Attractive, Highly Secure Retail Investment

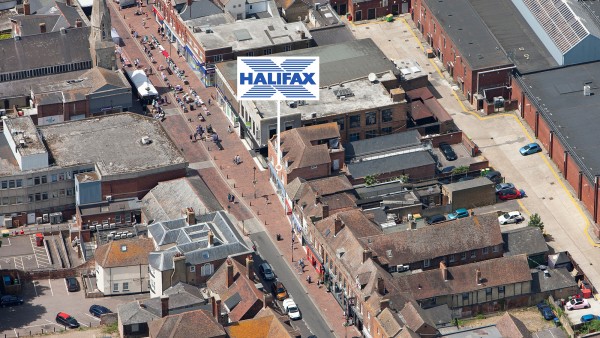

70/74 High Street | Sittingbourne | Kent | ME10 4AJ

£470,000

subject to contract

GALLERY

Blockchain

Track all marketing and execution activity for this property in the clicktopurchase Blockchain – only available at the Singer Vielle Network.

Q: Why is this so important?

A: The ultimate in trust, accountability and transparency from the commencement of marketing to conclusion of a sale.

Summary

-

Attractive retail investment

-

Undoubted income – let to Bank of Scotland Plc (t/a Halifax)

-

New lease from 17th May 2022

-

Tenant has been in occupation since 2007

-

Rent rebased - 40% below previous rental level

-

Prime retailing pitch in the heart of the town centre

-

£470,000, subject to contract

-

8.0% Net Initial Yield

Location

Sittingbourne is located approximately 74 km (46 miles) south east of Central London, 19 km (12 miles) north east of Maidstone, 18 km (11 miles) south east of Rochester and 15 km (9.5 miles) south east of Gillingham.

The town benefits from excellent transport links being placed directly on the A2 which links to the A249 dual carriageway which in turn provides direct access to Junction 5 of the M2 Motorway (3.2 km / 2 miles) and Junction 7 of the M20 Motorway (13 km / 8 miles). The M20 Motorway connects to the M25 Motorway and with it the national motorway network.

The town is connected to the national railway network with direct rail services to London Victoria and London St Pancras International with a fastest journey time of approximately 1 hour and 8 minutes and 59 minutes respectively while the Channel Tunnel and Ports of Dover and Folkestone are within 64 km (40 miles) to the south east. Manston Kent International Airport is 51 km (32 miles) to the east.

Situation

The property is situated in a prime position in the heart of the town centre on the pedestrianised High Street. Nearby occupiers include Superdrug, Barclays, NatWest, Card Factory, O2, Starbucks, Vodafone and Greggs.

The property also benefits from being in close proximity to the entrance to The Forum Shopping Centre which is home to retailers such as Specsavers, Costa Coffee, F.Hinds, New Look, Savers and Warren James.

Description

The property comprises a ground floor retail unit which has been fitted out to a high standard in the typical Bank of Scotland corporate style to provide an open plan banking hall with ancillary accommodation.

The upper floors comprise residential accommodation which does not form part of the sale.

Accommodation

The property has been measured by BKR Floor Plans and provides the following Net Internal Areas:

| Net Frontage | 9.40 m | 30’10” |

| Gross Frontage | 10.84 m | 35’7” |

| Zone A | 67.91 sq m | 731 sq ft |

| Zone B | 53.60 sq m | 577 sq ft |

| Zone C | 62.61 sq m | 674 sq ft |

| Remainder | 72.00 sq m | 775 sq ft |

| ITZA | 1,285 | |

| Total | 256.13 sq m | 2,757 sq ft |

A set of floor plans is available to download and the measured survey report will be re-addressed to a purchaser at a cost of £385 + VAT.

Tenure

Virtual Freehold. 999 year leasehold interest from 31st August 2007 at a peppercorn rent.

Tenancy

The ground floor is let to Bank of Scotland Plc (t/a Halifax) on a full repairing and insuring lease for a term of 5 years from 17th May 2022, expiring on 16th May 2027. There is a tenant’s break option on 16th May 2025, subject to not less than six months’ notice.

The current passing rent is £39,500 per annum.

The tenant has been in occupation since 2007 and has just signed a new lease, demonstrating their continued commitment to the property. The rent has been rebased from £66,000 per annum to £39,500 per annum (a 40% reduction).

Covenant

Bank of Scotland Plc t/a Halifax Bank (Company No. SC327000) has reported the following figures:

| 31st December 2021 | 31st December 2020 | |

|---|---|---|

| Total Income | £5,763 million | £5,147 million |

| Pre-Tax Profits | £2,316 million | £883 million |

| Total Assets | £313,912 million | £315,764 million |

Bank of Scotland Plc is a wholly owned subsidiary of Lloyds Banking Group Plc which operates under Halifax, Lloyds Bank and Bank of Scotland. Lloyds Banking Group is the UK’s largest digital bank and financial services group, reporting Pre-Tax Profits of £1,226 million and Total Assets of £871,269 million for the year ending 2020. For further information visit www.lloydsbankinggroup.com.

VAT

The property is elected for VAT. We anticipate that the sale should be capable of being treated as a Transfer of Going Concern (TOGC).

Proposal

We are instructed to seek £470,000 (Four Hundred and Seventy Thousand Pounds), subject to contract, reflecting a net initial yield of 8.0%, assuming standard purchaser’s costs of 4.57%.

Please note that a purchaser will be re-charged the costs of the measured survey (£385 + VAT) and searches (£543.73) which are provided in the data room.

Please note that a purchaser will be charged a Transaction Fee of £5,000 plus VAT.

Investment Considerations

-

An opportunity to acquire an attractive retail investment in the heart of Sittingbourne town centre;

-

New letting at a re-based rent of £39,500 per annum (40% less than previous rent);

-

Let to the undoubted covenant of Bank of Scotland PLC;

-

The tenant has been in occupation since 2007 and recently renewed their, demonstrating their continued commitment to the property;

-

A purchase at the asking price reflects an attractive net initial yield;

-

Attractive lot size for an investor;

Data Room and clicktopurchase®

Access to the data room and for the ability to purchase online with speed and ease, please click the clicktopurchase® “C” icon or the clicktopurchase® side bar. Purchasers will be able to access the complete legal package, clear verification and submit legally-binding offers to acquire the property.

Purchasers benefit from the trust, security and transparency provided by the platform. All activities, including the online contract execution, will form part of the electronic audit trail which is anchored in the clicktopurchase® Blockchain.

clicktopurchase® provides the opportunity for any investor, whether located UK or abroad, to uniquely purchase online with ease and certainty. To learn more about clicktopurchase®, click here.

DOWNLOADS

BROCHURE

Contact Us

| Singer Vielle | +44 (0) 207 935 7200 | |

|---|---|---|

| Dale Henry | dale@singervielle.co.uk | +44 (0) 203 701 1356 |

| Neil Singer | neil@singervielle.co.uk | +44 (0) 203 478 9120 |

Vendors Solicitor

| DJM Solicitors | +44 (0) 179 265 6507 | |

|---|---|---|

| Michael Snowdon | mjs@djm.law.co.uk | |