Attractive Office/Retail Investment on behalf of Administrators

Enterprise House | 32-34 Earl Grey Street | Edinburgh | EH3 9BN

£3,950,000

subject to contract

GALLERY

Summary

-

On behalf of Administrators, acting as agent without personal liability

-

Attractive retail & office investment

-

Edinburgh is the UK’s most prosperous city outside London

-

Located within the heart of the City Centre and financial district

-

Ground floor let to the undoubted covenant of Tesco Stores Limited

-

Offices let to national law firm Lyons Davidson – circa 8.5 years unexpired

-

Heritable Interest (Scottish Equivalent of English Freehold)

-

£3,950,000, subject to contract

-

6.82% Net Initial Yield

Location

Edinburgh is Scotland’s Capital City and its principal, financial and administrative centre, housing both the Scottish Parliament and the Scottish Government. The city also benefits from buoyant tourism.

The city has a population of 525,000 people and has grown steadily in recent years, with annual net growth of around 1% (5,000 new residents each year). Edinburgh's working age population is over 366,000. The city is recognised for its talent, with half of working-age residents educated to degree-level or above - more than any other UK city bar Oxford and Cambridge. More graduates live in Edinburgh than any other UK city bar London and Birmingham. In 2019, JLL ranked Edinburgh the 15th top city in the world for talent concentration in its Innovation Geographies index. Unemployment is the lowest of any major UK city (with a Jobseeker’s Allowance claimant rate of just 1.9% in December 2019), and gross disposable income is the highest outside of London.

Edinburgh is well-connected by rail, with trains offering swift journeys to destinations including Glasgow (42 minutes) and London (four hours 20 minutes). The city's 12 rail stations include the major city centre stations of Edinburgh Waverley and Haymarket, while the Edinburgh Gateway and Edinburgh Park stations link the city centre with West Edinburgh. The Edinburgh City Bypass links directly to the M8 leading to Glasgow (a one hour, 20 minute drive) and the A1 and A702 leading to London. Edinburgh Airport offers direct flights between Edinburgh and over 150 airports worldwide (Source: www.investinedinburgh.com).

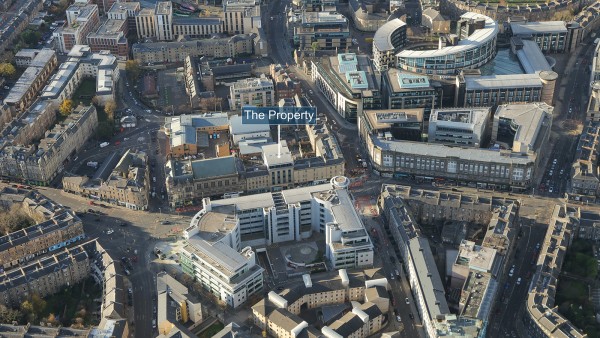

Situation

The property is situated on the west side of Earl Grey Street (A700) between its junctions with Fountainbridge to the north and Tollcross to the south. Surrounding occupiers include Boots, The Co-op, Sainsbury’s Local, Costa, Superdrug and Bank of Scotland.

Earl Grey Street forms part of one of the main arterial routes into Edinburgh City Centre from the south benefitting from high vehicular and pedestrian footfall. The subject property lies approximately 0.8 km (0.5 miles) to the south of Edinburgh City Centre within a mixed commercial and residential locality.

The property also benefits from being within the heart of Edinburgh’s financial hub and is surrounded by numerous blue chip financial, technological and professional businesses. Multinational law firm Pinsent Masons is located opposite the subject property. Semple Street and Edinburgh’s Exchange District are a mere 500 feet away with occupiers including Blackrock, Wood MacKenzie, Scottish Widows, Aberdeen Asset Management, Lloyds Banking Group, PWC, AON, IBM, Henderson Global Investors, Alliance Trust and Franklin Templeton. In addition, the Edinburgh International Conference Centre is a five minute walk to the north-west.

