an appropriate deduction on the completion sum.]

A purchase at the asking price reflects a 9.36% return, £910,000, and only £155,000 for the vacant accommodation.

Please note that a purchaser will be re-charged the costs of the measured survey (£575 + VAT) and searches (£723.42) which are provided in the data room.

Please note that a purchaser will be charged a Transaction Fee of £5,000 plus VAT.

Investment Considerations

-

An opportunity to acquire a prominent freehold investment in a Cathedral City;

-

Waterstones have renewed their lease demonstrating their commitment to the location;

-

Oodles have invested substantially into the property having signed a new lease;

-

Rents have been re-based to 57% of previous rents;

-

Potential to add value by extending the second and third floors, subject to planning;

-

Opportunity to convert the upper parts to residential use with an exit value of £1,650,000 (subject to planning);

-

A purchase at the asking price reflects an attractive yield profile;

-

Attractive lot size to an investor.

Data Room and clicktopurchase®

Access to the data room and for the ability to purchase online with speed and ease, please click the clicktopurchase® “C” icon or the clicktopurchase® side bar. Purchasers will be able to access the complete legal package, clear verification and submit legally-binding offers to acquire the property.

Purchasers benefit from the trust, security and transparency provided by the platform. All activities, including the online contract execution, will form part of the electronic audit trail which is anchored in the clicktopurchase® Blockchain.

clicktopurchase® provides the opportunity for any investor, whether located UK or abroad, to uniquely purchase online with ease and certainty. To learn more about clicktopurchase®, click here.

DOWNLOADS

BROCHURE

Contact Us

| Singer Vielle | +44 (0) 207 935 7200 | |

|---|---|---|

| Daniel Elia | daniel@singervielle.co.uk | +44 (0) 203 701 1353 |

| Dale Henry | dale@singervielle.co.uk | +44 (0) 203 701 1356 |

| Neil Singer | neil@singervielle.co.uk | +44 (0) 203 478 9120 |

Vendors Solicitor

| Gunnercooke | +44 (0) 333 014 3401 |

|---|---|

| Jonathan Wilkson | jonathan.wilkinson@gunnercooke.com |