Highly Secure Retail Investment

British Heart Foundation | 136 Lothian Road | Edinburgh | EH3 9BQ

£520,000

subject to contract

GALLERY

Summary

-

Edinburgh is the UK’s most prosperous city outside London

-

Prime position in the heart of the City Centre

-

Highly Secure Income - Let to British Heart Foundation

-

Tenant extended their lease in 2018, demonstrating their commitment to the property

-

Heritable Interest (Scottish Equivalent of English Freehold)

-

£520,000, subject to contract

-

7.72% Net Initial Yield

Location

Edinburgh is Scotland’s Capital City and its principal, financial and administrative centre, housing both the Scottish Parliament and the Scottish Government. It is the UK’s most prosperous city outside London (Source: Invest Edinburgh).

The city has a population of 495,000 people and a regional population of over 1.6 million

within the Fife and Scottish Borders catchment area. It is one of the eight UK centres categorised by Property Market Analysis as a major city on the basis of the volume and

quality of its retail offering. It is the most prosperous regional city in the UK and its

workforce is one of the most highly educated.

It is consistently ranked as one of the UK’s most competitive large cities, based on factors such as skills, productivity and qualifications, due, in part, to having four universities with over 60,000 students and producing over 15,000 graduates each year. It also has the second highest gross value added per resident in the UK, with GVA per resident of £38,000 compared to a UK averaged of £20,699.

Edinburgh is one of the most visited tourist destinations in the UK, attracting over 4 million visitors each year. With more overseas visitors than any other UK regional city it boasts the highest hotel occupancy (averaging 83.7%).

Situation

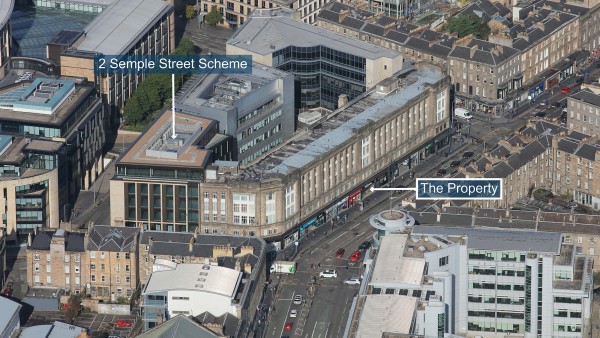

The subjects are situated on the west side of Lothian Road within the section of the street bounded by Morrison Street to the north and Semple Street to the south in the heart of the Edinburgh’s Exchange District.

Lothian Road forms part of one of the main arterial routes into Edinburgh City Centre from the south benefitting from high vehicular and pedestrian footfall. The subjects lie approximately 0.8 km (0.5 miles) to the south of Edinburgh City Centre within a mixed commercial and residential locality. Occupiers in the vicinity include Tesco Express, Boots, Costa, Superdrug, Poundland, Greggs, Odeon Cinema, and Pret a Manger.

In addition, the property is adjacent to 2 Semple Street, a prime, new Grade-A office scheme. The development extends to approximately 40,000 sq ft to comprise of two retail units at ground floor and five upper floors of Grade A office accommodation. The completion of this development will significantly improve the area and undoubtedly increase footfall. Other nearby office occupiers include Blackrock, Standard Life, Lloyds Banking Group, Brewin Dolphin and PwC.

Description

The subject property comprises a well-configured ground floor retail unit with ancillary accommodation at basement level. The property forms part of a steel framed Art Deco building dating back to 1935. The unit has been fitted out by the tenant in their usual corporate style.

Accommodation

The property has been measured by BRK Floor Plans and provides the following Net Internal Areas;

| Net Frontage | 6.55 m | 21’6” |

| Gross Frontage | 7.32 m | 24’0” |

| Zone A | 181.16 sq m | 654 sq ft |

| Zone B | 59.27 sq m | 638 sq ft |

| Zone C | 57.88 sq m | 623 sq ft |

| Remainder | 12.63 sq m | 136 sq ft |

| ITZA | 1,217 | |

| Total Ground Floor Sales | 190.54 sq m | 2,051 sq ft |

| Basement Ancillary | 66.14 sq m | 712 sq ft |

| Total | 256.68 sq m | 2,763 sq ft |

A set of floorplans are available to download and the measured survey report will be assigned to a purchaser at a cost of £250 + VAT.

