Residential / Commercial Property Significant Add-Value Opportunity – on behalf of Administrators

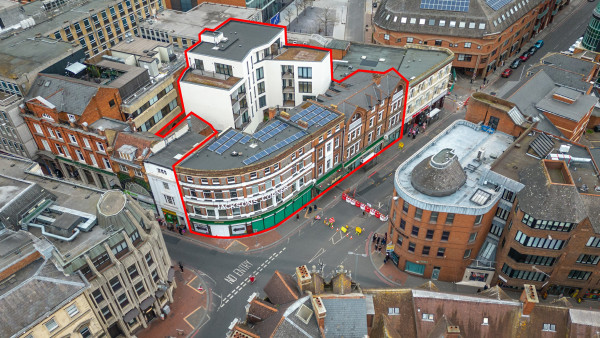

Jackson’s Corner | 1-9 King’s Road | Reading | RG1 2EA

£7,500,000

subject to contract

GALLERY

Blockchain

Track all marketing and execution activity for this property in the clicktopurchase Blockchain – only available at the Singer Vielle Network.

Q: Why is this so important?

A: The ultimate in trust, accountability and transparency from the commencement of marketing to conclusion of a sale.

Summary

-

Significant opportunity to enhance value

-

On behalf of Administrators, acting as agent without personal liability

-

Prominent development within Reading Town Centre

-

Combination of vacant refurbished and new apartments, and three commercial retail/restaurant units

-

Anticipated potential income between £638,000 - £670,000 per annum

-

Anticipated total exit value between £9,297,500 - £10,720,000

-

Offers in the region of £7.5m, subject to contract, providing a 70-80% margin.

Location / Situation

Reading is a dynamic commuter town some 45 miles / 72 kms west of Central London, 77 miles / 124 kms east of Bristol and 25 miles / 40 kms south of Oxford. The town is well connected to the national motorway network, served by the M4, whilst Reading Railway Station provides mainline services, including Crossrail which opened in 2023.

Reading is the economic capital of the Thames Valley; a de facto city, which continually transforms to attract global investment. It is ranked in the top 25 most attractive European cities for direct foreign investment (The Financial Times) and has one of the highest concentrations of digital businesses in the UK. Located at the epicentre of Britain’s transport network, Reading has a wealth of opportunities, being one of the best-connected places in the UK. This global connectivity has attracted an international workforce, students and visitors. Today over 150 languages are spoken in homes across Reading and the many diverse celebrations are testament to the open, friendly and vibrant community.

Jackson’s Corner is prominently located within the town centre at the junction of King’s Road and High Street. The position provides a direct pedestrian route into Reading’s main shopping district, including The Oracle shopping centre.

Description

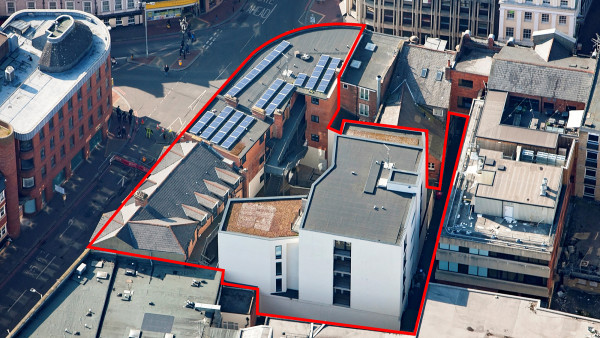

The property comprises an attractive apartment and commercial scheme on approximately 0.25 acres / 0.101 hectares which was completed and launched in 2021. Comprising the former Jackson’s Corner Department Store, the property now provides three commercial retail units beneath 18 apartments within refurbished accommodation fronting the street, along with a new rear block comprising 15 units.

The refurbished front scheme provides three floors of apartments; the new rear block is arranged over five floors and benefits from a lift. Access to the residential accommodation is via a passageway from the High Street, this leading to the central courtyard from which the apartments are accessed.

The commercial units have been completed in shell condition.

