Attractive Retail Investment in Affluent London Commuter Town

59-61 High Street | Camberley | GU15 3UL

£478,000

For Sale - subject to contract

GALLERY

Summary

-

Affluent London commuter town

-

Attractive retail investment

-

Let to Bayfield Opticians until January 2026

-

Recently upgraded High Street location

-

The unit has been fitted out to a very high standard

-

Freehold

-

£478,000, subject to contract

-

7.50% Net Initial Yield

Location

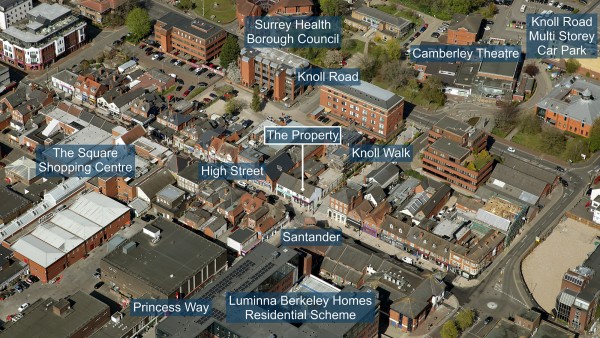

The affluent commuter town of Camberley is located approximately 17 miles (26.7 km) northwest of Guildford, 20 miles (31.4 km) southeast of Reading and approximately 35 miles (56.3 km) south-west of London. The town is very popular with London commuters and has a high level of per capita spending per head within the catchment.

Road links are excellent lying between Junctions 3 and 4 of the M3 which links to Junction 12 of the M25 Motorway. Camberley residents commuting by car to London experience a typical travel time of one hour and fifteen minutes via the M4.

Frequent rail services operate between Camberley and London Waterloo with a journey time of approximately 1 hour and 10 minutes. The nearest major airport to Camberley is London Heathrow which is 23 miles (37 km) from the centre of Camberley.

Situation

The property is situated in the town centre on the east side of the High Street which forms part of the prime retail offer in Camberley. Nearby occupiers include Santander, Barclays, WH Smith and McDonalds. As well as the High Street, The Mall Shopping Centre, Park Street and The Atrium Camberley provide a variety of independent and national retailers which include, Primark, Boots, Sainsbury’s, TK Maxx and H&M.

The Atrium, Camberley was developed in 2008 and brought over 230 residential units to the town centre; a strong entertainment offer - 9 screen cinema, bowling, restaurants, adult and a children’s gym, a soft play centre and a ballet school as well as retail which includes Next, H&M, Pandora, Sports Direct and Lidl.

Description

The property comprises an end of terrace ground floor retail unit. Internally, the retail floor area has been fitted out by the tenant to an exceptionally high standard.

Part of the ground floor, first and second floors and the surface of the flat roof do not form part of the sale and are being converted by the Vendor to residential use in line with approved planning permission, although works have not yet commenced on site. Plans of the scheme can be viewed here.

If a purchaser is interested in acquiring the upper parts and pursuing the residential conversion then the Vendor is willing to consider a separate offer for the residential element of the property.

Accommodation

The property has been measured by BKR Floor Plans and provides the following Net Internal floor areas:

| Net Frontage | 8.10 m | 26’7” |

| Gross Frontage | 9.07 m | 29’9” |

| Zone A | 50.26 sq m | 541 sq ft |

| Zone B | 49.79 sq m | 536 sq ft |

| Zone C | 35.39 sq m | 381 sq ft |

| Remainder | 42.46 sq m | 457 sq ft |

| ITZA | 961 | |

| Total Ground Floor | 177.90 sq m | 1,915 sq ft |

| Total | 177.90 sq m | 1,915 sq ft |

A set of floor plans is available to download and the measured survey report will be re-addressed to a purchaser at a cost of £345 + VAT.

Tenure

Freehold.

Part of the ground floor, first and second floors and the surface of the flat roof and airspace above will be let on a new 999 year lease from completion at a peppercorn rent. A copy of the draft headlease and lease plan is available to download in the data room.

Tenancy

The ground floor is let to Bayfield Z Limited (trading as Bayfields Opticians), with a guarantee from Bayfields Audiology Limited, on an effective repairing and insuring lease [The landlord insures and recovers a reasonable proportion from the tenant. The tenant pays a reasonable proportion of the costs of repair and maintenance of “Common Items”]. The term is 10 years from 18th January 2016, expiring on 17th January 2026.

