Highly Secure Retail Investment let to EE

61 Deansgate | Bolton | BL1 1DT

£715,000

subject to contract

GALLERY

Summary

-

Let to EE Limited

-

Highly secure income - Shareholders’ Funds £6.070 billion

-

Return frontage in a prime retailing pitch

-

The only EE store in Bolton

-

Tenant did not exercise November 2020 break clause

-

Re-purposing potential on the upper parts; an apportioned purchase value at only £37.29 per sq ft (£401 per sq m)

-

Freehold

-

£715,000, subject to contract

-

8% Net Initial Yield

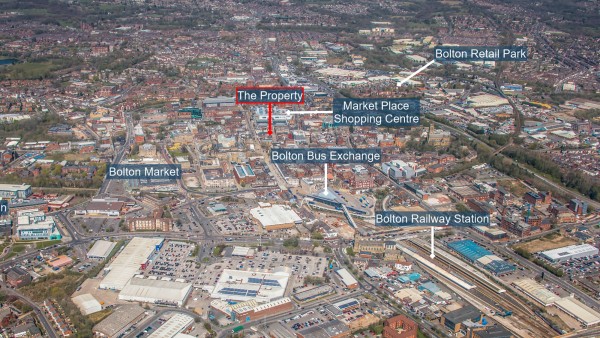

Location

Bolton is a major regional centre in the North West of England within the Greater Manchester conurbation. The town is approximately 12 miles (19.3 km) to the north west of Manchester city centre, 19 miles (30.5 km) north east of Warrington and 21 miles (33.8 km) south east of Preston.

The town benefits from excellent road communications and is situated between the M61 to the west, M66 to the east and M65 to the north (via the A666). The M61 ad M66 in turn provide access to Junctions 14 and 18 to the M60 motorway.

There is a regular and direct rail service between Bolton and Manchester Victoria with an approximate journey time of 25 minutes. London Euston can be accessed via Wigan or Manchester Piccadilly with a fastest journey time of approximately 2 hours and 30 minutes.

Manchester International Airport is approximately 21 miles (33.8 km) to the south east.

Bolton is a large sub-regional retailing centre with a primary catchment of approximately 660,000 people and a shopping population of approximately 235,000 (Source: www.bolton.gov.uk). The University of Bolton has approximately 6,000 students (Source: www.bolton.ac.uk).

Retail in Bolton is focused around the axis formed by Deansgate, Knowsley Street, Newport Street and Churchgate, a large proportion of which is pedestrianised. Deansgate, Oxford Street, Newport Street, Market Place and Market Street are the busiest parades in the town.

A £1.2bn regeneration programme comprising of large and small scale investment initiatives is on course to be completed by 2030. The regeneration programme will provide approximately 1,700 homes and 4,400 full time equivalent jobs, injecting a projected £487.5m of gross value added additional economic activity to the town. Listed below are some of the larger scale initiatives:

A £35m development by Forshaw Land & Property Group for 258 one and two-bed apartments and four, three-storey town houses at Pool Street and Bark Street. Plus a £30m development from Manchester-based private rental specialist developer Placefirst to create Bolton’s first build-to-rent (BtR) urban village around Central Street. Placefirst also proposes up to 15,000 sq.ft (1,394 sq.m) of Grade A office space and ground floor commercial units along Deansgate.

International property investment, development and construction company Beijing Construction Engineering Group International (BCEGI) has partnered with real estate investment and development specialist Midia to form a joint venture called Bolton Regeneration Limited (BRL). They will bring forward a circa £250m redevelopment of Crompton Place shopping centre and the surrounding area while opening up the area to provide pedestrian links to Bradshawgate. Having recently secured planning permission, the project offers 170,000 sq.ft (15,794 sq.m) of office space, 150 homes, a 110-bedroom hotel and retail, leisure, dining and events space.

Muse Developments plans a £150m riverside neighbourhood, featuring 352 new homes including townhouses and apartments, up to 80,729 sq.ft. (7,500 sq.m) of office space plus retail, professional services and community facilities and potential for an 80-bedroom hotel and 176 parking spaces.

A £40m scheme by Midia to provide a 20-storey tower of 144 rental apartments, 500 space multi-storey car park, a 38,736 sq.ft (3,600 sq.m) office block and 15,000 sq ft of public realm next to Bolton’s £48m transport interchange.