Tenure

Heritable (Scottish equivalent of English freehold).

Tenancy

The property is let on a renewed lease to British Heart Foundation on a full repairing and insuring basis for a term of 10 years from 28th November 2018, expiring on 27th November 2028 (approximately 8.5 years unexpired lease term).

There is a tenant’s break option on 28th November 2025, subject to six months’ prior written notice. The break option was originally dated 27th November 2023 but in accordance with a Minute of Variation the tenant agreed to move the break date to November 2025, in return for a six month rent free period from 28th May 2020 to 27th November 2020. The vendor will ‘top-up’ the income by an appropriate adjustment on the completion sum in order that a purchaser does not suffer an income shortfall.

The current passing rent is £42,000 per annum which, based on our analysis, equates to £34.50 Zone A. There is an upwards only rent review on 28th November 2023.

British Heart Foundation initially took an Assignation of the lease from Scotmid Co-Op in May 2016 and exercised an option to extend the lease in 2018 following strong trade.

Covenant

For the year ending 31st March 2019, British Heart Foundation (Co. No. 699547) has reported the following figures:

| Net income available for charitable purposes | £120.4 million |

| Total Funds | £56.2 million |

With over 730 shops across the UK, The British Heart Foundation is a registered charity whose vision is a world free from the fear of heart and circulatory disease. The charity raises money to research cures and treatments. For further information visit www.bhf.org.uk.

VAT

The property has been registered for VAT. It is anticipated that the sale will be treated as a Transfer of a Going Concern (TOGC).

Investment Evidence

The adjoining properties have recently been sold:

| Address | Tenant | Term Certain | Price / NIY | Date Sold |

|---|---|---|---|---|

| 132 Lothian Road | Philpotts | 5.25 years | £580,000 / 7.4% | Feb 2020 |

| 134 Lothian Road | Indigo Sun | 8 years | £520,000 / 7.2% | Feb 2020 |

Proposal

We are instructed to seek offers in the region of £520,000 (Five Hundred and Twenty Thousand Pounds), subject to contract, reflecting a net initial yield of 7.72%, assuming purchasers’ costs of 4.59%.

Please note a purchaser will be re-charged the cost of the searches and surveys which are provided in the data room.

Please note a purchaser will be charged a Transaction Fee of 1% of the Sale Price + VAT.

Investment Considerations

-

The property is located in the UK’s most prosperous city outside London;

-

The property occupies a prime prominent position in the heart of the city centre;

-

Highly secure income – let to British Heart Foundation;

-

Attractive unexpired lease term;

-

The tenant extended their lease in 2018, demonstrating their commitment to the property

-

A purchase at the asking price reflects an attractive net initial yield;

-

Attractive lot size for an investor.

DOWNLOADS

BROCHURE

Contact Us

| Singer Vielle | +44 (0) 207 935 7200 | |

|---|---|---|

| Dale Henry | dale@singervielle.co.uk | +44 (0) 203 701 1356 |

| Neil Singer | neil@singervielle.co.uk | +44 (0) 203 478 9120 |

| Graham Waddell | graham@singervielle.co.uk | +44 (0) 141 221 4545 |

Vendors Solicitor

| Morton Fraser LLP | +44 (0) 141 274 1119 | |

|---|---|---|

| David Stewart | David.Stewart@morton-fraser.com | |

| Lorri Pollock | Lorri.Pollock@morton-fraser.com | |

Joint Agent

| Eric Young & Co | ||

|---|---|---|

| Alastair Rowe | arowe@eyco.co.uk | +44 (0) 131 558 5140 |