High Yielding Secure Retail Investment at Re-Based Rent

2 - 6 Bridge Street | Hemel Hempstead | HP1 1EF

£200,000

subject to contract

GALLERY

Blockchain

Track all marketing and execution activity for this property in the clicktopurchase Blockchain – only available at the Singer Vielle Network.

Q: Why is this so important?

A: The ultimate in trust, accountability and transparency from the commencement of marketing to conclusion of a sale.

Summary

-

Town centre retail location

-

Attractive Retail/Use Class E Investment

-

Let to The Air Ambulance Service Trading Limited (Revenue £9m, Post-Tax Profits £1.78m) and NCP Commercial Services Ltd (Shareholder’s Funds £8.9m)

-

Retail rent has been re-based to 40% of the previous rent

-

Desirable return frontage property

-

Rear service yard with car parking

-

Potential to add residential, subject to planning

-

Passing rent of £21,000 pa

-

Freehold

-

Offers in the region of £200,000, subject to contract

-

10.26% Net Initial Yield

-

£58 per square foot / 628 per square metre

Location

Hemel Hempstead is the most populated urban area in Hertfordshire, approximately 26 miles (42 km) north west of Central London, 10 miles (16 km) north of Watford and 6 miles (9.6 km) west of St Albans.

The town benefits from excellent road communications and sits approximately 1.5 miles (2.4 km) from Junction 8 of the M1 motorway and 4 miles (6.4 km) north of Junction 21 of the M25 motorway. This provides easy access to a range of national motorways and arterial road networks such as the M4, M40, M3 and A1.

There are regular train services from Hemel Hempstead Station to London Euston with the journey time being approximately 30 minutes. In addition, Luton Airport is located 12 miles (19 km) to the north of the town, London Heathrow is 32 miles (51.5 km) to the south and London City airport is 39 miles (62 km) to the south east.

There is a population of over 9 million people living within a 30 mile (48 km) drive from Hemel Hempstead and Hertfordshire’s population is predicted to grow by 26% by 2030. Some nearby employers include Amazon UK, Vitabiotics, Hermes and Boston Scientific (www.citypopulation.de).

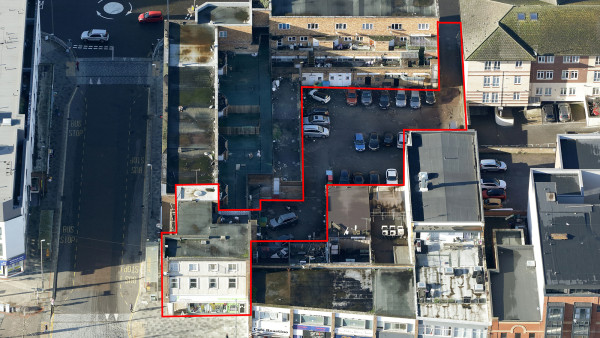

Situation

The property is situated on the northern side of Bridge Street on the junction with Marlowes, by the pedestrianised section and directly next to one of the main bus stops in the town centre.

Hemel Hempstead Hospital is located approximately 300 metres from the property.

Other retailers nearby include, Greggs, Subway, Santander, Boots, Poundland, Superdrug, WH Smith / Post Office, and B&M.

Marlowes Shopping Centre is approximately 150 metres from the property and comprises a 270,000 sq ft / 25,083 sq m centre anchored by Marks and Spencer, Tesco express and New Look. The shopping centre is served by a car park with 1,200 spaces.

Description

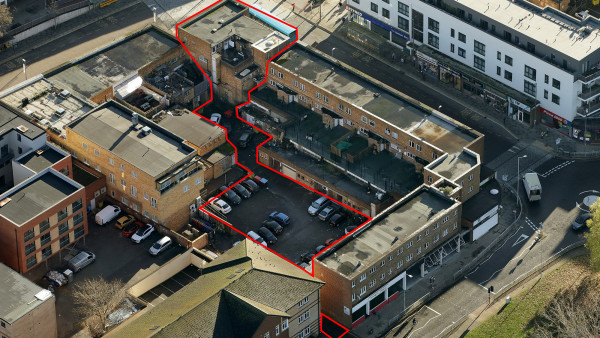

The property comprises a three-storey end of terrace retail property with a return frontage onto Marlowes.

The ground and first floor comprise retail accommodation, storage, office and a staff area. The retail unit benefits from a corner access point allowing customers to enter from Marlowes or Bridge Street. The property has been fitted out by the tenant to their usual corporate style.

The second floor comprises two self-contained flats sold off on long leases, accessed from the right of the property.

The property benefits from a rear service yard with car parking which has been let to NCP Commercial Services Ltd.

Accommodation

The property has been measured by BKR Floor Plans and provides the following floor Net Internal floor areas:

| Net Frontage | 13.72 m | 45’ |

| Gross Frontage | 14.17 m | 46’6” |

| Zone A | 68.93 sq m | 742 sq ft |

| Zone B | 67.26 sq m | 724 sq ft |

| Ground Floor | 136.19 sq m | 1,466 sq ft |

| First Floor | 124.58 sq m | 1,341 sq ft |

| Ground Floor ITZA | 1,104 UNITS | |

| Total NIA | 260.77 sq m | 2,807 sq ft |

| Total GIA | 318.37 sq m | 3,427 sq ft |

A set of floor plans is available to download and the measured survey report will be re-addressed to a purchaser at a cost of £475 + VAT.