A super connected ‘digital city’ will be created to place Bolton at the centre of the digital economy. The development will take place on a 7.3-hectare (18 acres) site around the Blackhorse Street area, adjacent to Bolton’s central railway station, and will be delivered via a joint venture with a private developer.

Development specialist Midia has secured permission for a £33m scheme to convert the Grade Two-listed former magistrates court on Le Mans Crescent into a boutique, 87-bedroom hotel and 17 serviced apartments.

A large £300 million development with the University of Bolton at its core.

Bolton Council is progressing multi-million pound bids to the Government’s Future High Street Fund and Towns Fund, contributing a potential £75m to regeneration projects across the borough.

Bolton’s £48m interchange has recently opened which replaces the bus station on Moor Lane.

Situation

The property occupies a prime position in the heart of the town centre with a return frontage onto the pedestrianised section of Deansgate and Market Street. This is the only EE store in Bolton with the closest other stores being in Middleborough and Bury.

The property sits at the end of a parade of mobile phone retailers all directly adjacent to one another, including Vodafone, Three and Carphone Warehouse.

Other businesses in the immediate vicinity include Café Nero, Greggs, McDonald’s, Nationwide, RBS, Superdrug, Sally, Wilko and a large Marks & Spencer department store.

The property is 150 metres from the newly refurbished Market Place Shopping Centre which is occupied by a wide range of businesses including Pandora, Boots, The Body Shop, Hotel Chocolate, Zara, River Island, JD Sports, Nando’s, Prezzo and The Light Cinema.

Deansgate and Market Place are the primary access routes to Market Place Shopping Centre from the bus and train stations resulting in a high footfall directly outside the property.

Description

The property comprises a three-storey retail unit with a return frontage. The ground floor provides sales space with office and storage space on the first and second floors. There is ancillary accommodation in the basement.

The upper floors of the property are accessed via a staircase to the rear of the sales area, which at one time had an independent access point from Market Street.

There is currently a customer access point via recessed automatic glass doors at the corner of the Property. The unit has extensive full height glazed frontages to both Deansgate and Market Street.

The retail floor area has been fitted out by the tenant to their usual corporate style.

Accommodation

The property has been measured by BKR Floor Plans and provides the following Net Internal floor areas:

| Net Frontage | 9.14 m | 30” |

| Gross Frontage | 9.91 m | 32’6” |

| Zone A | 60.57 sq m | 652 sq ft |

| Zone B | 66.33 sq m | 714 sq ft |

| Zone C | 2.23 sq m | 24 sq ft |

| Ground Floor ITZA | 1,015 units | |

| Total Ground Floor | 129.13 sq m | 1,390 sq ft |

| First Floor | 106.65 sq m | 1,148 sq ft |

| Second Floor | 134.98 sq m | 1,453 sq ft |

| Basement | 135.73 sq m | 1,461 sq ft |

| Total | 506.49 sq m | 5,452 sq ft |

A set of floor plans is available to download and the measured survey report will be re-addressed to a purchaser at a cost of £375 + VAT.

Tenure

Freehold.

Tenancy

The entire property is let to EE Limited on a full repairing and insuring lease for a term of 10 years from 2nd November 2015, expiring on 1st November 2025.

The lease incorporated a tenant break option on 2nd November 2020. However, in April 2020, it was agreed to remove the break option in exchange for a rent concession for 12 months at 50% of the contracted rent; the rent concession expired 1st May 2021. We suggest this demonstrates the tenant’s commitment to the location and property.

The current passing rent is £60,000 per annum which, based on our analysis, equates to a Zone A rate of £59 per sq ft. It is agreed that the tenant pay’s rent monthly.

There are no rent arrears.

Covenant

EE Limited (Co. No. 02382161), has reported the following figures:

| 31st March 2021 | 31st March 2020 | 31st March 2019 | |

|---|---|---|---|

| Revenue | £6.971 billion | £7.264 billion | £7.149 billion |

| Pre-Tax Profits | £1.381 billion | £1.643 billion | £1.440 billion |

| Shareholders’ Funds | £7.057 billion | £6.070 billion | £5.191 billion |

EE was acquired by BT Group Plc in January 2016 and is the largest and most advanced digital communications company in Britain, delivering mobile and fixed communication services. EE has approximately 553 retail stores, and services more than 31 million connections across its mobile, fixed and wholesale networks. For further information, please visit www.ee.co.uk.

