High Yielding Town Centre Retail Investment

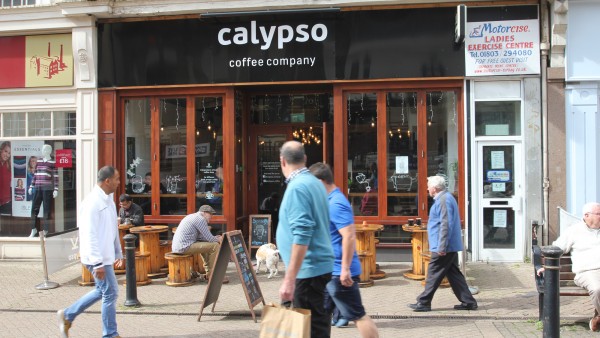

Calypso Coffee | Unit 4 | 45 Fleet Street | Torquay | Devon | TQ2 5DW

£245,000

subject to contract

GALLERY

Summary

-

Popular retail and tourist location

-

Prominent town centre retailing pitch

-

£245,000, subject to contract

-

10% net initial yield

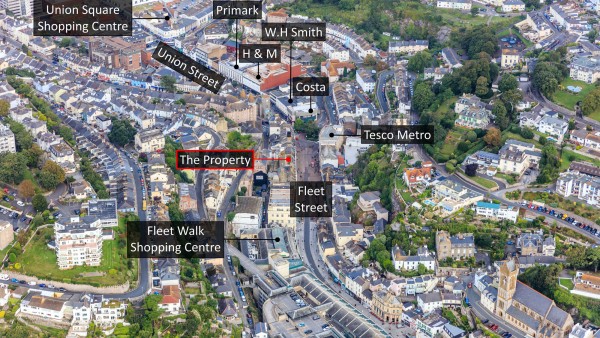

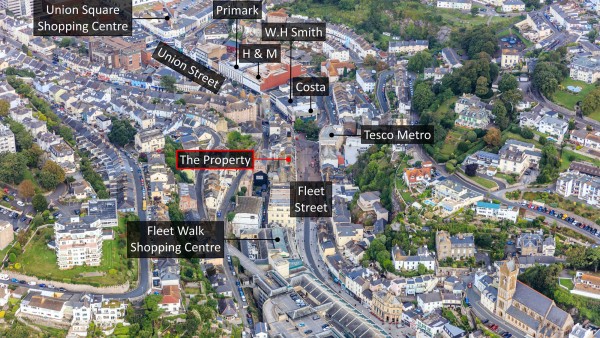

Location

Torquay is a seaside town in Devon located in the district of Torbay, approximately 35 km (22 miles) south of Exeter and 53 km (33 miles) east of Plymouth.

The town benefits from good road communications, being served by the A380 which in turn links with the M5 Motorway approximately 29 km (18 miles) to the north. The town is also connected to the national railway network with a fastest journey time to London Paddington of 2 hours 45 minutes. Exeter Airport is some 42 km (21 miles) to the north-east and serves a number of UK and European destinations.

Torquay forms part of the ‘English Riviera’ and is a popular tourist resort, attracting a large number of visitors each year. Situated on the South Devon Coast, the town is famous for its sandy beaches and family attractions. The population of Torquay is boosted significantly during the summer months.

Situation

The property is located on the western side of Fleet Street, one of the principal pedestrianised shopping streets in the heart of Torquay town centre. Nearby retailers include The Edinburgh Woollen Mill (adjacent), Santander, William Hill, Tesco Metro, Subway and Superdrug.

The Fleet Walk Shopping Centre is immediately to the south. Home to over 50 high street names together with a mix of specialist and independent shops, the centre also benefits from 414 car parking spaces. Retailers include Sportsdirect.com, Bonmarche, Starbucks, Greggs and TK Maxx.

Union Street, the prime retailing pitch for the town, is immediately to the north. Occupiers include Primark, H&M, River Island, WHSmith, JD Sports and Carphone Warehouse.

Description

The property comprises a retail unit arranged over ground floor and basement. Internally, the retail floor area is predominately open plan with ancillary areas and has been fitted out by the tenant to their usual corporate style.

The upper floors, which are self-contained and accessible from Fleet Street, have been sold off on a long lease.

Accommodation

The property has been measured by BKR Floor Plans and provides the following Net Internal floor areas:

| Gross Frontage | 6.68 metres | 21’11” |

| Net Frontage | 6.22 metres | 20’5” |

| Zone A | 33.44 sq m | 360 sq ft |

| Zone B | 23.50 sq m | 253 sq ft |

| ITZA | 487 | |

| Total Ground Floor | 56.95 sq m | 613 sq ft |

| Basement | 73.48 sq m | 791 sq ft |

| Total | 130.43 sq m | 1,404 sq ft |

A set of floor plans is available to download and the measured survey report can be re-addressed to a purchaser.

Planning

The property is located in the Torquay Harbour conservation area.

Tenure

A new 999 year long leasehold interest at a peppercorn rent.

Tenancy

The ground floor and basement is let to Lukasz Jankojc (t/a Calypso Coffee) on a full repairing and insuring lease for a term of 6 years from 26th October 2015, expiring on 25th October 2021. The current passing rent is £25,000 per annum. The lease benefits from an upwards only rent review on 26th October 2018.

The upper floors have been let on a 199 year lease from 26th April 2017 at a peppercorn rent.

Covenant

The property is let to an individual, Mr Lukasz Jankojc, trading as Calypso Coffee.

VAT

The property has been registered for VAT. It is anticipated that the sale will be treated as a Transfer of a Going Concern (TOGC).

Management Company

On completion the Buyer will become a shareholder and director of a Management Company and following the disposal of all four shop units comprised in the Seller’s title and the upper parts of the Property on long leases, the Seller will transfer the freehold reversion to such Management Company for the sum of £10.00.

Proposal

We are instructed to seek offers in the region of £245,000 (Two Hundred and Forty Five Thousand Pounds), subject to contract, reflecting a net initial yield of 10%, assuming purchaser’s costs of 2.51%.

Investment Considerations

-

An opportunity to acquire a town centre retail investment;

-

The property occupies a prominent retailing pitch;

-

Attractive lot size to an investor;

-

A purchase at the asking price reflects an attractive net initial yield.

DOWNLOADS

BROCHURE

Contact Us

| Singer Vielle | +44 (0) 207 935 7200 | |

|---|---|---|

| Neil Singer | neil@singervielle.co.uk | +44 (0) 203 478 9120 |

| Dale Henry | dale@singervielle.co.uk | +44 (0) 203 701 1356 |

| Richard Wolfryd | richard@singervielle.co.uk | +44 (0) 203 701 1353 |

| Faye Langoulant | faye@singervielle.co.uk | +44 (0) 203 478 9122 |

| Louanne Malan | louanne@singervielle.co.uk | +44 (0) 203 701 1386 |

Vendors Solicitor

| Edwards Duthie | +44 (0) 208 514 9000 |

|---|---|

| Michael Bonehill | michael.bonehill@edwardsduthie.com |