Description

The subject property is an attractive building constructed in circa 1956 with a stone-built façade, arranged over basement, ground and four upper floors.

The ground floor comprises a retail unit which has been fitted out by the tenant, Tesco, in their usual corporate style.

The four upper floors provide office accommodation which are accessed via a separate entrance to Enterprise House, situated adjacent to the entrance to the retail unit. The offices benefit from a specification including raised access flooring, lift, comfort cooling, double glazed windows and lowered ceilings incorporating recessed strip lighting. Each floor has separate male and female WC’s and kitchen facilities. The first and second floors are currently unoccupied.

The basement accommodation is demised to the office tenant but is unused.

There are six dedicated car parking spaces to the rear of the property.

Accommodation

The property has been measured by BKR Floor Plans and provides the following Net Internal floor areas:

| Retail (Tesco) | ||

|---|---|---|

| Net Frontage | 31’1” | 10.69 m |

| Gross Frontage | 39’3” | 11.96 m |

| Zone A | 1,058 sq ft | 98.29 sq m |

| Zone B | 1,312 sq ft | 121.88 sq m |

| Zone C | 853 sq ft | |

| ITZA | 1927 | |

| Total Ground Floor | 3,223 sq ft | 299.42 sq m |

| Offices (Lyons Davidson) | ||

| First Floor | 3,195 sq ft | 296.82 sq m |

| Second Floor | 3,132 sq ft | 290.96 sq m |

| Third Floor | 3,131 sq ft | 290.87 sq m |

| Fourth Floor | 2,898 sq ft | 269.22 sq m |

| Total Offices | 12,356 sq ft | 1,147.87 sq m |

| Basement | 1,379 sq ft | 128.11 sq m |

| Total | 16,958 sq ft | 1,447.29 sq m |

A set of floor plans is available to download and the measured survey report will be re-addressed to a purchaser at a cost of £495 + VAT.

Tenure

Heritable (Scottish equivalent of English freehold).

Tenancies

Retail

The ground floor is let to Tesco Stores Limited on effectively a full repairing and insuring lease for a term expiring on 8th December 2029 (8 years unexpired lease term). There is a tenant’s break option on 9th December 2024, subject to six months’ notice. The lease provides the landlord with the ability to recover costs in relation to common repairs.

The original lease was for a term of 15 years from 9th December 2004, expiring on 8th December 2019. In accordance with a Minute of Variation dated January 2020 the lease was extended for a further 10 years.

The current passing rent is £65,000 per annum. The lease benefits from an upwards only open market rent review on 9th December 2024.

Offices

The first, second, third and fourth floor office suites and basement premises are let to Lyons Davidson Limited on effectively a full repairing and insuring lease, subject to a Schedule of Condition, for a term of 15 years from 9th June 2015, expiring on 8th June 2030 (approximately 8.5 years unexpired). The tenant is required to pay a fair proportion of costs incurred by the landlord in insuring, repairing and maintaining the common areas.

The tenant has a right to use six car parking spaces within the car parking area.

The current passing rent is £222,030 per annum (£161 per sq m / £17.97 per sq ft overall). The lease benefits from five yearly open market rent reviews, the next being on 9th June 2025.

Therefore, an investor will benefit from a total income of £287,030 per annum.

Covenants

Tesco Stores Limited (Co. No. 00519500) has reported the following figures:

| 27th February 2021 | 29th February 2020 | |

|---|---|---|

| Turnover | £42,451 million | £42,951 million |

| Pre-Tax Profits | £1,018 million | £1,151 million |

| Net Assets | £5,472 million | £5,334 million |

Within the latest financial year the company had 2,751 stores throughout England, Scotland, Wales and Northern Ireland.

The company’s ultimate parent company, Tesco Plc, is the market leader of groceries in the UK and one of the world’s largest retailers with more than 360,000 employees. With group sales of £53.4 billion and statutory profit before tax of £825 million, Tesco Plc is a constituent of the FTSE-100 Index. For further information see www.tescoplc.com.

