High Yielding, Well Secured Retail Investment – 10.0%

Unit 2 The Cross | 4 High Street | Paisley | PA1 2YA

£435,000

subject to contract

GALLERY

Summary

-

Prominent town centre retailing pitch

-

Let to Holland & Barrett Retail Limited

-

Highly Secure Income – Shareholders’ Funds £279m

-

In excess of 6.5 years unexpired lease term without breaks

-

Trading from this property since 1995

-

Attractive Lot Size

-

10.0% net initial yield

Location

Paisley is situated in the west central Lowlands of Scotland and is one of the largest towns in Scotland. It is located approximately 15 km (9 miles) west of Glasgow and 96 km (60 miles) west of Edinburgh. The town is served by the M8 Motorway (Junctions 27, 28 and 29) which offers easy access to the surrounding areas. The A726 provides access to the M77 Motorway approximately 8 km (5 miles) to the south-east.

The town is connected to the national railway network with a fastest journey time to Glasgow Central of approximately 10 minutes. Glasgow Airport is approximately 3.2 km (2 miles) to the north.

Paisley was one of five UK cities to have been shortlisted for the UK City of Culture 2021.

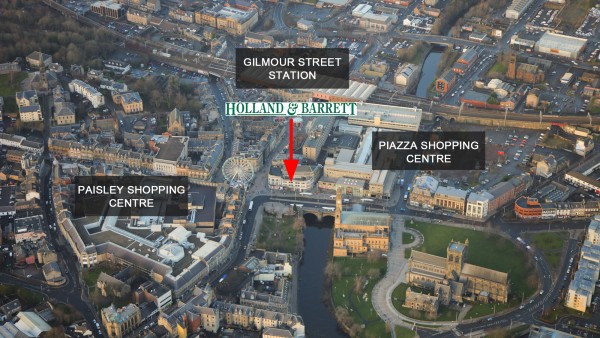

Situation

The property is prominently situated on the northern side of the High Street, in the heart of Paisley town centre, close to its junction with Gilmour Street. Nearby occupiers include Dorothy Perkins, Game, Bonmarche and Bank of Scotland. Gilmour Street mainline train station is only a couple of minutes’ walk to the north.

The Paisley Shopping Centre is situated immediately west of the property. Anchored by Marks & Spencer and Co Op, other tenants within the scheme include JD Sports, Boots, Greggs, O2, Vodafone and Savers. The centre also benefits from 530 car parking spaces.

The property also benefits from being adjacent to the Piazza Shopping Centre which comprises 17,726 sq m (190,800 sq ft) with 36 retail units and 366 car parking spaces. With anchor tenants including New Look, Iceland, Superdrug and Poundland, the centre benefits from an annual footfall of 5 million people (Source: New River).

Description

The property comprises a retail unit arranged over ground floor and basement. Internally, the retail floor area is predominately open plan with ancillary areas and has been fitted out by the tenant to their usual corporate style. The upper floors do not form part of the sale.

Accommodation

The property has been measured by Square Foot Media and provides the following Net Internal Areas;

| Zone A | 48.4 sq m | 521 sq ft |

| Zone B | 47.4 sq m | 510 sq ft |

| Zone C | 25.9 sq m | 279 sq ft |

| ITZA | 846 | |

| Total Ground Floor | 121.7 sq m | 1,310 sq ft |

| Basement | 126.6 sq m | 1,363 sq ft |

| Total | 248.3 sq m | 2,673 sq ft |

A set of floorplans are available to download and the measured survey report will be assigned to a purchaser at a cost of £395.00 + VAT.

Tenure

Heritable (Scottish equivalent of English freehold)

Tenancy

The property is let to Holland & Barrett Retail Limited on a full repairing and insuring lease at a passing rent of £45,000 per annum. Based on our analysis the passing rent equates to £48 Zone A.

The tenant has been in occupation since 1995 and such is their long term commitment to the property in 2011 they extended their lease for a further period of 10 years from 6th August 2015, expiring on 5th August 2025 (in excess of 6.5 years unexpired lease term). The lease benefits from 5 yearly upward only rent reviews.

Covenant

Holland & Barrett Retail Limited (Co. No. 02758955) has reported the following figures:

| 30th September 2017 | 30th September 2016 | |

|---|---|---|

| Turnover | £461,408,000 | £444,127,000 |

| Pre-Tax Profits | £81,776,000 | £112,823,000 |

| Shareholders’ Funds | £279,508,000 | £252,227,000 |

Britain’s largest health and wellness retail operator, Holland & Barrett was acquired by L1 Retail in a £1.8 billion transaction in June 2017. The company is headquartered in Warwickshire and employs approximately 7,000 people across its headquarters and its retail portfolio of over 1,000 retail shops. For more information visit www.hollandandbarrett.com.

VAT

The property has been registered for VAT. It is anticipated that the sale will be treated as a Transfer of a Going Concern (TOGC).

Proposal

We are instructed to seek a figure of £435,000 (Four Hundred and Thirty Five Thousand Pounds), subject to contract, reflecting a net initial yield of 10.0%, assuming purchasers’ costs of 4.06%.

Please note that a purchaser will be re-charged the costs of searches and surveys which are provided in the data room.

Please note a purchaser will be charged a transaction fee of £2,000 + VAT.

Investment Considerations

-

An opportunity to acquire a town centre retail investment;

-

The property occupies a prominent retailing pitch;

-

Let to the highly secure covenant of Holland & Barrett Retail Limited (Shareholders’ Funds £279 million);

-

Holland & Barrett has been trading from this property since 1995;

-

Attractive lot size to an investor;

-

A purchase at the asking price reflects an attractive net initial yield.

12/12/2018

DOWNLOADS

BROCHURE

Contact Us

| Singer Vielle | +44 (0) 207 935 7200 | |

|---|---|---|

| Neil Singer | neil@singervielle.co.uk | +44 (0) 203 478 9120 |

| Dale Henry | dale@singervielle.co.uk | +44 (0) 203 701 1356 |

| Graham Waddell | graham@singervielle.co.uk | +44 (0) 141 221 4545 |

| Douglas Wilson | douglas@singervielle.co.uk | +44 (0) 141 370 0284 |

| Faye Langoulant | faye@singervielle.co.uk | +44 (0) 203 478 9122 |

| Louanne Malan | louanne@singervielle.co.uk | +44 (0) 203 701 1386 |

Vendors Solicitor

| DWF | +44 (0) 141 228 8000 | |

|---|---|---|

| Chris McLeish | Chris.McLeish@dwf.law | |

| Ashleigh Farrell | Ashleigh.Farrell@dwf.law | |