Tenure

Freehold.

Tenancy

The property is let to The Air Ambulance Service Trading Limited on an internal repairing and insuring lease for a term of 3 years from 25th January 2022, expiring 24th January 2025 at a passing rent of £12,000 per annum. The rent is paid monthly. There is a tenant break clause effective 25th January 2024, subject to 6 months’ notice. The tenant did not exercise their 25th January 2023 break clause, demonstrating their commitment to this location.

Therefore, there are 2 years unexpired.

Whilst the tenant is responsible for internal repairs, this excludes air conditioning. The tenant pays a fair and reasonable proportion for external and structural repairs by way of the service charge, subject to a cap of £3,000 per annum.

The rent payable under the previous lease to The Air Ambulance Service Trading Limited was £30,000. Therefore, the rent has been rebased to just 40% of the previous rent.

Based on our analysis the passing rent equates to a Zone A rate of just £10.87 per square foot.

The two flats on the second floor have been sold off on one long lease with just 93 years unexpired. The ground rent is a peppercorn.

The car park at the rear is let to under a management agreement to NCP Commercial Services Ltd for an initial term of 18 months from 1st December 2022 at a rent of £9,000 per annum. After the first 12 months, the agreement is to automatically extend on a month-to-month basis until terminated by either party, subject to providing 1 months’ notice.

Therefore, the total passing rent is £21,000 per annum.

Covenant

The Air Ambulance Service Trading Limited (Co. No. 06987161) has reported the following figures:

| 31st December 2021 | 31st December 2020 | 31st December 2019 | |

|---|---|---|---|

| Revenue | £9,082,455 | £7,110,535 | £10,131,965 |

| Post-Tax Profits | £1,787,846 | £405,775 | £1,374,215 |

| Net Worth | £1,482,757 | £298,982 | £1,352,944 |

The company have been providing vital air ambulance services since 2003 across five countries and operate the national children’s Air Ambulance and the local air ambulance services for Warwickshire, Northamptonshire, Derbyshire, Leicestershire and Rutland.

Critical care paramedics, doctors and pilots attend an average of ten rescue missions a day. There are various forms of fund raising in place including donations, online shop, will gifting and a lottery to name a few.

For further information see www.theairambulanceservice.org.uk.

NCP Commercial Services Ltd (Co. No. 06065600) has reported in their September 2020 accounts - Total Shareholder’s Funds of £8,977,000.

NCP is the UK’s most recognised and longest standing private car park operator having been sounded in 1931. NCP operates car parking spaces across the UK at over 500 sites, possessing a 30% market share.

The company’s immediate parent company is MEIF II CP Holdings 3 Limited, incorporated and registered in England. The ultimate parent company is Park24, a company incorporated in Japan and listed on the Tokyo Stock Exchange.

For further information see www.ncp.co.uk.

VAT

The property has been registered for VAT. It is anticipated that the sale of this property will be treated as a Transfer of a Going Concern (TOGC).

Proposal

We are instructed to seek offers in the region of £200,000 (Two Hundred Thousand Pounds), subject to contract. This price reflects a net initial yield of 10.26%, assuming purchasers’ costs of 2.3%.

Please note that a purchaser will be re-charged the costs of the measured survey (£475 + VAT) and searches (£750.82) which are provided in the data room.

Please note that a purchaser will be charged a Transaction Fee of 1% of the Purchase Price plus VAT.

Investment Considerations

-

An opportunity to acquire a retail investment in the most populated urban area of Hertfordshire;

-

The property occupies a busy pitch in the town centre with a return frontage;

-

The property benefits from a service yard with car parking to the rear;

-

Let to an established Air Ambulance company and NCP Commercial Services Ltd;

-

Re-based retail rent to 40% of the previous rent;

-

Potential for lease extensions on the sold off flats;

-

Opportunity to add residential accommodation above the existing flats, subject to planning consent;

-

Tenant has been in occupation since 2016;

-

The purchase at the asking price reflects an attractively high net initial yield;

-

Attractive lot size to an investor.

Data Room and clicktopurchase®

Access to the data room and for the ability to purchase online with speed and ease, please click the clicktopurchase® “C” icon or the clicktopurchase® side bar. Purchasers will be able to access the complete legal package, clear verification and submit legally-binding offers to acquire the property.

Purchasers benefit from the trust, security and transparency provided by the platform. All activities, including the online contract execution, will form part of the electronic audit trail which is anchored in the clicktopurchase® Blockchain.

clicktopurchase® provides the opportunity for any investor, whether located UK or abroad, to uniquely purchase online with ease and certainty. To learn more about clicktopurchase®, click here.

DOWNLOADS

BROCHURE

Contact Us

| Singer Vielle | +44 (0) 207 935 7200 | |

|---|---|---|

| Daniel Elia | daniel@singervielle.co.uk | +44 (0) 203 701 1353 |

| Dale Henry | dale@singervielle.co.uk | +44 (0) 203 701 1356 |

| Neil Singer | neil@singervielle.co.uk | +44 (0) 203 478 9120 |

Vendors Solicitor

| Gunnercooke | +44 (0) 333 014 3401 |

|---|---|

| Jonathan Wilkson | jonathan.wilkinson@gunnercooke.com |