Attractive Retail Investment within Historic City Centre

Cardfactory | 55-56 High Street | Exeter | EX4 3DQ

£710,000

subject to contract

GALLERY

Summary

-

Popular South-West City for both commerce and tourism

-

Highly attractive retail investment

-

Let Sportswift Ltd, trading as Card Factory

-

Excellent city centre retailing pitch enjoying high levels of footfall

-

Virtual Freehold

-

VAT free investment opportunity

-

Offers in excess of £710,000, subject to contract

-

12.0% Net Initial Yield

Location

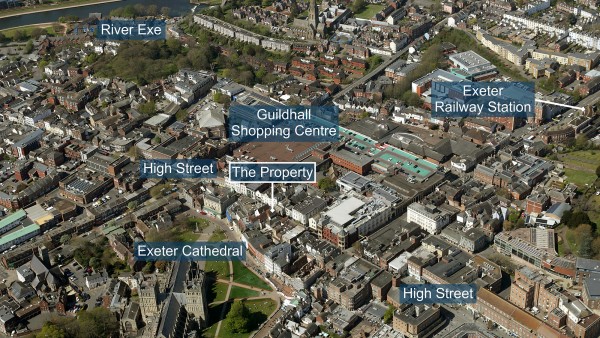

Exeter is a historic Cathedral and University City located in the South West of England. The city is the main commercial centre for Devon and is located approximately 45 miles (72 km) north-east of Plymouth, 81 miles (130 km) south-west of Bristol, and 175 miles (280 km) west of London.

Exeter benefits from excellent transport links being located two miles (3.2 km) west of the M5 motorway, with junctions 29, 30 and 31 all providing access to the city centre. To the west of Exeter is the A38 (Devon Expressway) giving direct access to Plymouth and the A30 to Cornwall. The A30 also links the A303 to the east, providing a trunk road connection to the M3 motorway and thereon to London.

The city has two mainline railway stations, Central and St David’s, both of which have direct services to numerous towns and cities throughout the national rail network. The fastest journey time to London Paddington is approximately 2 hours and 30 minutes.

Exeter International Airport is located 6 miles (10 km) to the east of the city with a range of UK and International flights to destinations that include Madrid, Munich, Dublin, Geneva, Nice and Edinburgh.

The city has strong industry and services sectors, with the Met Office being one of the three largest employers in the area, together with Exeter University and Devon County Council. Other major businesses represented in Exeter include EDF Energy and British Telecom.

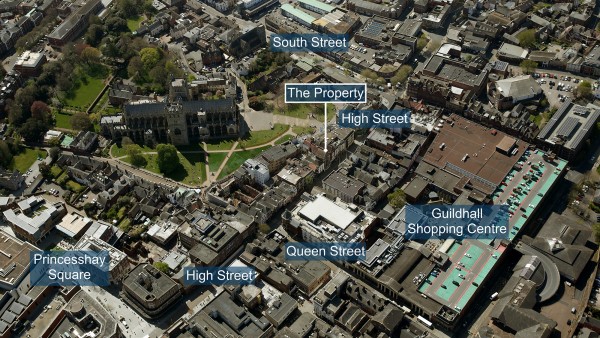

Situation

The subject property is situated in a prominent position at the south-eastern end of the High Street in amongst the prime shopping area which lies a short distance to the north-west located between the Guildhall Centre, the John Lewis store and the Princesshay Shopping Centre. The High Street is a designated pedestrian zone with limited access for buses and taxis only.

The historic Guildhall is located directly opposite the property, built in circa 1466 it is now Grade I Listed and is still used regularly for civic functions, full meetings of the City Council, official receptions, mayoral banquets and exhibitions.

Other nearby occupiers include Santander, NatWest, Burger King, White Stuff and Dr. Martens. Exeter is a well-established retail centre and provides one of Devon’s primary shopping destinations. The Princesshay Shopping Centre was developed by Land Securities Plc and opened in 2007. Guildhall Shopping Centre is located at the southern end of the High Street and is a retail and restaurant location, anchored by Primark, Wilko and Sainsbury’s. Approximately £12m was spent by Aviva investors in remodelling the Queen Street restaurant area to make it a destination for A3 occupiers within the city.

Description

The property comprises a Grade II listed building providing a ground floor retail unit with ancillary accommodation at basement level. The basement level provides storage, male and female WC’s and a staff kitchen area. Internally, the retail floor area has been fitted out by the tenant to their typical specification.

The upper parts of the property, comprising residential accommodation, is not owned by the vendor and, therefore, is not included within the investment. We understand that the upper floors are owned by Burrington Estates.

