“Cote” Restaurant – 19.5 Years Unexpired Lease Term – re-based rent

4 Church Street | Peterborough | PE1 1DT

£850,000

subject to contract

GALLERY

Summary

-

Located in a Cathedral City

-

Attractive building in the heart of the city centre

-

19.5 years unexpired lease term, no breaks

-

Let to the nationally-recognised restaurant chain, “Côte”

-

Freehold

-

£850,000, subject to contract

-

Net Yield 7.24% (with vendor’s top-up)

Location

Peterborough is an historic Cathedral city in the county of Cambridgeshire situated 132 km (82 miles) north of London, 56 km (35 miles) north-west of Cambridge and 66 km (41 miles) east of Leicester. Peterborough benefits from first class road communications being accessible via Junction 17 of the A1(M) which connect the city to London and the north and the A47 with connects the city to Leicester and the west.

Peterborough Railway Station is a major interchange on the East Coast Main Line providing direct daily services to London Kings Cross (51 minutes), Cambridge (50 minutes), Stevenage (49 minutes), Leicester (54 minutes), Birmingham (1 hour, 45 minutes) and Leeds (1 hour, 27 minutes).

London Luton Airport is approximately 96 km (60 miles) to the south and London Stansted Airport 104 km (65 miles) to the south east.

Peterborough benefits from a diverse economy and has become an important regional centre for business, education, health, industry, leisure and shopping. Between 2010-2020 Peterborough experienced 50% business growth, compared to averages of 27% in the East, and 32% across Great Britain. The city has a population of over 200,000 and has seen the fastest population growth rate of any UK city at 1.6% per annum over the last 10 years. It is predicted to grow to 225,000 by 2040.

The city centre is a vital hub for a catchment population of over 1 million nearby residents and over £1/2 billion is going towards regenerating the city centre. Queensgate Shopping Centre alone is undergoing a new £60 million extension including a new multiplex cinema, set to open in autumn 2021.

(Source: www.investinpeterborough.co.uk)

Situation

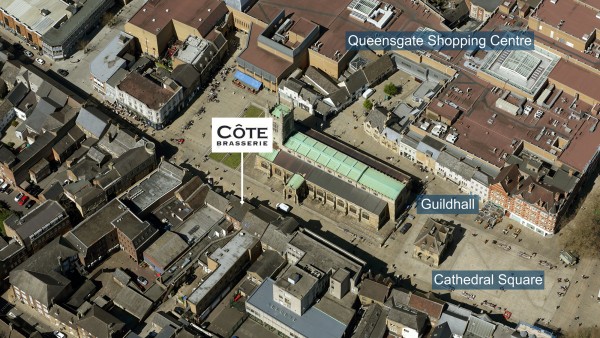

The property is situated on the pedestrianised Church Street, within the heart of Peterborough’s Historic Centre.

Church Street is designated as a Heritage Attraction location and the property benefits from being directly opposite the Grade I listed St John the Baptist Church and immediately to the west of Peterborough Cathedral. One of the finest Norman cathedrals in England dating back to 654 AD and the burial place of two queens this is a major tourist attraction, drawing many visitors to the immediate vicinity.

Church Street comprises part of the main retail offering in the city and the subject property is surrounded by many other well-known shops and eateries including Nando’s, Wildwood, Pizza Express, Bill’s, Five Guys, Virgin Money (adjacent) and Barclays. The Queensgate Shopping Centre is immediately to the north-east. Comprising 455,000 sq ft with 2,300 car parking spaces, key tenants include Primark, M&S, Joules and Hotel Chocolat.

The property also overlooks Cathedral Square and the iconic Guildhall with the surrounding area used for various events including Farmers Markets every second and fourth Thursday of the month.

Description

The property comprises a restaurant on ground and first floors with ancillary accommodation at basement, second and third floor levels.

The ground floor comprises a fully fitted out Côte Brasserie branded restaurant area with a dumb waiter serving hatch in the staff area which connects the ground floor with the first floor kitchen. At the rear of the property on this level are the customer WCs.

At first floor is further customer accommodation comprising an identically fitted out restaurant area with the staff kitchen at the rear. The second floor comprises staff and storage accommodation plus male and female WC’s.

The property is of brick construction with a full retail frontage at ground floor and a single storey extension at the rear. To the right of the building is a covered walkway below the first floor which provides vehicular access to the rear of the building where car parking is provided for 6 cars. The rear yard forms parts of the ownership; the neighbouring property and gas board have access rights.

Accommodation

The property has been measured by BKR Floor Plans and provides the following Net Internal floor areas:

| Net Frontage | 4.04 m | 13’3” |

| Gross Frontage | 7.27 m | 23’10” |

| Zone A | 24.34 sq m | 262 sq ft |

| Zone B | 32.61 sq m | 351 sq ft |

| Zone C | 24.15 sq m | 260 sq ft |

| Remainder | 61.50 sq m | 662 sq ft |

| ITZA | 585 | |

| Total Ground Floor | 142.60 sq m | 1,535 sq ft |

| Basement Ancillary | 150.59 sq m | 1,621 sq ft |

| First Floor Ancillary | 152.08 sq m | 1,637 sq ft |

| Second Floor Ancillary | 83.33 sq m | 897 sq ft |

| Third Floor Ancillary | 51.75 sq m | 557 sq ft |

| Total | 580.35 sq m | 6,247 sq ft |

A set of floor plans is available to download and the measured survey report will be re-addressed to a purchaser at a cost of £495 + VAT.

Tenure

Freehold.

