Office Investment / Add-Value Opportunity on behalf of Administrators

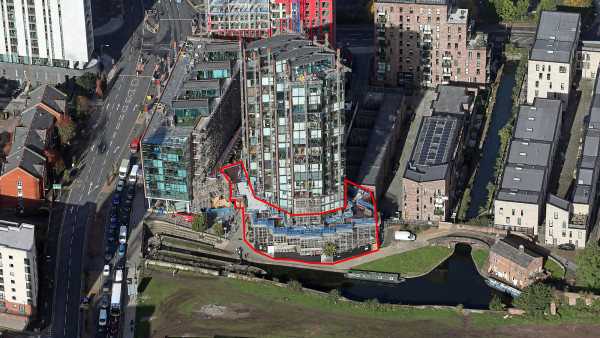

Unit 7 | 157 Great Ancoats Street | Manchester | M4 6DH

£900,000

subject to contract

GALLERY

Blockchain

Track all marketing and execution activity for this property in the clicktopurchase Blockchain – only available at the Singer Vielle Network.

Q: Why is this so important?

A: The ultimate in trust, accountability and transparency from the commencement of marketing to conclusion of a sale.

Summary

-

On behalf of Administrators, acting as agent without personal liability

-

Discounted Capital Value at £86.50 per sq ft / £903 per sq m

-

Located within a desirable commercial and residential location

-

Occupied by Morgan Sindall Construction and Infrastructure Ltd (Pre Tax Profits £49.6m) who are seeking to enter into a formal short-term tenancy

-

Asset management potential via refurbishment

-

Repurposing potential, subject to planning permission

-

Property sits below a residential tower comprising approximately 50 flats

-

Offers in the region of £900,000, subject to contract

Location

The property is located on Great Ancoats Street, fronting the Canal Path and within the New Islington locality. The location is a near centre suburb of Manchester, just 0.7 mile (1.1 km) to the south east of Manchester City Centre.

The suburb is bound by Ancoats to its north, Ardwick to the south and borders onto areas of Piccadilly Basin, Chinatown and Bradford conurbations.

The A665 is the primary route running through the suburb, running in a north-south direction linking to Oldham Road (A62) to the north and A635 to the south.

Manchester Airport is located 9.8 miles (15.7 km) to the south.

The suburb benefits from strong communication links being situated on the Manchester Metro Light Rail Network as well as being a short walking distance from the ‘regional hub’ railway stations provided by Manchester, to include Piccadilly and Victoria, providing services that connect to local, regional and national destinations.

Manchester is the second largest city in the United Kingdom after London.

Situation

The property is situated within a mixed commercial and residential area much of which has experienced a high degree of development in recent years.

Nearby developments include the new luxury development Oxygen Tower, a new build hotel complex named ‘Citadale’ and a Travelodge hotel.

The property benefits from being located close to various major arterial routes, bus routes and train station.

There are various shops and restaurants nearby and Central Retail Park is moments from the property.

The locality has excellent communications being served by a number of the city’s major arterial roads and also within close proximity to major motorway routes just 4.6 miles (7.4 km) from the property.

Description

The property comprises a two storey commercial premises arranged over ground and first floors, sitting beneath a large residential development consisting of approximately 50 residential units. The ground floor has been extended to the west and east flanks with steel and glass constructed facades.

The ground floor consists of a reception area, open plan office accommodation, staff kitchen, WCs and showers. The first floor consists of open plan accommodation, WCs and showers.

Fenestration throughout the building is by way of either metal frame double glazed windows as part of the overall construction of portions of the building or UPVC double glazed windows

Accommodation

The property has been measured by BKR Floor Plans and provides the following Gross Internal floor areas.

| Sq.Ft | Sq.M | |

|---|---|---|

| Ground Floor | 5,478 | 508.89 |

| First Floor | 4,927 | 457.75 |

| Total | 10,405 | 996.64 |

A set of floor plans is available to download and the measured survey report will be re-addressed to a purchaser at a cost of £495 + VAT.

Tenure

The property is held by CPSPV58 Limited under a 250-year lease from 8th March 2006 at a peppercorn rental.

Therefore, there are over 233 years unexpired.

The lease is subject to an annual service charge of £5,558.76.

Tenancy

Morgan Sindall Construction & Infrastructure Limited occupy the entire property by way of a tenancy at will and are paying a rent of £96,000 per annum. They are currently using the property as a site office whilst they fulfil their contract in repairing the cladding on the residential tower.

Covenant

Morgan Sindall Construction & Infrastructure Limited (Co. No. 04273754) has reported the following figures:

| Year Ending | 31st December 2021 | 31st December 2020 |

|---|---|---|

| Revenue | £1,416,470,000 | £1,533,146,000 |

| Pre-Tax Profits | £49,652,000 | £28,246,000 |

| Net Assets | £301,811,000 | £280,279,000 |

Morgan Sindall Construction & Infrastructure Limited is a UK construction and infrastructure business with a network of local offices. The Company works for private and public sector companies on projects and frameworks from £50,000 to over £1 billion. Activities range from small works and repair and maintenance to the design and delivery of complex construction and engineering projects. The Company also operates across the commercial, defence, education, emergency and custodial, energy, healthcare, industrial, leisure and community, nuclear, retail, science and technology, transport and water sectors.