Accommodation

Whilst the original plans for the scheme are available to download, in addition the property has been measured by BKR Floor Plans to confirm the accommodation below. These floor plans and the measured survey report will be re-addressed to a purchaser at a cost of £950 +VAT.

| Commercial | sq ft | sq m | ||||

|---|---|---|---|---|---|---|

| Unit 1 Ground Floor | 1,875 | 174.20 | ||||

| ITZA | 1,170 | |||||

| Unit 1 Basement | 1,666 | 154.78 | ||||

| Unit 1 Total | 3,541 | 328.98 | ||||

| Unit 2 Ground Floor | 1,875 | 174.16 | ||||

| ITZA | 789 | |||||

| Unit 2 Basement | 1,283 | 119.21 | ||||

| Unit 2 Total | 3,158 | 293.37 | ||||

| Unit 3 Ground Floor | 4,277 | 397.37 | ||||

| ITZA | 1,927 | |||||

| Unit 3 Basement | 1,625 | 150.94 | ||||

| Unit 3 Total | 5,902 | 548.31 | ||||

| Total Commercial (GIA) | 12,601 | 1,170.66 | ||||

| Residential | ||||||

| Block Name | New/ Refurbished |

Postal Address | Floor | Beds | GIA (sq ft) | |

| Duchess House | New | 1 | 1 | 1 | 512 | |

| Kings House | Refurb | 2 | 1 | 1 | 556 | |

| Kings House | Refurb | 3 | 1 | 1 | 512 | |

| Kings House | Refurb | 4 | 1 | 1 | 523 | |

| Duke House | Refurb | 5 | 1 | 2 | 742 | |

| Duke House | Refurb | 6 | 1 | 2 | 694 | |

| Duke House | Refurb | 7 | 1 | 2 | 679 | |

| Duchess House | New | 8 | 2 | 1 | 529 | |

| Duchess House | New | 11 | 2 | 1 | 540 | |

| Kings House | Refurb | 12 | 2 | 1 |

556 |

|

| Kings House | Refurb | 14 | 2 | 1 | 515 | |

| Kings House | Refurb | 15 | 2 | 1 | 523 | |

| Duke House | Refurb | 16 | 2 | 2 | 742 | |

| Duchess House | New | 19 | 3 | 1 | 529 | |

| Duchess House | New | 20 | 3 | 1 | 528 | |

| Duchess House | New | 21 | 3 | 2 | 755 | |

| Duchess House | New | 22 | 3 | 1 | 540 | |

| Kings House | Refurb | 23 | 3 | 1 | 512 | |

| Kings House | Refurb | 24 | 3 | 1 | 494 | |

| Duke House | Refurb | 26 | 3 | 2 | 744 | |

| Duke House | Refurb | 27 | 3 | 2 | 697 | |

| Duke House | Refurb | 28 | 3 | 2 | 669 | |

| Duchess House | New | 30 | 4 | 1 | 529 | |

| Duchess House | New | 31 | 4 | 1 | 540 | |

| Duchess House | New | 33 | 5 | 2 | 742 | |

| Duchess House | New | 34 | 5 | 1 | 622 | |

| Total | 15,523 | 1442.13 | ||||

Note that the above list of apartments excludes those which have been sold prior to the administrator’s involvement with the property.

Tenure

Freehold

A Deed of Easement of 28th February 2017 (see data room) provides a right of way over the passageway at 1-2 Market Place to enable pedestrian access to the rear courtyard and, hence, the residential accommodation. The adjoining land owner has certain obligations to keep in good repair and condition, as well as clean; the owner of Jackson’s Corner can repair and maintain should the adjoining fail to do so, and recover a fair and reasonable proportion of that cost.

An active-management opportunity exists to improve the attractiveness of the current entrance area to the residential apartments.

A significant opportunity exists to enhance value by creating a new entrance to the residential accommodation from King’s Road.

Tenancy Position

Unit 1 – an Agreement for Lease and Supplemental Agreement has been signed with Rosa’s London Limited (Thai café). The letting will be for 15 years at an initial rent of £30,000 per annum, rising to £60,000 per annum after 38 months. In addition, the tenant has been granted a 12 month rent-free period. Therefore the tenant has in effect been granted the equivalent of 31 months rent-free. The service charge is capped at £1.50 per sq ft for the first five years of the term.