Tenancy

The entire property is let to Côte Restaurant Group Limited on a full repairing and insuring lease for a term of 25 years from 7th March 2016, expiring on 6th March 2041 (19.5 year unexpired lease term).

Following a restructuring (see Covenant section below), on 19th March 2021 the lease was assigned from Cote Restaurants Limited to Cote Restaurant Group Limited.

In addition, a Deed of Variation was completed at the same time varying the rent and rent review clauses in the original lease. The rent was rebased down from £65,000 per annum to £35,000 per annum. The new rent is just over 50% of the previous rent.

In accordance with the Deed of Variation:

> Rent to be paid monthly rather than quarterly (see side letter).

> From 28th September 2020 to 27th December 2021 the annual rent is reduced to £35,000 + VAT.

> From 28th December 2021 to 6th March 2026 the annual rent is reduced to £50,000 + VAT.

> The 7th March 2021 rent review is removed.

> Open market rent reviews on 7th March 2026, 2031 and 2036. Reviewed rent to be the greater of open market and £65,000pax.

> From 28th December 2021 onwards, if the Government imposes a restriction on the tenant’s use of the property in order to prevent the spread of Coronavirus then the tenant will only be liable to pay 50% of the annual rent, until such time as the restriction ends.

The vendor will top-up the income to £65,000 per annum, given the minimum increase at 7th March 2026, in order that the purchaser does not suffer an income shortfall.

The Deed of Variation also provides that should any Government measures be imposed in relation to Coronavirus which prevents the tenant’s use of the premises, the rent is reduced to 50% of the Annual Rent for the duration of the measures. To remove concerns with this clause, a retention will be held for two years post completion of the sale to be used as cover for the purchaser, should this clause be envoked.

Covenant

Côte Restaurant Group Limited (Co. no 12873009) was newly incorporated in September 2020. Therefore, no accounts have yet been published. The company is majority owned by Better Taste Holdings 2 Limited, also a newly formed company.

Côte is one of the fastest growing and innovative restaurant businesses in the UK, operating French styled brasseries which are open every day for breakfast, lunch and dinner. At the date of the most recent published accounts the Company operated 96 restaurants. Côte’s philosophy is to provide consistently high-quality, freshly-prepared food in a modern bistro inspired setting. The restaurants are committed to sourcing seasonal and high-quality ingredients, focusing on selling authentic French dishes at affordable prices. For further information visit www.cote.co.uk.

The first brasserie opened in Wimbledon in 2007 with one of the founders being renowned restaurant entrepreneur Richard Caring. In 2013 the business was sold for a reported £100 million to the private equity firm CBPE Capital. Under CBPE’s ownership 23 new restaurants opened across the UK, the business created over 1,300 new jobs and EBITDA grew by over 60%. In 2015 Côte was sold for a reported £240 million to BC Partners, a leading private equity firm with advised funds of €12.6 billion.

Like many other businesses, the mandatory closure of all Côte’s restaurants due to COVID-19 resulted in a loss of revenue and earnings. Following a financial restructuring Côte Restaurants Limited was acquired by investment management firm Partners Group in September 2020. The company has reported that it has adapted well to the new environment and has appointed former Wagamama chief executive Jane Holbrook to join the board as chair.

VAT

The property has been registered for VAT. It is anticipated that the sale of this property will be treated as a Transfer of a Going Concern (TOGC).

Proposal

We are instructed to seek a figure of £850,000 (Eight Hundred and FiftyThousand Pounds), subject to contract, reflecting a net initial yield of 7.24% assuming standard purchaser’s costs of 5.56%. [The rental top-up will be dealt with by way an appropriate deduction on the completion sum.]

Please note that a purchaser will be re-charged the costs of the measured survey (£495 + VAT) and searches (£998.80) which are provided in the data room.

Please note that a purchaser will be charged a Transaction Fee of £5,000 plus VAT.

Investment Considerations

-

An opportunity to acquire a freehold investment in a Cathedral City;

-

The investment provides an attractive unexpired lease term of 19.5 years, without breaks;

-

Let to a highly established national restaurant chain;

-

The property occupies a prominent position within the heart of the City’s historic city centre;

-

Freehold;

-

A purchase at the asking price reflects an attractive yield profile;

-

Attractive lot size to an investor.

Data Room and clicktopurchase®

Access to the data room and for the ability to purchase online with speed and ease, please click the clicktopurchase® “C” icon or the clicktopurchase® side bar. Purchasers will be able to access the complete legal package, clear verification and submit legally-binding offers to acquire the property.

Purchasers benefit from the trust, security and transparency provided by the platform. All activities, including the online contract execution, will form part of the electronic audit trail which is anchored in the clicktopurchase® Blockchain.

clicktopurchase® provides the opportunity for any investor, whether located UK or abroad, to uniquely purchase online with ease and certainty. To learn more about clicktopurchase®, click here.

DOWNLOADS

BROCHURE

Contact Us

| Singer Vielle | +44 (0) 207 935 7200 | |

|---|---|---|

| Dale Henry | dale@singervielle.co.uk | +44 (0) 203 701 1356 |

| Daniel Elia | daniel@singervielle.co.uk | +44 (0) 203 701 1353 |

| Neil Singer | neil@singervielle.co.uk | +44 (0) 203 478 9120 |

Vendors Solicitor

| Gunnercooke | +44 (0) 3330 143 401 |

|---|---|

| Simon Davies | simon.davies@gunnercooke.com |

| Jonathan Wilkinson | jonathan.wilkinson@gunnercooke.com |