Well-Secured City Centre Retail Investment

Philpotts | 132 Lothian Road | Edinburgh | EH3 9BQ

£575,000

subject to contract

GALLERY

Summary

-

Edinburgh is the UK’s most prosperous city outside London

-

Prime position in the heart of the City Centre

-

Highly Secure Income – Let to A.F. Blakemore (Net Assets £78.5m)

-

Approximately 13.5 years unexpired lease term (5.5 years term certain)

-

Tenant renewed their lease in 2018, demonstrating their commitment to the property

-

Heritable Interest (Scottish Equivalent of English Freehold)

-

£575,000, subject to contract

-

7.5% Net Initial Yield

Location

Edinburgh is Scotland’s Capital City and its principal, financial and administrative centre, housing both the Scottish Parliament and the Scottish Government. It is the UK’s most prosperous city outside London (Source: Invest Edinburgh).

The city has a population of 495,000 people and a regional population of over 1.6 million within the Fife and Scottish Borders catchment area. It is one of the eight UK centres categorised by Property Market Analysis as a major city on the basis of the volume and quality of its retail offering. It is the most prosperous regional city in the UK and its workforce is one of the most highly educated.

It is consistently ranked as one of the UK’s most competitive large cities, based on factors such as skills, productivity and qualifications, due, in part, to having four universities with over 60,000 students and producing over 15,000 graduates each year. It also has the second highest gross value added per resident in the UK, with GVA per resident of £38,000 compared to a UK averaged of £20,699.

Edinburgh is one of the most visited tourist destinations in the UK, attracting over 4 million visitors each year. With more overseas visitors than any other UK regional city it boasts the highest hotel occupancy (averaging 83.7%).

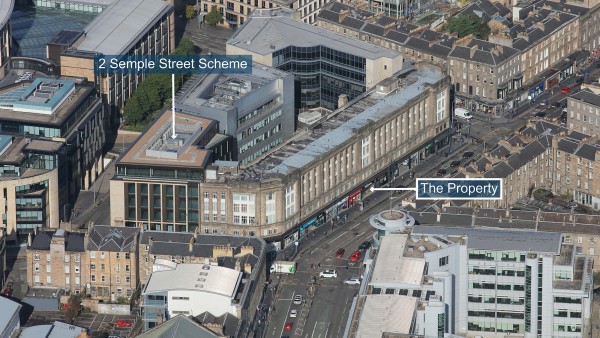

Situation

The subjects are situated on the west side of Lothian Road within the section of the street bounded by Morrison Street to the north and Semple Street to the south in the heart of the Edinburgh’s Exchange District.

Lothian Road forms part of one of the main arterial routes into Edinburgh City Centre from the south benefitting from high vehicular and pedestrian footfall. The subjects lie approximately 0.8 km (0.5 miles) to the south of Edinburgh City Centre within a mixed commercial and residential locality. Occupiers in the vicinity include Tesco Express, Boots, Costa, Superdrug, Poundland, Greggs, Odeon Cinema, and Pret a Manger.

In addition, the property is adjacent to 2 Semple Street, a prime, new Grade-A office scheme. The development extends to approximately 40,000 sq ft to comprise of two retail units at ground floor and five upper floors of Grade A office accommodation. The completion of this development will significantly improve the area and undoubtedly increase footfall. Other nearby office occupiers include Blackrock, Standard Life, Lloyds Banking Group, Brewin Dolphin and PwC.

Description

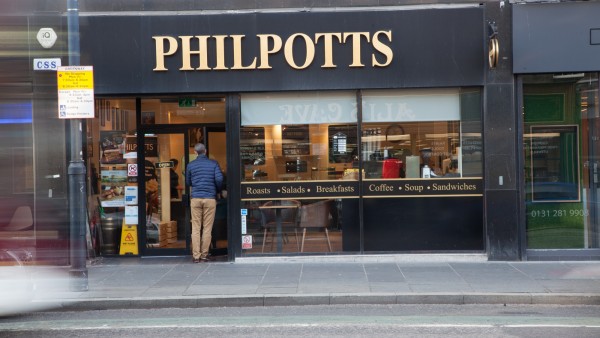

The subject property comprises a well-configured ground floor retail unit with ancillary accommodation over basement and first floor. The property forms part of a steel framed Art Deco building dating back to 1935. The unit has been fitted out by the tenant in their usual corporate style.

