Freehold Restaurant & Retail Investment

Providence Corner | 37 Pyle Street | Newport Isle Of Wight | PO30 1JA

£1,000,000

asking price

GALLERY

Summary

-

Freehold restaurant & retail investment

-

Town centre location

-

Let to Pizza Express & Subway

-

60% of income secured against Pizza Express, SH Funds £525m

-

60% of retail income secured for in excess of 22 years

-

A1/A3 planning consent

-

6.95% net initial yield

Location

Located off the south coast of England, the Isle of Wight is separated from the mainland by the Solent with Portsmouth the nearest large town being 21 km (13 miles) to the north east. The island can be easily accessed with up to 200 ferry crossings a day operating from Portsmouth, Southampton and Lymington. There are excellent rail connections to all the major ferry ports, providing fast access to the Isle of Wight from across the UK. Travel time from London stations to most of the ports is less than two hours. Flights from Heathrow and Gatwick airports serve The Isle of Wight, along with regional flights from Bournemouth and Southampton.

The Isle of Wight has a resident population in the region of 139,000. The population increases significantly during the summer months as a result of an influx of tourists. Newport is the principal town on the Isle of Wight and lies at the heart of the island, often referred to as its capital. From the town centre, the A3020 procides access to the port of Cowes to the north if the island whilst the A3054 provides access to the ports of Ryde and Fishbourne (the main car ferry) to the north east of the island.

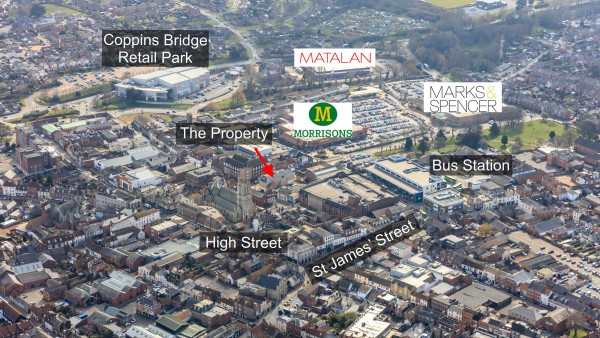

Situation

The historic town of Newport is the main retail location on the Isle of Wight. The subject property is situated in the heart of the town centre, at the corner of Pyle Street and Town Lane which acts as a thoroughfare linking Marks & Spencer, Morrisons and the bus station to the south with the prime retail pitch of High Street to the north.

Occupiers on Pyle Street include TK Maxx, The Cooperative Food, Santander and Lloyds Pharmacy. Other nearby occupiers include Peacocks, Jane Norman, New Look, H&M and Sports Direct. St Thomas’ Square is immediately to the north of the property and provides a range of shops, cafes and restaurants. There is a pay & display car park to the rear of the property accommodating approximately 35 vehicles, plus an NCP pay & display car park accessed via Pyle Street which provides 270 car parking spaces.

Description

The property is a modern mixed use building of steel frame construction comprising two ground floor retail units and 16 residential apartments on three upper floors which have been sold off on long leases.

Internally, Unit 1 (Pizza Express) has been fitted out as a restaurant in the tenant’s typical corporate style providing for approximately 90 covers, with an open plan Pizzeria. The kitchen and ancillary areas, comprising a store room and staff area, are located to the rear of the unit.

Unit 2 (Subway) comprises a fast food restaurant fitted out in the tenant’s typical corporate style with an open plan preparation counter and providing for approximately 5 covers.

The property benefits from a service yard to the rear, accessed via Town Lane. Access to the residential upper parts is via a separate entrance fronting Pyle Street.

Accommodation

We have been advised that the property provides the following areas

| Unit 1 (Pizza Express) | GIA | GIA |

|---|---|---|

| Ground Floor | 276.94 sq m | 2,981 sq ft |

| Unit 2 (Subway) | NIA | NIA |

|---|---|---|

| Zone A | 52.29 sq m | 563 sq ft |

| Zone B | 47.60 sq m | 512 sq ft |

| Zone C | 6.84 sq m | 74 sq ft |

| Zone D | 7.04 sq m | 76 sq ft |

| ITZA | 78.68 sq m | 847 sq ft |

| Total Ground Floor | 113.77 sq m | 1,225 sq ft |

Tenure

Freehold

Tenancy

Unit 1

Let to Pizza Express (Restaurants) Limited on effectively full repairing and insuring terms for a term of 35 years from 24th June 2003, expiring 23rd June 2038. Therefore, there is in excess of 22 years unexpired lease term. The current passing rent is £44,000 per annum (£159 per sq m / £14.76 per sq ft overall). The lease benefits from 5 yearly upwards only rent reviews, the next being on 23rd June 2018. It is assumed that the premises have an agreed gross internal area of 2,981 sq ft for rent review purposes.