Payment History

The tenant has an excellent rent payment history which can be found in the data room. There are no rent arrears.

Asset Management

The upper parts are demised to the tenant but are not being fully utilised.

We assess the passing rent attributable to the self-contained upper parts at approximately £8,000 per annum. Based upon the asking yield of 8% in relation to an apportioned rent for the retail of £52,000, this allocates a purchase price to this area of the property at only £88,000 which equates to only £37.30 per sq.ft (£401 per sq.m). In comparison, the average sale value for flats in Bolton is £148,000 and £157 per sq.ft (£1,689 per sq.m) (Source: www.zoopla.co.uk).

Subject to consents, it is suggested that the upper floors could potentially provide for residential accommodation with exit values significantly in excess of the apportioned purchase price for this element of the property.

In March 2013, 17-21 Oxford St was granted planning permission to convert the upper floors into nine one-bed flats. This development has now been completed. Planning reference number: 89160/12.

In October 2019, 4-6 Oxford Street obtained permitted development to change the use of the first and second floors into two flats. Planning reference number: 07044/19.

Alternatively, should the upper parts be refurbished, we believe the office space would achieve a rental in the region of £7 per square foot (£75.32 per sq.m) totalling an ERV of £18,207.

The property is not listed.

Recent Comparable

The guide price offers a discount compared to a recently completed transaction, sold by Singer Vielle on Deansgate. In October 2021, the freehold interest in 73 Deansgate was sold for £1,494,000. The property is let to Nationwide at a passing rent of £130,000 per annum which reflects a Zone A rate of £80 per square foot. This sale price reflects a net initial yield of 8.20% and a capital value of £138.55 per square foot.

61 Deansgate (the subject property), is for sale at a price of £715,000. The passing rent is £60,000 which reflects a Zone A rate of £59 per square foot. The price reflects a net initial yield of 8% and a capital value of £131 per square foot.

VAT

The property is elected for VAT. We anticipate that the sale should be capable of being treated as a Transfer of Going Concern (TOGC).

Proposal

We are instructed to seek a figure of £715,000 (Seven Hundred and Fifteen Thousand Pounds), subject to contract, reflecting a net initial yield of 8%, assuming standard purchaser’s costs of 5.33%.

Please note that a purchaser will be re-charged the costs of surveys and searches, which are provided in the data room, totalling £1,321.65.

Please note that a purchaser will be charged a Transaction Fee of £5,000 plus VAT.

Investment Considerations

-

The property occupies a prime position in the city centre with a return frontage;

-

The tenant break option for November 2020 was removed, indicating their commitment to the property;

-

Securely let to EE Ltd (Pre-Tax Profit £1.643 billion);

-

The only EE store in Bolton;

-

Freehold;

-

A purchase at the asking price reflects an attractive net initial yield;

-

Attractive lot size to an investor.

Data Room and clicktopurchase®

Access to the data room and for the ability to purchase online with speed and ease, please click the clicktopurchase® “C” icon or the clicktopurchase® side bar. Purchasers will be able to access the complete legal package, clear verification and submit legally-binding offers to acquire the property.

Purchasers benefit from the trust, security and transparency provided by the platform. All activities, including the online contract execution, will form part of the electronic audit trail which is anchored in the clicktopurchase® Blockchain.

clicktopurchase® provides the opportunity for any investor, whether located UK or abroad, to uniquely purchase online with ease and certainty. To learn more about clicktopurchase®, click here.

DOWNLOADS

BROCHURE

Contact Us

| Singer Vielle | +44 (0) 207 935 7200 | |

|---|---|---|

| Daniel Elia | daniel@singervielle.co.uk | +44 (0) 203 701 1353 |

| Dale Henry | dale@singervielle.co.uk | +44 (0) 203 701 1356 |

| Neil Singer | neil@singervielle.co.uk | +44 (0) 203 478 9120 |

Vendors Solicitor

| Gunnercooke | +44 (0) 333 014 3401 |

|---|---|

| Simon Davies | simon.davies@gunnercooke.com |

| Jonathan Wilkson | jonathan.wilkinson@gunnercooke.com |