Lyons Davidson Limited (Co. No. 07592441) has reported the following figures:

| 30th November 2020 | 30th November 2019 | |

|---|---|---|

| Turnover | £30,813,641 | £36,143,493 |

| Pre-Tax Profits (Loss) | (£4,763,904) | (£3,132,535) |

| Net Assets | £5,104,363 | £9,522,165 |

Lyons Davidson Limited (trading as Lyons Davidson Solicitors) is a full-service legal practice operating throughout the UK and has been providing services to businesses, individuals and the insurance industry for over 40 years. The company has offices in Bristol, Cardiff, Leeds, Scotland and Solihull. For further information see www.lyonsdavidson.co.uk.

The immediate and ultimate parent company is LD Group Holdings Limited. “The ultimate controlling parties are R J Squire and I G Squire by virtue of their interests in the issued ordinary share capital of LD Group Holdings Limited”.

The accounts report the following directors [note their roles at Lyons Davidson]: G (Gillian) A Banbury [Finance Director], A (Alexandra) A L Hewitt [Compliance Director], M (Michelle) L Lennaghan [Commercial Director], M (Mark) Savill [Managing Director] and R (Richard) J Squire [Director].

LD Group Holdings Limited (Co. No. 09489691) has reported the following figures:

| 30th November 2020 | 30th November 2019 | |

|---|---|---|

| Turnover | £30,813,641 | £36,143,493 |

| Pre-Tax Profits (Loss) | (£4,377,508) | (£2,556,480) |

| Net Assets | (£9,467,740) | (£5,626,947) |

“The ultimate controlling parties are R (Richard) J Squire and I (Isobel) G Squire by virtue of their interests in the issued share capital of the company”.

We are not privy to the private partnership arrangements but suggest that it is not unusual for solicitors within a law practice to indemnify partners who are directors of holding companies responsible for lease obligations.

VAT

It is anticipated that the sale will be treated as a Transfer of a Going Concern (TOGC) and the purchaser will be required to submit the appropriate election to HMRC. It should be noted that the administrators may not hold documentation to prove VAT election at the point of completion.

Proposal

We are instructed to seek a figure of £3,950,000 (Three Million, Nine Hundred and Fifty Thousand Pounds), subject to contract, reflecting a net initial yield of 6.82%, assuming standard purchaser’s costs of 6.51%.

Please note that a purchaser will be re-charged the costs of the measured survey (£495 + VAT) and searches (£130 + VAT) which are provided in the data room.

Investment Considerations

-

The property is located in the UK’s most prosperous city outside London;

-

The property occupies a prominent position in the heart of the city centre and Edinburgh’s financial district;

-

Ground floor retail unit let to the undoubted covenant of Tesco Stores Limited;

-

Offices let to national law firm Lyons Davidson providing an attractive unexpired lease term of approximately 8.5 years;

-

Heritable Interest (Scottish Equivalent of English Freehold);

-

A purchase at the asking price reflects an attractive net initial yield;

Disclaimer

The affairs, business and property of the Company is being managed by the Joint Administrators Andrew Knowles and Steven Muncaster, who act as agents for the Company and without personal liability. Both are licensed by the Insolvency Practitioners Association and are bound by the Insolvency Code of Ethics.

DOWNLOADS

BROCHURE

Contact Us

| Singer Vielle | +44 (0) 207 935 7200 | |

|---|---|---|

| Dale Henry | dale@singervielle.co.uk | +44 (0) 203 701 1356 |

| Neil Singer | neil@singervielle.co.uk | +44 (0) 203 478 9120 |

| Daniel Elia | daniel@singervielle.co.uk | +44 (0) 203 701 1353 |

| Graham Waddell | graham@singervielle.co.uk | +44 (0) 141 221 4545 |

Vendors Solicitor

| Burness Paul | +44 (0)131 473 6000 | |

|---|---|---|

| Richard Rennie | richard.rennie@burnesspaull.com | +44 (0) 131 473 6168 |

| Andy Tyler | andy.tyler@burnesspaull.com | +44 (0)131 473 6303 |