Central London, RPI-Linked “Starbucks” Investment

Blackfriars Circus | 143 Blackfriars Road | London | SE1 8E1

£1,075,000

subject to contract

GALLERY

Blockchain

Track all marketing and execution activity for this property in the clicktopurchase Blockchain – only available at the Singer Vielle Network.

Q: Why is this so important?

A: The ultimate in trust, accountability and transparency from the commencement of marketing to conclusion of a sale.

Summary

-

Central London location

-

Let to Starbucks Coffee Company (UK) Limited

-

Highly Secure Income

-

10 year lease from September 2018, without breaks

-

RPI-linked rent review in Sept 2023

-

Highly prominent property with extensive frontage

-

£1,075,000, subject to contract

-

4.0% Net Initial Yield

-

Minimum guaranteed yield in 2023 based on current RPI – 4.75%

Location

Southwark is a district of Central London situated on the south bank of the River Thames, approximately 3.2 km (2 miles) south-west of London’s West End and less than 1.6 km (1 mile) south of the City of London.

It forms the north-western part of the wider London Borough of Southwark, which borders the City of London and the London Borough of Tower Hamlets to the north, the London Borough of Lambeth to the west and the London Borough of Lewisham to the east. Tower Bridge, The Millennium Bridge, Blackfriars Bridge, Southwark Bridge and London Bridge all connect the City of London to the borough.

Many of London’s most renowned tourist attractions are located in the vicinity including The London Eye, Tate Modern, The Shard, Imperial War Museum, Borough Market, The Old Vic and The National Theatre. The famous South Bank is a short walk away with festivals, cinemas and pop-up markets.

In common with much of the south bank of the Thames, Southwark has experienced extensive regeneration over recent years with many new residential and office developments, shops, restaurants, galleries and bars. The area is in easy walking distance of the City and West End. As a result, it has become a major business hub for many national and international corporations.

The location benefits from excellent communications and is served by multiple underground and overground train stations. London City Airport is approximately 13 km (8 miles) to the east and Heathrow Airport approximately 27 km (17 miles) to the west, both easily accessible via London’s public transport system.

Situation

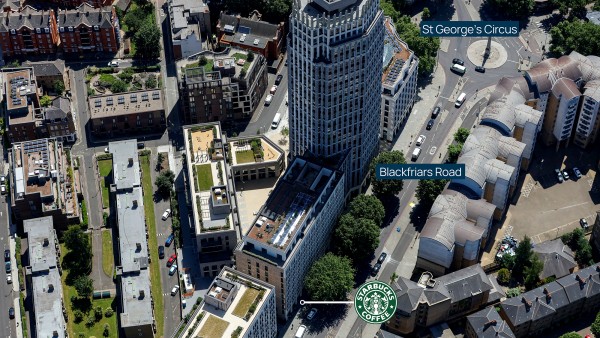

The property occupies a highly prominent position fronting Blackfriars Road, in close proximity to St George’s Circus and the junction with Borough Road. Other nearby occupiers include Tesco Express (adjacent), Pret A Manger, Costa, Sainsbury’s Local, H10 London Waterloo Hotel and The Prince’s Trust.

The immediate vicinity consists of office buildings, hotels, restaurants, cafes, shops, homes, educational buildings, leisure businesses and tourist attractions. London South Bank University and its halls of residence are immediately to the south, hence the property benefits from being in an area housing a very large student population.

The property benefits from excellent communication links being within a five-minute walk from Southwark Station (Jubilee line) with direct trains to Westminster, Bond Street, Canary Wharf and Stratford. London Waterloo (Underground & National Rail Terminus), Elephant & Castle (Northern & Bakerloo lines), Lambeth North (Northern line) and Blackfriars (Thames Link, Circle & District lines) are also all within easy walking distance. Numerous bus routes also serve the area providing easy access to the West End and other parts of London.

Description

The property forms part of “Blackfriars Circus”, a prestige, contemporary development by Barratt Homes completed in 2017/18. The scheme comprises five buildings over a large plot of land bordered by Blackfriars Road and Borough Road providing over 330 modern apartments as well as substantial office and retail accommodation, plus two new public spaces. Designed by the award winning Maccreanor Lavington architects, Blackfriars Circus was the Brick Award 2018 winner and shortlisted for the prestigious RIBA London Award 2020 and 2021 Neave Brown Award for Housing.

The investment comprises two ground floor units, No’s 4&5, which have been amalgamated and benefit from extensive frontage onto Blackfriars Road. Internally the property has been fitted out by the tenant to a high specification and predominantly provides an open-plan retail area.

The property has an EPC rating of B. A copy of the EPC is held within the data room.