The Company is part of the Morgan Sindall Group plc (Co. No. 00521970) which has reported the following figures:

| Year Ending | 31st December 2021 | 31st December 2020 |

| Revenue | £3,212.8 million | £3,034.0 million |

| Pre-Tax Profits | £126.2 million | £60.8 million |

| Net Assets | £474.2 million | £420.1 million |

Morgan Sindall is listed on the London Stock Exchange and is a constituent of the FTSE 250 Index. It is a group of specialist businesses, delivering construction and regeneration across the UK for the public, commercial and regulated sectors. The group employs approximately 6,900 people and operates through five divisions; Construction & Infrastructure, Fit Out, Property Services, Partnership Housing and Urban Regeneration.

2021 was a record year for Morgan Sindall, delivering a record set of results 42% above the Group’s last peak in 2019. The Group continued to win work throughout 2021; secured workload at the year end was £8,614m, up 4% on the prior year. Over 46% of this workload is secured for 2024 onwards. Adjusted operating profit increased by 92% to £131.2m (2020: £68.5m)

Office Sales and Letting Evidence

| Sale Evidence | ||||

|---|---|---|---|---|

| Address | Date | Price | Price psf | NIY |

| Giants Basin, M3 | 10/12//2021 | £2,600,000 | £252 | 6.25% |

| Calrence House, M2 | 01/12/2021 | £6,700,000 | £337 | 6.15% |

| Unit 4 Ball Green | 25/03/2021 | £750,000 | £187 | NA |

| 1 Adbaston Road | 15/06/2021 | £900,000 | £213 | NA |

| Letting Evidence | ||||

|---|---|---|---|---|

| Address | Date | Lease Term | Rent PA | Rent psf |

| 46-58 Copperas Street, M4 | 27/01/2022 | 5 years | £23,400 | £16.51 |

| 15 Swan Street, M4 | 21/07/2021 | 5 years | £29,196 | £18.80 |

| Basil Chambers, M4 | 24/05/2021 | 5 years | £12,500 | £15.49 |

| Express Building, M4 | 30/07/2020 | 5 years | £240,000 | £20 |

VAT

VAT is payable on the purchase price.

Proposal

We are instructed to seek offers in the region of £900,000 (Nine Hundred Thousand Pounds), subject to contract.

This price reflects an overall capital value of £86.50 per sq ft / £903 per sq m. It is suggested that the property could command a rent in the order of £156,000 per annum (£15 per sq ft / £156.5 per sq m), reflecting a potential gross yield of 12.5%.

Investment Considerations

-

Low capital value;

-

Opportunity to purchase a commercial property within a desirable location in Manchester;

-

Potential to add value via refurbishment or repositioning;

-

Excellent transport links,

-

Regeneration area;

-

Ability to enter into a new lease with Morgan Sindall Construction and Infrastructure Ltd (Net Assets £301m) subject to negotiation;

-

Potential to generate attractive yield;

-

Attractive lot size for an investor;

Disclaimer

-

The attention is drawn to the fact that access to all areas of the property may not be possible prior to completion

-

Replies to standard enquiries will not be provided as part of the conveyancing process

-

The property will be sold as seen. No express or implied warranties or representations are given.

-

Any prospective owner must be prepared to undertake robust asset management initiatives to regularise the basis upon which any commercial and residential occupants remain in situ.

-

The guide price has been set realistically to reflect significant opportunities to build a sustainable income stream and enhance value

Data Room and clicktopurchase®

Access to the data room and for the ability to purchase online with speed and ease, please click the clicktopurchase® “C” icon or the clicktopurchase® side bar. Purchasers will be able to access the complete legal package, clear verification and submit legally-binding offers to acquire the property.

Purchasers benefit from the trust, security and transparency provided by the platform. All activities, including the online contract execution, will form part of the electronic audit trail which is anchored in the clicktopurchase® Blockchain.

clicktopurchase® provides the opportunity for any investor, whether located UK or abroad, to uniquely purchase online with ease and certainty. To learn more about clicktopurchase®, click here.

DOWNLOADS

BROCHURE

Contact Us

| Singer Vielle | +44 (0) 207 935 7200 | |

|---|---|---|

| Daniel Elia | daniel@singervielle.co.uk | +44 (0) 203 701 1353 |

| Dale Henry | dale@singervielle.co.uk | +44 (0) 203 701 1356 |

| Neil Singer | neil@singervielle.co.uk | +44 (0) 203 478 9120 |

Vendors Solicitor

| Freeths | +44 (0) 345 404 4154 |

|---|---|

| Ryan Smith | ryan.smith@freeths.co.uk |