Prime High Yielding Retail Investment

5 Eastgate Street | Gloucester | GL1 1NS

£700,000

subject to contract

GALLERY

Coronavirus Act 2020

The property is sold with the benefit of a rent guarantee from the vendor to ensure an investor has no issues receiving income in light of the Coronavirus Act 2020 Part 1 Section 82. This is no reflection upon the tenants’ ability to meet their rental obligations but an understandable protection for a purchaser. The guarantee is to end the earlier of the end of the rent moratorium, or a period of 6 months, whichever is the sooner.

Summary

-

Gloucester is an historic Cathedral City

-

Located in the 100% prime retail pitch

-

Let to Sportswift Ltd, trading as Card Factory

-

Freehold

-

Re-purposing potential on the upper parts

-

£700,000, subject to contract

-

11.5% Net Initial Yield

-

Implied asking price in relation to the upper floors of only £23.50 per sq ft / £253 per sq m

-

The property is sold with the benefit of a rent guarantee from the vendor to ensure an investor has no issues receiving income in light of the Coronavirus Act 2020 Part 1 Section 82

Location

The historic Cathedral City of Gloucester is the county town of Gloucestershire and is one of the principal commercial centres in the South West of England. The city is situated approximately 167 km (104 miles) west of London, 56 km (35 miles) north of Bristol and 87 km (54 miles) south of Birmingham.

The town has excellent road communications as it is located at the intersection of the A40 and the A438, providing a direct link to the M5 at Junctions 11, 11A and 12. In turn, the M5 provides a continuous motorway link to the M4, M50, M6 and M42 and the rest of the national motorway network.

By rail, Gloucester benefits from direct services to London (Paddington), with a fastest journey time of approximately 2 hours. Direct services also operate to Birmingham, Bristol and Cardiff with journey times of around 1 hour.

In addition, Bristol International Airport is located approximately 59 km (37 miles) to the south, providing a range of national and international flight options.

Gloucester has a population of 129,300 people, estimated to reach 144,000 by 2035.

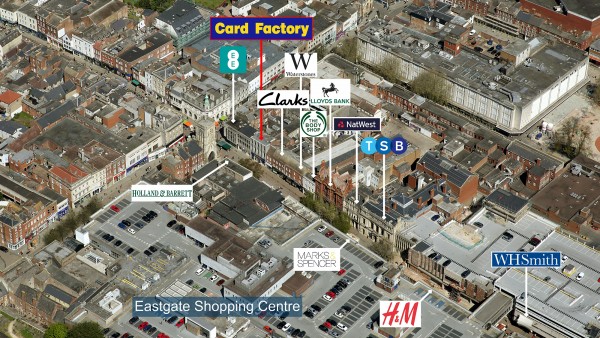

The property occupies a prime trading location on the pedestrianised Eastgate Street, in close proximity to ‘The Cross’ being the confluence of Northgate, Southgate, Eastgate and Westgate Retailers in the immediate vicinity include Marks & Spencer, Clarks, Holland & Barrett, Waterstones and Primark.

The Eastgate Shopping Centre is in close proximity to the subject property. Providing 23,225 sq m (250,000 sq ft) of retail space, the centre is anchored by Marks & Spencer, which has both external and internal frontages. Other tenants include JD Sports, Vision Express, Greggs, Tesco Express and H&M. The centre also comprises a 370 space car park at first floor level.

Gloucester city centre is currently experiencing significant regeneration.

In September 2020, Gloucester City Council announced exciting plans for major redevelopment projects including the reinvention of Kings Quarter. This project was awarded £5 million worth of funding to transform Kings Square into a modern city centre square. With funding of £10.7million received from GFirst LEP, the plan also includes a major redevelopment of the railway station with the recent new bus station, an inspired entry point for visitors that opened in 2018.

Further development was announced in March with the Council’s approval of the transformative Forum project which will stand between the station and Kings Square providing over 125,000 sq ft of office space, an innovation hub, 4-star hotel, retail & dining space, car parking and cathedral view apartments. The Forum is being developed by the Reef Group alongside the City Council and will open up the centre, linking the key city quarters.

The former Debenhams store is set to become a new University of Gloucestershire campus. The university is fully refurbishing and converting the building into a learning centre for students and staff.

The new development projects will create over 1,000 jobs. (Source: www.investgloucester.co.uk).

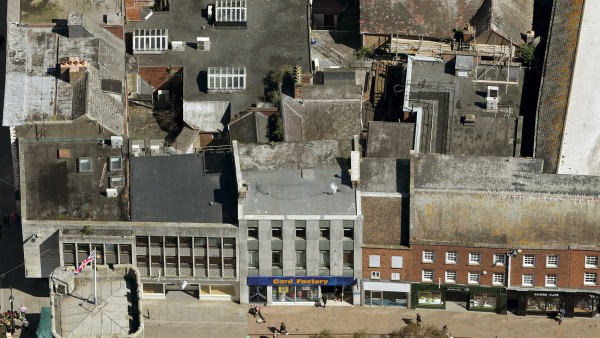

Description

The property comprises a mid-terrace building arranged over basement, ground and two upper floors. Internally the ground floor is arranged as an open plan retail area which has been fitted out by the tenant to their typical specification. The basement and first floor provide ancillary accommodation whilst the second floor is in a dilapidated condition and is currently unused by the tenant.