Unit 2

Let to Subway Realty Limited on effectively full repairing and insuring terms, subject to a Schedule of Condition, for a term of 15 years from 2nd April 2013, expiring 1st April 2028 (12 years unexpired lease term). There is a tenant’s break option on 2nd April 2021, subject to 6 months’ prior written notice. The tenant pays rent monthly.

The current passing rent is £23,000 per annum and the lease is subject to the following fixed rental increases:

2nd April 2016 – 1st April 2017 £23,000 per annum

2nd April 2017 – 1st April 2018 £25,000 per annum

2nd April 2018 – 1st April 2023 £28,000 per annum

The lease is subject to an RPI-linked rent review (capped and collared at 1% & 4%) on 2nd April 2023.

The vendor will top up the rent at completion to £28,000 per annum which equates to £33.06 Zone A.

The landlord charges the retail tenants a further 5% of the contracted rent in respect of a management fee.

Upper Floors

The 16 residential apartments on the upper floors have all been let on 125 year leases commencing between October 2003 and July 2004, producing a total ground rent of £1,475 per annum. Notices under the Landlord and Tenant Act 1987 (As Amended) have been served on the residential tenants.

Following a Leasehold Valuation Tribunal ruling in November 2012, the service charge management for the property was appointed to John Rowell Estate Management. Further details are available in the Data Room.

Therefore, an investor will benefit from a total income of £73,475 per annum excluding the management fee.

Market Commentary

The current passing rent for Unit 2 (Subway) of £23,000 per annum equates to £27.16 Zone A and the 'topped up' rent of £28,000 per annum equates to £33.06 Zone A. We understand prime rents in Newport are currently in the region of £65.00 Zone A on the High Street with rent on St James' Square currently in the order of £45.00 Zone A.

Covenant

Pizza Express (Restaurants) Limited (Co. No. 02805490) has reported the following figures;

| 28th June 2015 | 28th June 2014 | |

|---|---|---|

| Turnover | £382,942,000 | £351,658,000 |

| Pre-Tax Profits | £76,365,000 | £67,901,000 |

| Shareholders’ Funds | £525,263,000 | £452,376,000 |

Established in 1965, Pizza Express is the market-leading casual dining brand in the UK, currently operating over 430 sites. The company also has strong positions across international markets with around 70 sites trading from 13 different markets. In July 2014, Gondola announced the sale of PizzaExpress to Hony Capital, a leading Chinese private equity firm with strong expertise in cross-border investments. For further information please visit corporate.pizzaexpress.com.

Subway Realty Limited (Co. No. 04174473) has reported the following figures;

| 31st December 2014 | 31st December 2013 | |

|---|---|---|

| Turnover | £28,613,501 | £27,940,819 |

| Pre-Tax Profit | £1,946,179 | £1,457,251 |

| Shareholders’ Funds | £655,859 | £1,632,387 |

Subway was founded in the USA in 1965. Globally there are more than 37,000 Subway stores in 100 countries. All stores are independently owned and operated by franchisees. The UK is the largest market outside North America.

The first UK store opened in 1996 and by the end of the last financial year the company had increased the number of stores to 1,282. Subway Realty Limited (SRL) is a UK corporation dedicated to leasing properties for SUBWAY® franchisees. SRL enters into leases with landlords and developers, and then subleases the sites to the franchisees. Leasing properties directly to SRL ensures landlords get a concept which has a long track record of dependability and the brand strength of more than 37,000 stores worldwide. For further information please visit www.subway.co.uk.

Proposal

Value Added Tax

The property has been elected for VAT. It is anticipated that the sale will be treated as a Transfer of a Going Concern (TOGC).

Proposal

Our client is seeking £1,000,000 (One Million Pounds), subject to contract, reflecting a net initial yield of 6.95% assuming standard purchaser's costs of 5.75%.

Investment Considerations

-

An opportunity to acquire a freehold retail and leisure investment;

-

The property occupies a prominent position within Newport town centre;

-

60% of the income is secured against Pizza Express (Restaurants) Limited - SH Funds £525m;

-

60% of the retail income secured for in excess of 22 years;

-

The property benefits from A1 and A3 planning consent;

-

A purchase at the asking price reflects an attractive net initial yield;

-

The investment provides a purchaser with an attractive lot size.