Well Secured, Long Dated Income Investment

10-13 Cardiff Street | Aberdare | CF44 7DP

£1,140,000

subject to contract

GALLERY

Summary

-

Freehold town centre retail investment

-

Let to Wilko Retail Ltd

-

Highly Secure Income (D&B Rating 5A1, Net Assets £110m)

-

9 years unexpired lease term

-

Very low passing rent equating to only £2.87 per sq ft

-

Long term redevelopment potential, subject to planning

-

£1,140,000, subject to contract

-

8.3% Net Initial Yield

-

14.4% Suggested Reversionary Yield

-

Low capital value of £32.81 per sq ft

Location

Aberdare is located in South Wales, approximately 9.6 km (6 miles) south-west of Merthyr Tydfil, 48 km (30 miles) north-west of Cardiff and 45 km (28 miles) north-east of Swansea.

The town benefits from good road communications with the A470 providing direct access to Junction 32 of the M4 Motorway approximately 31 km (19 miles) to the south. The town is also connected to the national railway network with a journey time to Cardiff of one hour. Cardiff Airport is situated approximately 48 km (30 miles) to the south.

Situation

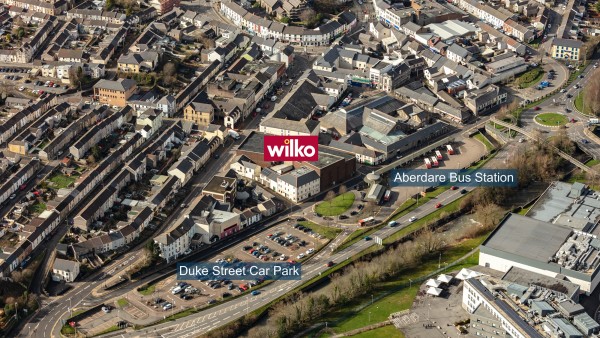

The property occupies a prominent position on Cardiff Street, within the heart of Aberdare town centre. Nearby occupiers include Argos, Peacocks, New Look and Nationwide.

Aberdare Bus Station and the Duke Street Public Car Park are immediately to the rear of the subject property. Aberdare Railway Station is approximately 0.4 km (0.25 miles) to the north-east.

The property also benefits from being in close proximity to a recently completed £1 million residential scheme comprising 12 apartments on the site of a former hotel, The Boot.

Description

The property provides retail use on ground floor together with storage and ancillary accommodation on basement, first and second floor. The property benefits from two goods lifts and a side loading bay accessed via Station Street. The unit has been fitted out by the tenant to their usual corporate style.

In addition to a prominent glazed frontage to Cardiff Street, the property also has a return frontage to Station Street which connects Cardiff Street with Aberdare Bus Station to the rear. Therefore, the property benefits from a strong pedestrian flow.

Accommodation

The property provides the following measured Gross Internal Areas:

| Ground Floor | Retail | 1,464 sq m | 15,758 sq ft |

| Basement | Storage | 49 sq m | 527 sq ft |

| First Floor | Storage/Void | 1,468 sq m | 15,801 sq ft |

| Second Floor | Plant Room | 247 sq m | 2,658 sq ft |

| Total | 3,228 sq m | 34,744 sq ft |

A set of floor plans is available to download.

Tenure

Freehold.

Tenancy

The property is entirely let to Wilko Retail Limited for a term of 15 years from 5th March 2014, expiring on 4th March 2029 (9 years unexpired lease term). The lease is Full Repairing and Insuring, subject to a Schedule of Condition.

The current passing rent is £99,661 per annum which equates to a very low rate of only £30.87 per sq m / £2.87 per sq ft. There are no rent reviews during the term of the lease, for reasons explained in the Rental Value section below.

The tenant has an option to renew their lease at any time between 1st January 2020 and 4th September 2028 for a further 10 years from 5th March 2029, subject to a break option on 4th March 2034. The renewed lease it to be at open market value, with a day 1 rent review and a rent review at the 5th year.

Rental Value

In 2014 one half of the Wilkinson family sold their 50% share of the Wilko Company to the other half of the family. The sale of the stake was conducted through a demerger of a group company with £39.5 million in cash and a number of freehold properties occupied by Wilko store. Due to the fact that it was a family de-merger, the rents (including the subject property) were agreed at a very favourable level to Wilko. As a result, the leases were agreed for a term of 15 years, without any rent reviews.