The current passing rent is £37,500 per annum which, based on our analysis, equates to a Zone A rate of £39.00 per sq ft.

A tenant’s break option in January 2021 was removed as part of an agreement with the tenant to reduce the rent to £18,750 per annum for a period of 12 months from May 2020.

All rent is paid and up to date, with no arrears.

The upper floors are to be let for a term of 999 years from completion at a peppercorn rent.

Covenant

Bayfields Z Limited (Co. No. 09446782), has reported the following figures;

| 31st December 2019 | 31st December 2018 | |

|---|---|---|

| Revenue | £7,503,580 | £6,685,389 |

| Pre-Tax Profits | £225,665 | (£52,981) |

| Net Assets | £3,385,819 | £3,254,018 |

Incorporated in 2015, Bayfields Z Limited trade as Bayfields Opticians and Audiologists and operate from 24 stores across the UK including, Northcote Road, London, Woking, Royal Leamington Spa, Guildford and Harrogate. www.bayfieldsopticians.com.

Bayfields Z Limited stores remained open during the recent lockdown periods to see clients for emergency and essential appointments. This allowed the company to receive a level of NHS eye test income, plus the company did benefit from its healthy level of contact lens direct debit income. Since the return to routine eye and hearing care appointments during June 2020, they are able to see less clients per clinic albeit the conversion rates for these clients have increased and revenues and profitability to date have returned to pre-lockdown levels. The latest financial accounts state that there has been no significant evidence of Covid-19 impacting the business to date. Impacts on the company’s supply chain resulting from Covid-19 are not expected to be significant and the company is well placed to manage the risks associated with, and detrimental impact of Covid-19. The group’s balance sheet was significantly strengthened with an investment from BGF in March 2020.

VAT

The property has been registered for VAT. It is anticipated that the sale of this property will be treated as a Transfer of a Going Concern (TOGC).

Proposal

We are instructed to seek a figure of £478,000 (Four Hundred and Seventy Eight Thousand Pounds), subject to contract, reflecting a net initial yield of 7.5%, assuming standard purchaser’s costs of 4.60%.

Please note that a purchaser will be re-charged the costs of the measured survey (£345 + VAT) and searches (£755.94) which are provided in the data room.

Please note that a purchaser will be charged a Transaction Fee of 1.00% plus VAT of the final agreed sale price.

If a purchaser is interested in acquiring the upper parts and pursuing the residential conversion then the Vendor is willing to consider a separate offer for the residential element of the property.

Investment Considerations

-

An opportunity to acquire a prominent investment in a highly affluent South-East commuter town;

-

The property occupies an excellent retailing pitch between one of the main car parks in the town and the prime retail provision of Camberley;

-

The unit has been fitted out to a very high standard by the tenant;

-

Freehold;

-

A purchase at the asking price reflects an attractive net initial yield;

-

Attractive lot size to an investor.

Data Room and clicktopurchase®

Access to the data room and for the ability to purchase online with speed and ease, please click the clicktopurchase® “C” icon or the clicktopurchase® side bar. Purchasers will be able to access the complete legal package, clear verification and submit legally-binding offers to acquire the property.

Purchasers benefit from the trust, security and transparency provided by the platform. All activities, including the online contract execution, will form part of the electronic audit trail which is anchored in the clicktopurchase® Blockchain.

clicktopurchase® provides the opportunity for any investor, whether located UK or abroad, to uniquely purchase online with ease and certainty. To learn more about clicktopurchase®, click here.

DOWNLOADS

BROCHURE

Contact Us

| Singer Vielle | +44 (0) 207 935 7200 | |

|---|---|---|

| Dale Henry | dale@singervielle.co.uk | +44 (0) 203 701 1356 |

| Daniel Elia | daniel@singervielle.co.uk | +44 (0) 203 701 1353 |

| Neil Singer | neil@singervielle.co.uk | +44 (0) 203 478 9120 |

Vendors Solicitor

| Gunnercooke | +44 (0) 3330 143 401 |

|---|---|

| Jonathan Wilkinson | jonathan.wilkinson@gunnercooke.com |

| Simon Davies | simon.davies@gunnercooke.com |