VAT Free London Convenience Store Investment

16-18 Rosehill Road | Biggin Hill | London | TN16 3NF

£870,000

subject to contract

GALLERY

Summary

-

Let to Co-Operative Group Food Limited

-

Highly secure income - Pre-Tax Profits £207.9 million

-

New 15.5 year lease from November 2019

-

10 years term certain

-

5 yearly rent reviews in line with CPI

-

VAT Free

-

Located in a densely populated and affluent residential location

-

£870,000, subject to contact

-

6.00% net initial yield

Location

Biggin Hill is a densely populated district in Greater London situated on the southern edge of the London Borough of Bromley along the A233, approximately 8 miles (12.8 km) south east of Croydon and 17 miles (27.5 km) south of Central London.

The location benefits from good road communications being located approximately 8 miles (13 km) north east of the M25, 10 miles (16 km) north east of the M23 and 12 miles (19 km) south west of the M20.

Hayes (Kent) Railway Station is 5.9 miles (9.5 km) from Biggin Hill and provides direct and regular journeys to London Charing Cross and to London Cannon Street in 40 minutes. Woldingham Train Station is 7 miles to the West of Biggin Hill and provides regular and direct journeys to London Victoria in 30 minutes. There is a good service of local buses which provide routes to Westerham, Tatsfield and Bromley.

Biggin Hill Airport, a former RAF base, is the busiest light aviation centre in southern England hosting annual air shows. Gatwick Airport is 20 miles (32 km) to the south and Heathrow Airport is 30 miles (64 km) to the north west.

Attractions include golf courses, Chartwell, home of Sir Winston Churchill and Downe House, home to Sir Charles Darwin.

Situation

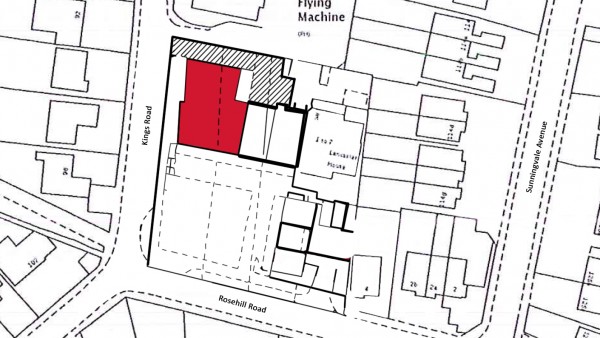

The property occupies a prominent corner site on the northern side of Rosehill Road at its junction with Kings Road with the surrounding area being primarily residential.

The property is approximately 0.7 miles (1.1 km) west of Biggin Hill Main Road, home to a mix of retail and leisure businesses.

The businesses adjacent include a hair and beauty salon, a glass and glazing company, a restaurant, a cleaning supplies company and an off licence.

Description

The property comprises a modern, ground floor retail unit. Internally, the unit provides a convenience store which has just been fitted out by the tenant to their usual corporate style.

The upper floor has been sold off on long leases and are not included in the sale.

Accommodation

Unit 1 has been measured by BKR Floor Plans and provides the following Net Internal Areas:

| Net Frontage | 42’11” | 13.08 m |

| Gross Frontage | 48’3” | 14.71 m |

| Sq Ft | Sq M | |

|---|---|---|

| Zone A | 961 | 89.28 |

| Zone B | 967 | 89.83 |

| Zone C | 719 | 66.80 |

| Remainder | 421 | 39.11 |

| ITZA | 1,677 units | |

| Ground Floor Total | 3,068 | 285.02 |

The property provides a Gross Internal Area totalling 3,202 Sq Ft / 297.47 Sq M.

The measured survey is available to download and will be re-addressed to a purchaser at a cost of £325 + VAT.

Planning

The property is not listed and is not located within a conservation area.

Tenure

A new 999 year leasehold interest (less 3 days).

Tenancy

The property is let to Co-Operative Group Food Limited for a term of 15.5 years from 15th November 2019, expiring on 15th May 2035 (15 years unexpired lease term). There is a tenant’s break option on 14th November 2030, subject to 6 months’ prior written notice.

The current passing rent is £55,000 per annum (£17.18 psf). The lease benefits from a rent review on 15th May 2026 and every 5 years thereafter. The rent is reviewed in line with the Consumer Price Index (compounded annually), subject to a cap of 3% and collar of 1%.

The tenant has an option to renew the lease on the same terms, but at the greater of the passing rent or open market rent. Therefore, should the tenant renew their lease at expiry, the rent review is on an upwards only basis.

