Prime Retail Investment on behalf of Administrators

175 High Street | Perth | PH1 5UN

£432,500

subject to contract

GALLERY

Summary

-

On behalf of Administrators, acting as agent without personal liability

-

City centre retail investment opportunity

-

100% prime retailing pitch

-

Securely let to JoJo Maman Bébé (Shareholders’ Funds £23.47m)

-

Heritable interest (Scottish equivalent of English freehold)

-

£432,500, subject to contract

-

10.0% Net Initial Yield

Location

Perth sits within Central Scotland on the banks of the River Tay and is the administrative centre of Perth and Kinross. The city is approximately 69 km (43 miles) north of Edinburgh, 96 km (60 miles) north-east of Glasgow and 35 km (22 miles) south-west of Dundee.

Perth benefits from good road communications being easily accessible from the M90 and A90 trunk roads. In addition, the city is connected to the national railway network with a fastest journey time to Edinburgh and Glasgow of 1 hour 20 minutes and 1 hour respectively.

As an area, Perth has grown by 12% in the past ten years, generating £4billion GVA in 2019 with productivity of £58,700 – 17% higher than the Scottish average. Perth and the wider region has the lowest unemployment rate in the country - 1.7% below the Scottish average. Perth College UHI boasts 9,000 students annually and is the largest campus in the University of Highlands and Islands. Many of Scotland’s leading universities and research centres are less than an hour away, meaning world-class institutions such as The University of St Andrews, Abertay University, Glasgow School of Art and The University of Edinburgh are all within easy reach (Source: Invest in Perth).

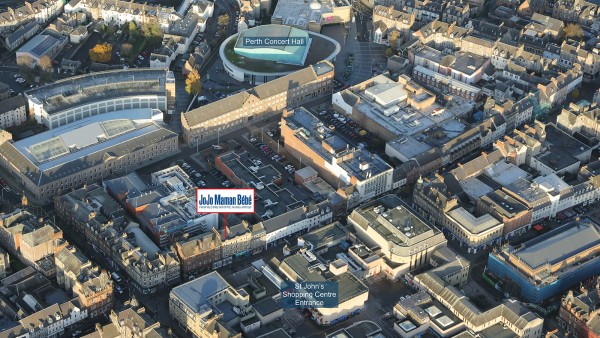

Situation

The subject property occupies a 100% prime retailing pitch in the pedestrianised section of the High Street in the heart of the city centre. Surrounding occupiers include Boots, Holland & Barrett, EE, Next, Specsavers and Marks & Spencer.

The property benefits from being immediately opposite the main entrance to St John’s Shopping Centre, the prime shopping destination in Perth city centre, anchored by Primark. Other retailers in the centre include River Island, JD Sports, Waterstones, H Samuel, O2, Ernest Jones and Trespass.

Description

The property comprises a ground floor retail unit with first floor storage and ancillary accommodation. The remaining two upper floors are separately owned.

Accommodation

The property has been measured by BKR Floor Plans and provides the following Net Internal floor areas:

| Gross Frontage | 19’9” | 5.41m |

| Net Frontage | 19’3” | 5.87m |

| Zone A | 517 sq ft | 48.03 sq m |

| Zone B | 457 sq ft | 42.46 sq m |

| Zone C | 51 sq ft | 4.74 sq m |

| Total Ground Floor | 1,025 sq ft | 95.22 sq m |

| Lower Ground Floor | 541 sq ft | 50.26 sq m |

| First Floor | 381 sq ft | 35.39 sq m |

| ITZA | 850 | |

| Total | 1,947 sq ft | 180.88 sq m |

A set of floor plans is available to download and the measured survey report will be re-addressed to a purchaser at a cost of £395 + VAT.

Tenure

Heritable (Scottish equivalent of English Freehold).

Tenancy

The property is let to JoJo Maman Bébé Limited on a full repairing and insuring lease for a term of 10 years from 13th April 2015, expiring on 12th April 2025.

The current passing rent is £45,000 per annum. The rent is paid monthly.

Covenant

JoJo Maman Bébé Limited (Co. No. 02737508) has reported the following figures:

| 30th June 2021 | 30th June 2020 | |

|---|---|---|

| Turnover | £63,488,755 | £62,329,694 |

| Pre-Tax Profits | £5,824,131 | £653,208 |

| Shareholders’ Funds | £23,471,028 | £18,873,973 |

Established in 1993, the principal activity of the company is the design and sale of high quality maternity, baby and children’s clothing, nursery products and gifts and toys. The business has approximately 86 stores and trades via omni-channel retail direct to the consumer in the UK & Ireland and via wholesale and ecommerce sales internationally.

As a result of the Covid-19 pandemic the company reported an impressive growth of online sales of +34.9% (£10.8m) compared to the prior financial year. According to their accounts “this significantly minimised the loss of stores sales…and whilst the pandemic impacted results and operations, the group has recorded profit after tax of £4.6m compared to £280k in the prior year. The group’s recovery from the reduced profit in the prior year, the healthy year end cash balance of £16.4 million and the fact that the group remains debt free, shows the resilience of the group, the strength of the brand and the ability of the board, even during unprecedented times.”

For further information see www.jojomamanbebe.co.uk.

VAT

It is anticipated that the sale will be treated as a Transfer of a Going Concern (TOGC) and the purchaser will be required to submit the appropriate election to HMRC. It should be noted that the administrators may not hold documentation to prove VAT election at the point of completion.

Proposal

We are instructed to seek offers in excess of £432,500 (Four Hundred and Thirty Two Thousand, Five Hundred Pounds), subject to contract, reflecting a net initial yield of 10.0%, assuming standard purchaser’s costs of 4.14%.

Please note that a purchaser will be re-charged the costs of the measured survey (£475 + VAT) and searches (£130+VAT) which are provided in the data room.

Please note that a purchaser will be charged a Transaction Fee of 1% of the Purchase Price plus VAT.

Investment Considerations

-

An opportunity to acquire a city centre retail investment;

-

The property occupies a 100% prime retailing pitch;

-

The property provides secure income, being let to JoJo Maman Bébé Limited (Net Assets of £23.47 million);

-

A purchase at the asking price will provide an investor with an attractive net initial yield;

-

Attractive lot size to an investor.

Disclaimer

The affairs, business and property of the Company is being managed by the Joint Administrators Andrew Knowles and Steven Muncaster, who act as agents for the Company and without personal liability. Both are licensed by the Insolvency Practitioners Association and are bound by the Insolvency Code of Ethics.

DOWNLOADS

BROCHURE

Contact Us

| Singer Vielle | +44 (0) 207 935 7200 | |

|---|---|---|

| Dale Henry | dale@singervielle.co.uk | +44 (0) 203 701 1356 |

| Neil Singer | neil@singervielle.co.uk | +44 (0) 203 478 9120 |

| Daniel Elia | daniel@singervielle.co.uk | +44 (0) 203 701 1353 |

| Graham Waddell | graham@singervielle.co.uk | +44 (0) 141 221 4545 |

Vendors Solicitor

| Burness Paul | +44 (0)131 473 6000 | |

|---|---|---|

| Stuart Dickie | stuart.dickie@burnesspaull.com | +44 (0)131 370 8971 |