Accommodation

The property has been measured by BRK Floor Plans and provides the following Net Internal Areas;

| Net Frontage | 6.02 m | 21’9” |

| Gross Frontage | 6.62 m | 21’9” |

| Zone A | 181.16 sq m | 628 sq ft |

| Zone B | 57.51 sq m | 619 sq ft |

| Zone C | 28.06 sq m | 302 sq ft |

| ITZA | 1,201 | |

| Total Ground Floor Sales | 143.90 sq m | 1,549 sq ft |

| Basement | 42.83 sq m | 461 sq ft |

| First Floor | 131.73 sq m | 1,418 sq ft |

| Total | 318.46 sq m | 3,428 sq ft |

A set of floorplans are available to download and the measured survey report will be assigned to a purchaser at a cost of £250 + VAT.

Tenure

Heritable (Scottish equivalent of English freehold).

Tenancy

The ground floor is let on a renewed lease to A.F. Blakemore and Son Limited (t/a Philpotts) on a full repairing and insuring basis for a term of 15 years from 7th April 2018, expiring on 6th April 2033 (approximately 13.5 years unexpired lease term). There is a tenant’s break option on 7th April 2025, subject to six months’ prior written notice.

The current passing rent is £45,000 per annum which, based on our analysis, equates to £37.50 Zone A. There is an upwards only rent review on 7th April 2023 and 7th April 2028.

The tenant has been in occupation since 2008.

Covenant

Philpotts was established in 1985 and has 22 stores located across the UK, providing a range of hot and cold food and beverages. In February 2019 the company was acquired by A.F. Blakemore and Son Limited.

A.F. Blakemore and Son Limited (Co. No. 00391135) has reported the following figures:

| 30tt April 2019 | 30th April 2018 | |

|---|---|---|

| Turnover | £1,135,638,000 | £1,256,891,000 |

| Pre-Tax Profits | £6,006,000 | (£20,658,000)* |

| Net Assets | £78,505,000 | £74,509,000 |

*Exceptional costs of £25.43 million were responsible for the pre-tax loss in 2018.

The principal activity of the company is the wholesale and retail distribution of grocery products and the operation of grocery based convenience stores.

A.F. Blakemore & Son Ltd is one of the largest family-owned businesses in the UK. Established in 1917 as a counter-service grocery store, the company now employs more than 7,800 people. The business entails retail, wholesale distribution, food service, logistics, specialist foods and shop fitting divisions.

A.F. Blakemore is the largest SPAR operator in the UK, owning 280 SPAR stores and serving more than 960 in total across England and Wales. The company is also a member of the Unitas Wholesale group and a significant supplier to the independent grocery sector across the UK.

For further information visit www.philpotts.co.uk.

VAT

The property has been registered for VAT. It is anticipated that the sale will be treated as a Transfer of a Going Concern (TOGC).

Proposal

We are instructed to seek offers in the region of £575,000 (Five Hundred and Seventy Five Thousand Pounds), subject to contract, reflecting a net initial yield of 7.5%, assuming purchasers’ costs of 4.8%.

Please note a purchaser will be re-charged the cost of the searches and surveys which are provided in the data room.

Please note a purchaser will be charged a Transaction Fee of 1% of the Sale Price + VAT.

Investment Considerations

-

The property is located in the UK’s most prosperous city outside London;

-

The property occupies a prime prominent position in the heart of the city centre;

-

The income is well secured to A.F. Blakemore (Net Assets £78.5 million);

-

Attractive unexpired lease term of approximately 13.5 years;

-

A purchase at the asking price reflects an attractive net initial yield;

-

Attractive lot size for an investor.

Finance

We have partnered with a leading finance adviser to provide loan services. To learn more, please visit our “Finance” section.

DOWNLOADS

BROCHURE

Contact Us

| Singer Vielle | +44 (0) 207 935 7200 | |

|---|---|---|

| Dale Henry | dale@singervielle.co.uk | +44 (0) 203 701 1356 |

| Neil Singer | neil@singervielle.co.uk | +44 (0) 203 478 9120 |

| Graham Waddell | graham@singervielle.co.uk | +44 (0) 141 221 4545 |

Vendors Solicitor

| Morton Fraser LLP | +44 (0) 141 274 1126 | |

|---|---|---|

| Morven Alexander | Morven.Alexander@morton-fraser.com | |

Joint Agent

| Eric Young & Co | ||

|---|---|---|

| Alastair Rowe | arowe@eyco.co.uk | +44 (0) 131 558 5140 |