The passing rent for the subject property equates to only £2.87 per sq ft which is a significant discount to other Wilko stores in Wales:

| Address | Area | Passing Rent | Rent Per Sq Ft |

|---|---|---|---|

| 12/13 Newmarket Walk, Merthyr Tydfil | 15,000 sq ft | £130,000pa | £8.66 |

| Unit 9, Cibi Walk, Abergavenny | 24,667 sq ft | £207,500pa | £8.41 |

| Crane Street, Pontypool | 18,515 sq ft | £115,000pa | £6.21 |

Adopting a conservative rate of £5.00 per sq ft, the property has an estimated rental value of £173,720 per annum.

Covenant

For the year ending 2nd February 2019, Wilko Retail Limited (Co. No. 00365335, formerly Wilkinson Hardware Stores Limited) reported the following figures;

| Revenue | £1,508,690,000 |

| Pre-Tax Profit | £25,049,000 |

| Net Assets | £109,922,000 |

The company is debt free with the accounts stating ‘nil drawn banking facilities’.

Wilko is a family owned private limited company which has been trading for over 85 years. Established from a single shop in Leicester in 1930, today the company trades from more than 400 stores throughout the United Kingdom. In 2013 the company changed its name from Wilkinson to Wilko and according to its website 6 out of 10 shoppers in the United Kingdom shop with Wilko.

Wilko has an extensive range of own brand products including health & beauty, housewares, kitchenware, DIY, stationery, pet care products, gardening and toys. 2019 reflected a strong year for Wilko brand products, with own brand participation increasing from 52.7% in 2018 to 54.5% in 2019.

Wilko Retail Limited has a D&B Rating of 5A1 (as of 21st November 2019).

For further information visit www.wilko.com.

VAT

The property has been registered for VAT. It is anticipated that the sale will be treated as a Transfer of a Going Concern (TOGC).

Proposal

We are instructed to seek a figure of £1,140,000 (One Million, One Hundred and Forty Thousand Pounds), subject to contract, reflecting a net initial yield of 8.3%, a suggested reversionary yield of 14.4% and a low capital value of £32.81 per sq ft, assuming purchaser’s costs of 5.88%.

Please note that a purchaser will be re-charged the costs of the searches which are provided in the data room.

Please note a purchaser will be charged a Transaction Fee of £2,500 + VAT.

Investment Considerations

-

An opportunity to acquire a freehold retail investment;

-

The property occupies a prominent position within the town centre;

-

The investment provides highly secure income, being let to Wilko Retail Limited (D&B Rating 5A1, Net Assets £110 million);

-

Attractive unexpired lease term of 9 years;

-

The property is let off a very low passing rent of only £2.87 per sq ft;

-

The property may offer long term redevelopment potential, subject to planning;

-

A purchase at the asking price reflects an attractive net initial yield with a significant future reversion.

-

A purchase at the asking price reflects a low capital value of £32.81 per sq ft.

Data Room and clicktopurchase®

Access to the data room and for the ability to purchase online with speed and ease, please click the clicktopurchase® “C” icon or the clicktopurchase® side bar. Purchasers will be able to access the complete legal package, clear verification and submit legally-binding offers to acquire the property.

Purchasers benefit from the trust, security and transparency provided by the platform. All activities, including the online contract execution, will form part of the electronic audit trail which is anchored in the clicktopurchase® Blockchain.

clicktopurchase® provides the opportunity for any investor, whether located UK or abroad, to uniquely purchase online with ease and certainty. To learn more about clicktopurchase®, click here.

Finance

We have partnered with a leading finance adviser to provide loan services. To learn more, please visit our “Finance” section.

DOWNLOADS

BROCHURE

Contact Us

| Singer Vielle | +44 (0) 207 935 7200 | |

|---|---|---|

| Dale Henry | dale@singervielle.co.uk | +44 (0) 203 701 1356 |

| Neil Singer | neil@singervielle.co.uk | +44 (0) 203 478 9120 |

Vendors Solicitor

| Irwin Mitchell LLP | +44 (0) 207 400 8715 | |

|---|---|---|

| Simon Tager | Simon.Tager@IrwinMitchell.com | |