Freehold Co-Op Supermarket Investment

14 Glanvilles Mill | Ivybridge | Devon | PL21 9PS

£2,730,000

subject to contract

GALLERY

Summary

-

Freehold town centre supermarket

-

Let to Co-Operative Group Limited

-

Highly secure income – Total Equity £3,209 million

-

10 years unexpired lease term

-

Forms the anchor store for the town’s principal shopping centre

-

Store extensively refurbished by the tenant in 2016, demonstrating their commitment to the property

-

£2,730,000 subject to contract

-

6.5% net initial yield

Location

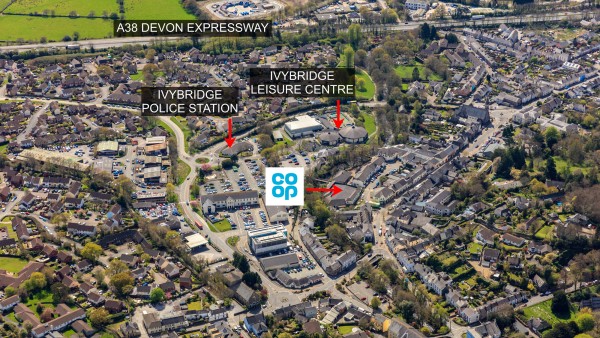

Ivybridge is the largest town in the South Hams area of Devon and is the gateway to the southern boundary of the Dartmoor National Park.

The town benefits from good road communications being immediately adjacent to the A38 Devon Expressway, providing easy access to Plymouth 19 km (12 miles) to the west and Exeter 53 km (33 miles) to the north-east. In addition, Torquay is approximately 34 km (21 miles) to the north-east. The town is ideally located for travelling throughout picturesque South Devon.

Ivybridge is connected to the national rail network with regular services to Plymouth and Exeter. There is also a direct service to London Paddington with a journey time of approximately 3 hours.

Situation

The subject property forms the anchor store for the Glanvilles Mill Shopping Centre which is located in the heart of Ivybridge town centre, fronting Fore Street. The Centre, which totals approximately 3,703 sq m (39,863 sq ft), provides the town’s principal retail offering representing almost 30% of the retail floorspace in the town.

In addition to the subject supermarket, the Centre has an additional 27 units hosting a mix of regional, national and local businesses including the Post Office, Barnardo’s, Newsome Opticians, Connells Estate Agents, Devon Partnership Trust, Warrens Bakers, Maitlands Estate Agents, Salvation Army and Go Mobile. For further information visit www.glanvillesmill.co.uk.

The Glanvilles Mill Shopping Centre is linked to the town’s main car park immediately to south which provides approximately 300 spaces.

The subject property is the only supermarket in the town, the only other food retailers being a Tesco Express and a McColls.

Description

The property is a detached purpose built supermarket property with its main entrance fronting the main Glanvilles Mill Shopping Centre. The property is also directly accessed from the town’s main public car park which is connected via a footbridge.

The property has been fitted out by the tenant to a high standard in their usual corporate style. The main ground floor retail area is open plan, plus there are chiller/freezer facilities, ancillary stores and offices. A small first floor area provides staff accommodation and WC’s. The property also benefits from a goods entrance and loading area at the rear.

We understand the store was extensively refurbished by the tenant in 2016 at a cost of approximately £1 million.

Accommodation

The property has been measured by BKR Floor Plans and provides the following Gross Internal accommodation;

| Ground Floor | 1,035.65 sq m | 11,148 sq ft |

| First Floor | 80.17 sq m | 863 sq ft |

| Total | 1,115.82 sq m | 12,011 sq ft |

A set of floor plans is available to download and the measured survey report will be re-addressed to a purchaser.

Tenure

Freehold.

Tenancy

The property is let to Co-Operative Group Limited, on a Full Repairing and Insuring lease for a term of 17 years from and including 28th June 2011 and expiring on 27th June 2028 (approximately 10 years unexpired lease term with no breaks).

The current passing rent is £189,000 per annum (£169.38 per sq m / £15.73 per sq ft). The lease benefits from 5 yearly open market rent reviews, the next being on 28th December 2018.

Service Charge

The service charge for Unit 14 is:

| 2015 | £20,455 |

| 2016 | £24,139 |

| 2017 | £23,930 |

| 2018 | £15,103 |

Covenant

The property is well secured to Co-Operative Group Limited (No. 00525R) which has reported the following figures;

| 31st January 2016 | 31st January 2015 | |

|---|---|---|

| Revenue | £9,472 million | £9,201 million |

| Underlying Pre-Tax Profit | £59 million | £81 million |

| Total Assets | £9,186 million | £8,729 million |

| Total Equity | £3,209 million | £2,937 million |

With origins tracing back to 1844 the Co-Operative Group has become one of the world’s largest consumer co-operatives and the largest mutual business in the United Kingdom, with interests across food, funerals, insurance, electrical and legal services.

In its Interim Report 2017, the Group reported that the profit before tax in the first half of the year was up 47% when compared to 2016. Convenience store like-for-like sales were up 4.5% and underlying profit for Co-op Food stood at £65 million with operating profit at £77 million (2016: £63 million), an increase of 22%.

On 2nd January 2018, The Co-op announced plans to open 100 new food stores across the UK in 2018, creating an estimated 1,600 jobs. A total of £160 million will be invested in new stores and major makeovers for a further 150 of its outlets. In addition, the Co-op has confirmed it has reached an agreement to become exclusive wholesale supplier to the 2,200 stores across the Costcutter Supermarkets Group network from spring 2018.

For further information visit www.co-operative.coop.

Value Added Tax

The Seller is registered for VAT and has opted to tax. Therefore, it is anticipated that the sale will be treated as a Transfer of a Going Concern (TOGC).

Proposal

We are instructed to seek a figure of £2,730,000 (Two Million, Seven Hundred and Thirty Thousand Pounds), subject to contract, reflecting a net initial yield of 6.5%, assuming standard purchaser’s costs of 6.42%.

Investment Considerations

-

An opportunity to acquire a freehold town centre supermarket investment opportunity;

-

The property is let to the highly secure covenant of Co-Operative Group Limited;

-

10 years unexpired with no breaks;

-

The tenant spent £1 million upgrading the store in 2016, demonstrating their commitment to the property;

-

The subject property forms the anchor store for the town’s principal shopping centre;

-

A purchase at the asking price will provide an investor with an attractive net initial yield;

DOWNLOADS

BROCHURES

Contact Us

| Singer Vielle | +44 (0) 207 935 7200 | |

|---|---|---|

| Neil Singer | neil@singervielle.co.uk | +44 (0) 203 478 9120 |

| Dale Henry | dale@singervielle.co.uk | +44 (0) 203 701 1356 |

| Faye Langoulant | faye@singervielle.co.uk | +44 (0) 203 478 9122 |

| Louanne Malan | louanne@singervielle.co.uk | +44 (0) 203 701 1386 |

Vendor's Solicitor

| Sheet Anchor Properties Limited c/o LCP Management Limited |

+44 (0) 20 7630 2735 |

|---|---|

| Dambudzo Ngara (In-House) |

dngara@lcpproperties.co.uk |