Covenant

Co-operative Group Food Limited has reported the following figures:

| Year Ending | 5th January 2019 | 6th January 2018 |

|---|---|---|

| Revenue | £7,185,200,000 | £6,940,200,000 |

| Pre-Tax Profit | £207,900,000 | £232,500,000 |

| Net Assets | £1,970,500,000 | £1,875,100,000 |

Co-operative Group Food Limited is a subsidiary of the Co-operative Group Ltd, one of the largest retailers in the UK. The Co-operative operate in a range of areas including food, clothing, insurance and funeral services.

Co-operative Group Food Limited are the fifth largest food retailer in the United Kingdom with over 2,800 stores and over 69,000 employees across its local, convenience and medium sized stores.

For the year ending 6th January 2018, Co-operative Group Limited reported a turnover of £9,470,000,000, profit before tax of £72,000,000 and a total net worth of £2,191,000,000.

For further information visit www.coop.co.uk.

VAT

The property has not been registered for VAT and therefore VAT is not applicable on the purchase price.

Investment Evidence

| Date | Location | Covenant | Term Certain | Price | NIY |

|---|---|---|---|---|---|

| Jan-20 | Martin Way, Morden | Sainsbury’s | 11 | £1,375,000 | 5.41% |

| Jan-20 | London, Lordship Lane | Sainsbury’s Supermarkets Ltd | 2.5 | £1,400,000 | 5.05% |

| Jan-20 | London, Stoke Newington | Iceland | 12 | £1,875,000 | 5.75% |

| Dec-19 | Fulham Road, London | Sainsbury’s | 5 | £2,100,000 | 4.75% |

| May-19 | Winchester | Co-op | 11 | £517,500 | 5.25% |

| Feb-19 | High Street, Whitstable, Kent | Sainsbury’s | 8 | £1,350,000 | 5.34% |

| Feb-19 | Twickenham, Hampton Road | Co-Operative Group Food Limited | 15 | £2,185,000 | 4.79% |

| Dec-18 | Clapham Road, London | Sainsbury’s | 11 | £2,600,000 | 3.99% |

| Nov-18 | Coulsdon, Brighton Road | Little Waitrose | 16 | £5,860,000 | 4.02% |

| Sep-18 | Adenmore Road, London | Sainsbury’s | 15 | £2,102,000 | 4.25% |

| May-18 | Colliers Wood | Co-op | 15 | £1,730,000 | 4.90% |

Proposal

We are instructed to seek offers in excess of £870,000 (Eight Hundred and Seventy Thousand Pounds), subject to contract and exclusive of VAT, reflecting a net initial yield of 6%, assuming purchasers’ costs of 5.59%.

Please note that a purchaser will be re-charged the cost of searches and surveys which are provided in the data room.

Please note a purchaser will be charged a transaction fee of £5,000 + VAT.

Investment Considerations

-

An opportunity to acquire a modern convenience store investment in a densely populated and affluent London location;

-

The property is situated on a prominent corner site;

-

Let to the highly secure covenant of Co-operative Group Food Limited (Pre-Tax Profits £208 million, Net Assets £1.97 billion);

-

15 years unexpired lease term;

-

Attractive lot size to an investor interested in acquiring a highly secure London investment;

-

A purchase at the asking price reflects an attractive net initial yield.

Data Room and clicktopurchase®

Access to the data room and for the ability to purchase online with speed and ease, please click the clicktopurchase® “C” icon or the clicktopurchase® side bar. Purchasers will be able to access the complete legal package, clear verification and submit legally-binding offers to acquire the property.

Purchasers benefit from the trust, security and transparency provided by the platform. All activities, including the online contract execution, will form part of the electronic audit trail which is anchored in the clicktopurchase® Blockchain.

clicktopurchase® provides the opportunity for any investor, whether located UK or abroad, to uniquely purchase online with ease and certainty. To learn more about clicktopurchase®, click here.

Finance

We have partnered with a leading finance adviser to provide loan services. To learn more, please visit our “Finance” section.

DOWNLOADS

BROCHURE

Contact Us

| Singer Vielle | +44 (0) 207 935 7200 | |

|---|---|---|

| Daniel Elia | daniel@singervielle.co.uk | +44 (0) 203 701 1353 |

| Dale Henry | dale@singervielle.co.uk | +44 (0) 203 701 1356 |

| Neil Singer | neil@singervielle.co.uk | +44 (0) 203 478 9120 |

Vendors Solicitor

| Burkill Govier | +44 (0) 125 271 7171 | |

|---|---|---|

| Justin Burkill | jjb@burkillgovier.com | |