Accommodation

The property has been measured by BKR Floor Plans and provides the following Net Internal floor areas:

| Net Frontage | 6.93 m | 22’9” |

| Gross Frontage | 8.53 m | 28’0” |

| Zone A | 40.41 sq m | 435 sq ft |

| Zone B | 43.76 sq m | 471 sq ft |

| Zone C | 48.22 sq m | 519 sq ft |

| Remainder | 2.88 sq m | 31 sq ft |

| ITZA | 804 | |

| Total Ground Floor | 135.26 sq m | 1,456 sq ft |

| Basement | 107.21 sq m | 1,154 sq ft |

| First Floor Ancillary | 72.18 sq m | 777 sq ft |

| Second Floor Ancillary | 74.23 sq m | 799 sq ft |

| Total | 388.88 sq m | 4,186 sq ft |

A set of floor plans is available to download and the measured survey report will be re-addressed to a purchaser at a cost of £375 + VAT.

Tenure

Freehold.

Note that the ownership of a small section to the rear of the property only extends to the ground floor, with the area above excluded from the title. Please see the title plan and register within the data room for further information.

Tenancy

The property is entirely let to Sportswift Limited (t/a Card Factory) on a full repairing and insuring lease for a term of 10 years from 2nd October 2015, expiring on 1st October 2025.

The current passing rent is £85,000 per annum which, based on our analysis, equates to a Zone A rate of £97 per sq ft.

The tenant is currently in arrears, owing £54,574.66 + VAT. An informal repayment plan has been agreed with the tenant whereby the debt is being repaid over twelve months commencing October 2021, with rents paid monthly from 1st May 2021.

Covenant

Sportswift Limited (Co. No. 3493972), has reported the following figures;

| 31st January 2020 | 31st January 2019 | |

|---|---|---|

| Revenue | £433,400,000 | £417,167,000 |

| Pre-Tax Profits | £67,672,000 | £66,206,000 |

| Net Assets | £53,736,000 | £27,574,000 |

The Company is the principal trading entity within the Card Factory plc Group, the UK’s leading specialist retailer of greeting cards, dressings and gifts. The Company focuses on the value and mid-market segments of the UK’s large and resilient greeting cards market, in addition to offering a range of complementary products associated with card giving occasions. The UK card and gift market is large and highly fragmented with the greetings card sector alone estimated by industry analysts to be worth c. £1.3 billion at retail sales value. Card Factory commenced operations in 1997 and now operates through its nationwide chain of over 1,000 stores as well as through its online offering www.cardfactory.co.uk.

A recent article published in The Times titled “The party’s not over for Card Factory” (23 May 2021) explains how the company has been affected by the impact of Covid but, having been profitable since 2014, offering a personalised card service on their website as of 2020 and having sales in Aldi and Matalan stores, the outlook is optimistic for the company and a recommended buy share.

Asset Management

The upper parts are demised to the tenant but are not being fully utilised.

We assess the passing rent attributable to the upper parts at approximately £4,700 per annum. Based upon the asking yield of 11.5% in relation to an apportioned rent for the retail of £80,308, this allocates a purchase price to the upper floor areas of the property at some £37,000 which equates to only £23.50 per sq ft. In comparison, the average sale value for flats in Gloucester is £122,000 and £77 per sq ft (Source: www.zoopla.co.uk).

Subject to consents, it is suggested that the upper floors could potentially provide for residential accommodation with exit values significantly in excess of the apportioned purchase price for this element of the property.

VAT

The property has been registered for VAT. Therefore, it is anticipated that the sale will be treated as a Transfer of a Going Concern (TOGC).

Proposal

We are instructed to seek a figure of £700,000 (Seven Hundred Thousand Pounds) subject to contract, reflecting a net initial yield of 11.5%, assuming standard purchaser’s costs of 5.30%.

Please note that a purchaser will be re-charged the costs of the measured survey (£375 + VAT) and searches (£903.89) which are provided in the data room.

Please note that a purchaser will be charged a Transaction Fee of £5,000 plus VAT.

Investment Considerations

-

An opportunity to acquire a freehold retail investment in an historic Cathedral City;

-

The property is let to the well-regarded covenant of Sportswift Limited with Net Assets of £53m (2020);

-

The property occupies a prime retailing pitch in the heart of Gloucester city centre;

-

A purchase at the asking price reflects an attractive net initial yield;

-

The apportioned price in relation to the upper floors represents a significant discount;

-

Attractive lot size to an investor.

-

The property is sold with the benefit of a rent guarantee from the vendor to ensure an investor has no issues receiving income in light of the Coronavirus Act 2020 Part 1 Section 82.

Data Room and clicktopurchase®

Access to the data room and for the ability to purchase online with speed and ease, please click the clicktopurchase® “C” icon or the clicktopurchase® side bar. Purchasers will be able to access the complete legal package, clear verification and submit legally-binding offers to acquire the property.

Purchasers benefit from the trust, security and transparency provided by the platform. All activities, including the online contract execution, will form part of the electronic audit trail which is anchored in the clicktopurchase® Blockchain.

clicktopurchase® provides the opportunity for any investor, whether located UK or abroad, to uniquely purchase online with ease and certainty. To learn more about clicktopurchase®, click here.

DOWNLOADS

BROCHURE

Update your investment requirements and we will alert you as suitable properties become available.

Contact Us

| Singer Vielle | +44 (0) 207 935 7200 | |

|---|---|---|

| Daniel Elia | daniel@singervielle.co.uk | +44 (0) 203 701 1353 |

| Dale Henry | dale@singervielle.co.uk | +44 (0) 203 701 1356 |

| Neil Singer | neil@singervielle.co.uk | +44 (0) 203 478 9120 |

Vendors Solicitor

| Gunnercooke | +44 (0) 333 014 3401 |

|---|---|

| Simon Davies | simon.davies@gunnercooke.com |

| Jonathan Wilkson | jonathan.wilkinson@gunnercooke.com |