The Agreement required works to be undertaken by the landlord; a specification is provided in the data room. The only items currently outstanding are the works to the fire escape and the connection of a water supply. An M&E consultant (Kendall Kingscott) has been appointed to finalise the specification in order to enable the letting to complete.

The lease is also conditional upon the tenant having obtained a premises licence. This has been obtained and a copy can be found within the data room.

Unit 2 – an Agreement for Lease has been signed to let to Fat Hippo (burger bar)for 15 years at an initial rent of £55,000 per annum, with a 18 month rent free period and a tenant break option at the end of the tenth year. The service charge is capped at £1.50 per sq ft for the first five years of the term.

The agreement requires the landlord to undertake appropriate works, including providing a route for an extraction duct; the works are to be undertaken once the tenant has secured planning permission for their ventilation system, which is being progressed.

The lease is also conditional upon the tenant having obtained a premises licence. The tenant is to use reasonable endeavours to obtain it as soon as reasonably practicable.

Unit 3 – The unit is being offered to the market to let by Fleurets and Hicks Baker. The asking rent is to be £75,000 per annum. It should be noted that the property was recently under offer to a menswear retailer at £92,500 per annum

Please refer to The Budget of the Remaining Works within the dataroom. General works have been priced at £15,500, works for landlord’s obligations for unit 1 at £11,500, landlord’s works for unit 2 at £27,300, and costs for a number of items prior to letting unit 3 at £11,600.

Covenants

Rosa’s London Limited (Co. No 07734532)has reported the following figures:

| Year Ending | 28th March 2022 | 28th March 2021 |

|---|---|---|

| Turnover | £27,228,826 | £16,327,930 |

| Pre-Tax Profits | £608,208 | -£258,868 |

| Balance Sheet | £4,385,229 | £3,972,546 |

“Rosa’s Thai” currently trades from 35 nationwide outlets according to the company’s website. www.rosasthai.com.

Please note that there is no rent deposit.

Fat Hippo Restaurants Limited (Co. No 07207305)has reported the following figures:

| Year Ending | 31st July 2021 | 31st July 2020 |

|---|---|---|

| Balance Sheet | £428,935 | £191,653 |

“Fat Hippo” currently trades from 16 nationwide outlets according to the company’s website. www.fathippo.co.uk.

Please note that there is no rent deposit.

Service Charge

The property is being managed by Sennen who took over the management on 30th November 2022. A copy of the management agreement can be found in the data room.

Please refer to the spreadsheet within the dataroom which shows the service charge currently running at £89,485 per annum. The void service charge cost to the administrator (which excludes the sold units depicted in orange) is currently in the order of £74,000 per annum.

The property is not currently incurring business rates as the property is in administration. The rateable value for unit 1 is £87,500, unit 2 £53,500 and unit 3 £117,000.

Development Information

The development was completed in accordance with planning Application Number 171238 which, along with relevant planning documentation, can be accessed from the data room.

We also provide a planning conditions tracker regarding the planning conditions and draw your attention to items 25 and 26 (see section below “BREEAM”).

Item 25 relates to the requirement to demonstrate that 50% of new dwellings are required to achieve a minimum 19% improvement in emission rate over the target defined under the Building Regulations. This target has not yet been achieved; please refer to XCO2 Carbon Reduction Performance Report within the dataroom for further information.

BREEAM

Condition 26 of the planning permission for the development requires that either 50% of the residential units within the frontage building achieve on refurbishment a BREEAM excellent standard (minimum score of 70 points) and the remaining 50% a BREEAM very good standard (minimum score of 55 points), or that all units achieve a BREEAM very good standard but with a minimum score of 62.5%. The scheme has not yet achieved this rating.

XCO2 consultants submitted a final report to Building Research Establishment (BRE) targeting 58% (BREEAM Very Good) rating. The intention has been to achieve the score of 58% and then submit a non-material amendment to the planning requirement, reducing the planning permission target score to the one achieved.

