Secure Retail Investment in Affluent South East Commuter Town

81-85 High Street | Dorking | Surrey | RH4 1AW

£925,000

subject to contract

GALLERY

Summary

-

Wealthy South East commuter town

-

Attractive, prime retail investment

-

Let to WH Smith (Net Assets £884 million)

-

Part sub-let to Boots Opticians (Net Assets £112 million)

-

Let until October 2026

-

October 2021 break option removed, demonstrating the tenant’s commitment to the property

-

Re-based rent following the taking back of the upper parts by the landlord

-

Prime position on the High Street

-

Two in-situ tenants, providing flexibility at lease expiry

-

£925,000, subject to contract

-

7.0% Net Initial Yield

Location

Dorking is an affluent South East market town in Surrey which forms part of the London commuter belt. It is situated 42 km (26 miles) south of Central London and 19 km (12 miles) east of Guildford.

The town benefits from excellent road connections, being served by the A24 which links directly with Junction 9 of the M25 Motorway and is approximately 9.5 km (6 miles) to the north and Worthing to the south. The A25 also provides direct access to Guildford to the west. The town benefits from three railway stations with regular services to London Victoria and London Waterloo with fastest journey times of 56 minutes and 51 minutes respectively. London Gatwick Airport is approximately 23 km (14 miles) to the south-east and Heathrow Airport some 40 km (25 miles) to the north.

The town is bordered on three sides by the Surrey Hills Area of Outstanding Natural Beauty and is an attractive area for occupiers given its excellent transport links.

Situation

The subject property is situated within the heart of Dorking Town Centre, occupying a prime central retailing pitch on the High Street. The property lies a short distance to the west of St Martin’s Walk Shopping Centre which boasts a selection of well-known brands including Marks & Spencer, The Body Shop, Vodafone and Milletts. Other nearby retailers include Sainsburys, Mountain Warehouse, Barclays, WHSmith, Fat Face, Boots, EE and Starbucks.

Description

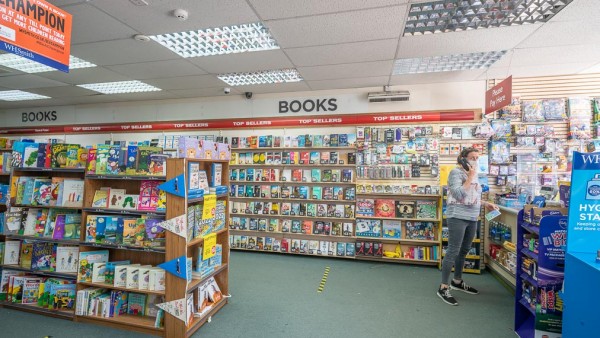

The property comprises a retail unit arranged on ground floor with ancillary accommodation at basement level. Internally, the retail floor is predominantly open plan with ancillary areas and has been fitted out by the tenant to their usual corporate style.

The unit has been sub-divided by the tenant and part sub-let to Boots Opticians.

The upper floors, which comprise six residential apartments, do not form part of the sale. However, further details can be provided upon request should an investor be interested in acquiring these upper parts.

Accommodation

The lease states that the following floor areas are to be used in calculating the open market rent of the property:

| 81 High Street | Sq M | Sq Ft |

|---|---|---|

| Ground Floor Sales | 200.65 | 2,159 |

| ITZA | 725 | |

| Ground Floor Rear Ancillary | 39.13 | 421 |

| Sub-Total | 239.78 | 2,580 |

| 83 High Street | Sq M | Sq Ft |

| Ground Floor Sales | 90.15 | 970 |

| ITZA | 554 | |

| Basement Storage | 58.92 | 634 |

| Sub-Total | 149.07 | 1,601 |

| Total | 388.85 | 4,184 |

The property has been measured by BKR Floor Plans, with the measured survey producing the following areas:

| Gross Frontage | 5.38 m | 17 ft 8 inches |

| Net Frontage | 4.95 m | 16 ft 3 inches |

| Sq M | Sq Ft | |

|---|---|---|

| 81 High Street | ||

| Zone A | 36.32 | 391 |

| Zone B | 35.21 | 379 |

| Zone C | 32.14 | 346 |

| Remainder | 149.29 | 1,607 |

| ITZA | 868 | |

| Sub-Total | 252.97 | 2,723 |

| 83 High Street | ||

| Zone A | 25.83 | 278 |

| Zone B | 18.77 | 202 |

| Zone C | 26.10 | 281 |

| Remainder | 6.22 | 67 |

| ITZA | 458 | |

| Ground Floor Total | 76.92 | 828 |

| Basement | 122.44 | 1,318 |

| Sub-Total | 199.36 | 2,146 |

| Total | 452.33 sq m | 4,869 sq ft |

A set of floor plans is available to download and the measured survey report will be assigned to a purchaser at a cost of £455 + VAT.

The measured areas are greater than the floor areas stated in the lease, to the advantage of an investor.

Rateable Value

According to the Valuation Office the rateable value for the retail unit is as follows:

| Address | Description | Rateable Value |

|---|---|---|

| 81 High Street (WH Smith) | Shop & Premises | £43,250 |

| 83 High Street (Boots) | Shop & Premises | £33,000 |

The Uniform Business Rate is 49.9 pence per pound for rateable values below £51,000.