Accommodation

The property has been measured by BKR Floor Plans and provides the following accommodation:

| Net Frontage | 34’9” | 10.59m |

| Gross Frontage | 39’0” | 11.89m |

| Net Internal Area | 1,490 sq ft | 138.42 sq m |

| Gross Internal Area | 1,600 sq ft | 148.64 sq m |

The measured survey is available to download and will be re-addressed to a purchaser at a cost of £425 + VAT.

Tenure

Virtual Freehold. 999 year lease from 1st April 2016 at a peppercorn rent.

Tenancy

The property is let to Starbucks Coffee Company (UK) Limited on effectively a full repairing and insuring lease for a term of 10 years from 14th September 2018, expiring on 13th September 2028.

The current passing rent is £45,500 per annum (£328.71 per sq m / £30.54 per sq ft overall).

The lease benefits from a rent review on 14th September 2023. The rent is reviewed in line with the Retail Price Index (RPI), collared and capped at 1% and 4% respectively.

Applying the latest published RPI figure the rent will increase to a minimum of £53,988 per annum.

Covenant

For the year ending 31st October 2021, Starbucks Coffee Company (UK) Limited (Co. No. 02959325) has reported the following figures:

| Turnover | £328,014,000 |

| Pre-Tax Profits | £13,348,000 |

| Net Assets | £17,578,000 |

In the latest financial year the Company had a total of 1,000 stores in the UK of which 297 are Company owned and 703 are Licenced/Franchised stores.

The Company is a wholly owned subsidiary of Starbucks Coffee Holdings Limited (UK) Limited (FY 2021: Shareholders’ Funds £332,324,711), which in turn is owned by Starbucks Corporation (FY 2021: Net Revenue $29,060.6 million, Total Assets of $31,392.6 million).

Starbucks is the premier roaster, marketeer and retailer of specialty coffee in the world, operating from more than 30,000 stores in 84 markets. Formed in 1985, Starbucks Corporation trades on the NASDAQ. The company purchases and roasts high-quality coffees that it sells, along with handcrafted coffee, tea and other beverages and a variety of high-quality food items through company-operated stores. It also sells a variety of coffee and tea products and licenses its trademarks through other channels, such as licensed stores as well as grocery and foodservice through their Global Coffee Alliance with Nestlé. In addition to their flagship Starbucks Coffee brand, the company sells goods and services under the following brands: Teavana, Seattle’s Best Coffee, Evolution Fresh, Ethos, Starbucks Reserve and Princi. For further information visit www.starbucks.com.

VAT

The property has been registered for VAT. It is anticipated that the sale will be treated as a Transfer of a Going Concern (TOGC).

Proposal

We are instructed to seek a figure of £1,075,000 (One Million and Seventy-Five Thousand Pounds), subject to contract, reflecting a net initial yield of 4.0%, assuming purchaser’s costs of 5.82%.

Based on the most recently published RPI figure (May 2022), the yield will increase to 4.75% at the rent review in September 2023.

Please note that a purchaser will be re-charged the costs of the measured survey (£425 + VAT) and searches (£983.03) which are provided in the data room.

Please note a purchaser will be charged a Transaction Fee of £5,000 + VAT.

Investment Considerations

-

An opportunity to acquire a Central London investment;

-

The investment provides highly secure income, being let to Starbucks Coffee Company (UK) Limited, owned by Starbucks Corporation;

-

Attractive unexpired lease term – let until September 2028, without breaks;

-

RPI-linked rent review in September 2023;

-

The property occupies a highly prominent position fronting Blackfriars Road, within five minutes’ walk from Southwark Station;

-

The property forms part of a prestige, award winning development by Barratt Homes;

-

A double unit property, providing a Landlord with flexibility at lease expiry;

-

Attractive lot size for an investor.

Data Room and clicktopurchase®

Access to the data room and for the ability to purchase online with speed and ease, please click the clicktopurchase® “C” icon or the clicktopurchase® side bar. Purchasers will be able to access the complete legal package, clear verification and submit legally-binding offers to acquire the property.

Purchasers benefit from the trust, security and transparency provided by the platform. All activities, including the online contract execution, will form part of the electronic audit trail which is anchored in the clicktopurchase® Blockchain.

clicktopurchase® provides the opportunity for any investor, whether located UK or abroad, to uniquely purchase online with ease and certainty. To learn more about clicktopurchase®, click here.

DOWNLOADS

BROCHURE

Contact Us

| Singer Vielle | +44 (0) 207 935 7200 | |

|---|---|---|

| Dale Henry | dale@singervielle.co.uk | +44 (0) 203 701 1356 |

| Neil Singer | neil@singervielle.co.uk | +44 (0) 203 478 9120 |

Vendors Solicitor

| Quastels LLP | +44 (0) 207 908 2555 | |

|---|---|---|

| Mark Cornelius | mcornelius@quastels.com | |

Joint Agent

| Scott Real Estate | +44 (0) 7780 602 618 |

|---|---|

| Daniel Freedman | daniel@scottre.co.uk |