In March 2023, XCO2 received BREAM Domestic Refurbishment assessment of “Very Good”. The appropriate certificates are available to download from the data room. It is now anticipated that this will be sufficient to discharge the planning condition; consultants Barton Wilmore are advising and liaising with Reading Borough Council.

The property is covered by a “Build-Zone” Insurance warranties for a period of 10 years from practical completion which was March 2021. Furthermore, warranties are provided in the dataroom as follows:

-

Structural Engineer – Pringuer-James Consulting Engineers Limited

-

Principal Designer – Two One Safety Services Limited

-

Mechanical and Electrical Engineer – Futureserv Limited

-

Architect – Dexter Moren Associates Limited

-

Architect – CAMM Architects Limited

-

Contractor – Peak Group London Limited

-

Contractor – Ankor Construction Limited

A Fire Risk Assessment dated 22 November 2022 is available in the dataroom. The majority of issues have since been treated. The assessment raised an issue relating to the decking in the courtyard area. As a result, the administrators are organising treatment in May to fire protect the decking.

Energy Performance Certificates for the residential apartments can be found in the data room. The Energy ratings are between B and D.

Energy Performance Certificates for the commercial accommodation can be found in the data room. The Energy rating is E.

A Health and Safety Risk Assessment was undertaken in November 2022. The report is available to view within the data room.

Significant Value-Enhancement Opportunity

Prior to the current professional teams’ involvement, the following residential property sales were achieved.

| Block Name | New/ Refurbished |

Postal Address | Floor | Beds | GIA (sq ft) | Sold |

| Duchess House | New | 9 | 2 | 1 | 512 | £255,000 (June 2022) |

| Duchess House | New | 10 | 2 | 2 | 728 | £340,000 (Nov 2021) |

| Duke House | Refurb | 17 | 2 | 2 | 664 | £422,144 (July 2021) |

| Duke House | Refurb | 18 | 2 | 2 | 640 | £420,529 (May 2021) |

| Duke House | Refurb | 25 | 3 | 1 | 437 | £289,396 (July 2021) |

| Duchess House | New | 29 | 4 | 1 | 512 | £327,250 (Sept 2021) |

| Duchess House | New | 32 | 4 | 2 | 728 | £451,875 (Sept 2021) |

“The latest Haslams Property Price Index (Q1 23) indicates that a sense of normality is returning to Reading’s residential property market as last September’s disastrous budget recedes to be a distant memory. Whilst many landlords, tenants, buyers and sellers continue to face the challenges of higher inflation and borrowing, people are still moving and this is the bedrock of what appears to be a measured and cautious recovery.

The local economy remains relatively strong, resilient and out-performs most. News that the wider economy may avoid a recession also helped improve sentiment and consequently there is more confidence than in Q4 22. Whilst people are now more willing and able to reduce asking prices to generate interest; the underlying value of properties in the area up 1.22% versus Q4 22 and up 2.64% over the past 12 months. Town centre apartments outperformed the local market returning 1.62% and 3.56% respectively. The performance of town centre apartments reflects the imbalance in the supply. Typically, Reading would absorb the sales of 200-300 new apartments each year. However, we are unlikely to see more than 30 units delivered through the whole of 2022, 2023, and 2024 due to most new units being allocated for Built to Rent rather than Build to Sell.

Rental demand for town centre apartments continues to out-strip supply. PRS town centre apartments now average just under £28 sq ft per annum with gross yields now sitting at 6.26%: a shift of 83 basis points since the beginning of 2021 (from 5.43%). This reflects the fact that increases in capital values have not kept pace with the growth in rentals values over the same period (7.16% annual growth in rental values).

We suggest that the total value for the residential apartments lies between £6,897,500 (£444 per sq ft) and £7,970,000 (513 per sq ft). These figures represent a significant discount to the sale figures recently achieved. Please refer to the schedule available to download provided by the local residential experts, Haslams.

As well as the evidence of sales at Jackson’s Corner, we are aware of comparable sales achieved at One Reading, Station Road, Reading where apartments have sold during 2022/23 at between £453 and £678 per sq ft, averaging £577 per sq ft.

It is proposed that the rental income potential lies between £433,000 per annum and £465,000 per annum.