Tenure

Freehold.

The upper floors will be let on a new 999 year lease from completion at a rent of £600 per annum.

Tenancy

The ground floor is entirely let to WH Smith Retail Holdings Limited (t/a British Bookshops & Stationers), guaranteed by WH Smith High Street Holdings Limited, on a full repairing and insuring lease for a term of 15 years from 25th October 2011, expiring on 24th October 2026.

In accordance with a Deed of Surrender of Part and Variation dated 19th October 2020, the upper parts were taken back by the Landlord and the tenant’s October 2021 break option removed. The rent was also reduced from £120,000 per annum to a current rent of £68,000 per annum. The tenant has a personal concession to pay rent monthly – please see data room.

Part of the ground floor at 83 High Street has been sub-let to Boots Opticians Professional Services Limited on a virtual co-terminus lease expiring on 20th October 2026 at a current rent of £30,500 per annum.

The tenant has an excellent payment record. All rents are paid and up to date, with no arrears. Note that the lease and the sub-lease provide that the tenant and sub-tenant benefit from security of tenure.

The upper floors will be let on a new 999 year lease at a rent of £600 per annum.

Covenant

The tenant, WHSmith Retail Holdings Limited (Co. No. 0471941), has reported the following figures:

| 31st August 2021 | 31st August 2020 | |

|---|---|---|

| Turnover | £160,225,000 | £181,561,000 |

| Pre-Tax Profits (Loss) | (£12,511,000) | (£49,224,000) |

| Net Assets | £883,833,000 | £890,889,000 |

For the year ending 31st August 2021 the guarantor, WHSmith High Street Holdings Limited (Co. No. 6560371), reported Net Assets of £101,604,000.

The ultimate parent company is WH Smith Plc, a leading global retailer for news, books and convenience made up of two core business – Travel and High Street. WHSmith Travel operates in over 150 air units, over 130 hospital units and over 290 rail units and other UK locations. WHSmith High Street has an extensive reach across the UK, and a presence on nearly every significant UK high street, mainly in prime locations. Their retail offering includes a wide range of products in the following categories: Stationery (including greeting cards, general stationery, art and craft, and gifting), News and Impulse (including newspapers, magazines, confectionery and drinks) and Books. For further information see www.whsmithplc.co.uk.

The sub-tenant, Boots Opticians Professional Services Limited (Co. No. 06779221), has reported the following figures:

| 31st August 2020 | 31st August 2019 | |

|---|---|---|

| Revenue | £291,186,000 | £393,687,000 |

| Pre-Tax Profits (Loss) | (£43,616,000) | £14,281,000 |

| Net Assets | £112,276,000 | £156,250,000 |

The Company operated a total of 550 stores as at 31st August 2020 of which 385 were owned stores and 165 were franchised. The ultimate parent company is Walgreens Boots Alliance Inc, a global leader in retail pharmacy with a presence in more than 25 countries, over 21,000 stores and more than 450,000 employees. For further information see www.boots-uk.com/about-boots-uk/healthcare/boots-opticians.

VAT

The property is elected for VAT. We anticipate that the sale should be capable of being treated as a Transfer of Going Concern (TOGC).

Proposal

We are instructed to seek offers in the region of £925,000 (Nine Hundred and Twenty-Five Thousand Pounds), subject to contract, reflecting a net initial yield of 7.0%, assuming standard purchaser’s costs of 5.66%.

Please note that a purchaser will be re-charged the costs of searches (£1,254.25) and measured survey (£455 + VAT) which are provided in the data room.

Please note that a purchaser will be charged a Transaction Fee of £5,000 plus VAT.

Investment Considerations

-

An opportunity to acquire a freehold retail investment within a wealthy South East commuter town;

-

The property occupies a prime position on the High Street;

-

Securely let to WH Smith (Net Assets £884 million);

-

Part sub-let to Boots Opticians (Net Assets £112 million);

-

Let until October 2026;

-

The October 2021 break option has been removed, demonstrating the tenant’s commitment to the property;

-

The rent has been re-based following the taking back of the upper parts by the landlord;

-

Two in-situ tenants, providing a Landlord with flexibility at lease expiry;

-

A purchase at the asking price reflects an attractive net initial yield.

Data Room and clicktopurchase®

Access to the data room and for the ability to purchase online with speed and ease, please click the clicktopurchase® “C” icon or the clicktopurchase® side bar. Purchasers will be able to access the complete legal package, clear verification and submit legally-binding offers to acquire the property.

Purchasers benefit from the trust, security and transparency provided by the platform. All activities, including the online contract execution, will form part of the electronic audit trail which is anchored in the clicktopurchase® Blockchain.

clicktopurchase® provides the opportunity for any investor, whether located UK or abroad, to uniquely purchase online with ease and certainty. To learn more about clicktopurchase®, click here.

DOWNLOADS

BROCHURE

Contact Us

| Singer Vielle | +44 (0) 207 935 7200 |

|---|---|

| Dale Henry | dale@singervielle.co.uk |

| Neil Singer | neil@singervielle.co.uk |

Vendors Solicitor

| Quastels | +44 (0) 207 908 2580 |

|---|---|

| Aisha Anjum | aanjum@quastels.com |

| Owen Walsh | owalsh@quastels.com |