Accommodation

The property has been measured by BKR Floor Plans and provides the following Net Internal floor areas:

| Net Frontage | 7.01 m | 23’0” |

| Gross Frontage | 8.43 m | 27’8” |

| Zone A | 42.92 sq m | 462 sq ft |

| Zone B | 41.15 sq m | 443 sq ft |

| Zone C | 27.78 sq m | 299 sq ft |

| Remainder | 11.71 sq m | 126 sq ft |

| ITZA | 774 | |

| Total Ground Floor | 123.56 sq m | 1,330 sq ft |

| Basement Ancillary | 111.20 sq m | 1,179 sq ft |

| Total | 234.76 sq m | 2,527 sq ft |

A set of floor plans is available to download and the measured survey report will be re-addressed to a purchaser at a cost of £475 + VAT.

Planning

The property is Grade II listed (hence, empty rates are not payable) and situated within the Exeter Central Conservation Area.

Tenure

Virtual Freehold for a term of 999 years from 11th October 1985 at a peppercorn rent. Contributions to the maintenance of the property are organised through a service charge which is operated by managing agents, Whitton & Lang, on behalf of the freeholder, Cathedral View (Exeter) Limited. Current service charge contributions are £3,239 – the service charge is available to download (see “Commercial Premises B”).

Tenancy

The property is let to Sportswift Limited (trading as Card Factory) on a full repairing and insuring lease for a term of 10 years from 5th July 2016, expiring on 4th July 2026.

The current passing rent is £90,000 per annum which, based on our analysis, equates to a Zone A rate of £108.50 per sq ft, allowing for £5.00 per sq ft on the basement area.

All rent is paid and up to date with, with no arrears. We include within the legal package a full payment history.

Covenant

Sportswift Limited (Co. No. 3493972), has reported the following figures;

| 31st January 2020 | 31st January 2019 | |

|---|---|---|

| Revenue | £433,400,000 | £417,167,000 |

| Pre-Tax Profits | £67,672,000 | £66,206,000 |

| Net Assets | £53,736,000 | £27,574,000 |

The Company is the principal trading entity within the Card Factory plc Group, the UK’s leading specialist retailer of greeting cards, dressings and gifts. The Company focuses on the value and mid-market segments of the UK’s large and resilient greeting cards market, in addition to offering a range of complementary products associated with card giving occasions. The UK card and gift market is large and highly fragmented with the greetings card sector alone estimated by industry analysts to be worth c. £1.3 billion at retail sales value. Card Factory commenced operations in 1997 and now operates through its nationwide chain of over 1,000 stores as well as through its online offering www.cardfactory.co.uk.

A recent article published in The Times titled “The party’s not over for Card Factory” (23 May 2021) explains how the company has been affected by the impact of Covid but, having been profitable since 2014, offering a personalised card service on their website as of 2020 and having sales in Aldi and Matalan stores, the outlook is optimistic for the company and a recommended buy share.

VAT

The property has not been registered for VAT and therefore VAT is not applicable on the purchase price.

Proposal

We are instructed to seek offers in excess of £710,000 (Seven Hundred and Ten Thousand Pounds), subject to contract, reflecting a net initial yield of 12.0%, assuming standard purchaser’s costs of 5.32%.

Please note that a purchaser will be re-charged the costs of the measured survey (£475 + VAT) and searches (£798.48) which are provided in the data room.

Please note that a purchaser will be charged a Transaction Fee of £5,000 plus VAT.

Investment Considerations

-

An opportunity to acquire an attractive investment in a popular , historic, south-west city;

-

The property is let to the well-regarded covenant of Sportswift Limited with Net Assets of £53m (2020);

-

Ground and basement premises providing excellent frontage onto Exeter’s pedestrianised retailing location;

-

The property occupies an excellent retailing pitch in the heart of Exeter city centre;

-

VAT free investment opportunity;

-

Virtual Freehold at a peppercorn rent;

-

A purchase at the asking price reflects an attractive net initial yield;

-

Attractive lot size to an investor.

Data Room and clicktopurchase®

Access to the data room and for the ability to purchase online with speed and ease, please click the clicktopurchase® “C” icon or the clicktopurchase® side bar. Purchasers will be able to access the complete legal package, clear verification and submit legally-binding offers to acquire the property.

Purchasers benefit from the trust, security and transparency provided by the platform. All activities, including the online contract execution, will form part of the electronic audit trail which is anchored in the clicktopurchase® Blockchain.

clicktopurchase® provides the opportunity for any investor, whether located UK or abroad, to uniquely purchase online with ease and certainty. To learn more about clicktopurchase®, click here.

DOWNLOADS

BROCHURE

Update your investment requirements and we will alert you as suitable properties become available.

Contact Us

| Singer Vielle | +44 (0) 207 935 7200 | |

|---|---|---|

| Daniel Elia | daniel@singervielle.co.uk | +44 (0) 203 701 1353 |

| Dale Henry | dale@singervielle.co.uk | +44 (0) 203 701 1356 |

| Neil Singer | neil@singervielle.co.uk | +44 (0) 203 478 9120 |

Vendors Solicitor

| Gunnercooke | +44 (0) 333 014 3401 |

|---|---|

| Simon Davies | simon.davies@gunnercooke.com |

| Jonathan Wilkson | jonathan.wilkinson@gunnercooke.com |