Unit 1 has been let at £60,000 per annum, equating to £45 Zone A. Unit 2 is let at £55,000 per annum, equating to £61 Zone A. The asking rent for unit 3 is £75,000 per annum, representing only £36 Zone A; however, the unit was recently under offer at £92,500 per annum representing £45 Zone.

Accordingly, we suggest that the potential commercial income is in the order of £205,000 per annum. Based upon proposed exit yields of 7 to 8%, the value to be realised from the commercial element of the property is in the order of £2.4m to £2.75m.

In summary, we suggest that the range of value to be realised from the property is between £9,297,500 and £10,720,000.

We suggest the rental income potential is between £638,000 and £670,000 per annum.

We suggest there are many areas for a purchaser to enhance the value of the property, including the following:

-

Letting the commercial accommodation

-

Letting the residential accommodation

-

Enhancing the specification of the property

-

Improving the appeal of the passageway entrance to the apartments.

-

Creating a new entrance to the apartments from the street. Details of a proposal is provided in the data room. This includes creation of an additional apartment.

-

Improving the aesthetic appeal of the property externally

-

Improving the courtyard area

-

Completing the various management initiatives listed

VAT

We understand that the property has been elected for VAT.

Proposal

We are instructed to seek offers in the region of £7,500,000 (Seven Million, Five Hundred Thousand Pounds), subject to contract, for the freehold interest.

Please note that a purchaser will be re-charged the costs of the searches (£1,500 + VAT) which are provided in the data room.

Conditional Offers

It should be noted that the vendor will entertain clicktopurchase legal offers with completion conditional upon finance, as well as unconditional offers. Should an offer be accepted and a contract formed with completion conditional upon finance being obtained by a purchaser, if a purchaser subsequently withdraws due to the lack of funding, a payment will be withheld from the contract deposit of 0.5% of the contract price.

Investment Considerations

-

The property is located in a prominent position within Reading town centre;

-

A purchase at the asking price represents a significant discount to the potential value to be realised for the property;

-

Once management initiatives are completed, the property has the potential to generate a significant rental income;

Disclaimer

The affairs, business and property of the Company is being managed by the Joint Administrators Paul Zalkin and Simon Campbell, of Quantuma Advisory Limited who act as agents for the Company and without personal liability. Both are licensed by the Insolvency Practitioners Association and are bound by the Insolvency Code of Ethics

The attention is drawn to the fact that access to all areas of the property may not be possible prior to completion.

Replies to standard enquiries will not be provided as part of the conveyancing process.

The property will be sold as seen. No express or implied warranties or representations are given.

Any prospective owner must be prepared to undertake robust asset management initiatives to regularise the basis upon which any commercial and residential occupants remain in situ.

The guide price has been set realistically to reflect significant opportunities to build a sustainable income stream and enhance value.

Data Room and clicktopurchase®

Access to the data room and for the ability to purchase online with speed and ease, please click the clicktopurchase® “C” icon or the clicktopurchase® side bar. Purchasers will be able to access the complete legal package, clear verification and submit legally-binding offers to acquire the property.

Purchasers benefit from the trust, security and transparency provided by the platform. All activities, including the online contract execution, will form part of the electronic audit trail which is anchored in the clicktopurchase® Blockchain.

clicktopurchase® provides the opportunity for any investor, whether located UK or abroad, to uniquely purchase online with ease and certainty. To learn more about clicktopurchase®, click here.

DOWNLOADS

BROCHURE

Contact Us

| Singer Vielle | +44 (0) 207 935 7200 | |

|---|---|---|

| Neil Singer | neil@singervielle.co.uk | +44 (0) 203 478 9120 |

| Dale Henry | dale@singervielle.co.uk | +44 (0) 203 701 1356 |

Vendors Solicitor

| Joelson | +44 (0) 207 580 5721 | |

|---|---|---|

| David Hershkorn | david.h@joelsonlaw.com | |

| Michael Friend | michael.f@joelsonlaw.com | |

Joint Agent

| Haslams Estate Agents | ||

|---|---|---|

| Mike Shearn | mike.shearn@haslams.net | +44 (0) 118 960 1087 |